Comptroller of the Treasury Opinion on PLN Public Records Request re Fees 2010

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

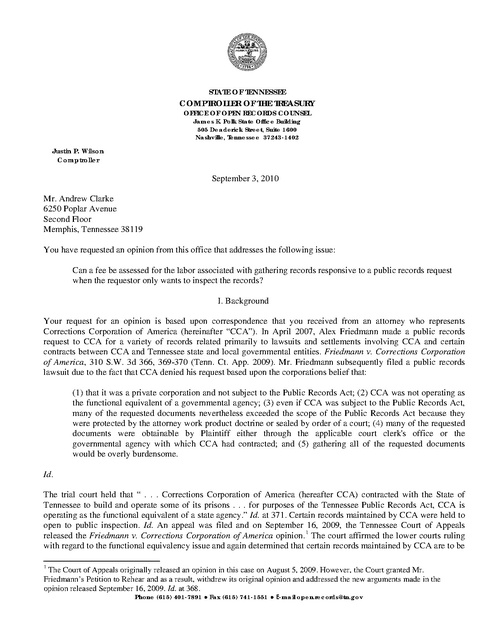

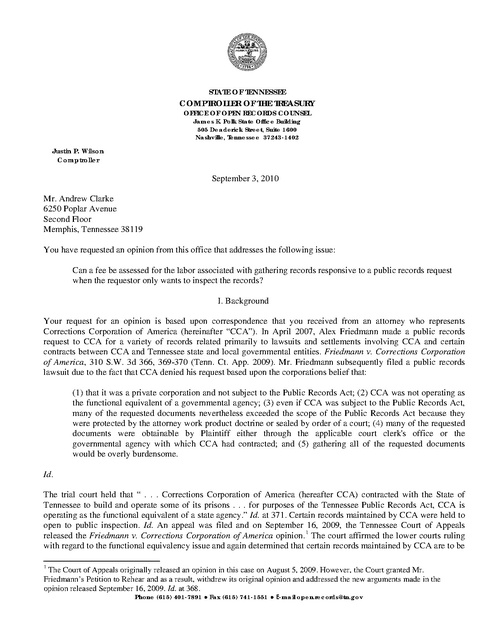

STATE OF TENNESSEE COMPTROLLER OF THE TREASURY OFFICE OF OPEN RECORDS COUNSEL James K. Polk State Office Building 505 Deaderick Street, Suite 1600 Nashville, Tennessee 37243-1402 Justin P. Wilson Comptroller September 3, 2010 Mr. Andrew Clarke 6250 Poplar Avenue Second Floor Memphis, Tennessee 38119 You have requested an opinion from this office that addresses the following issue: Can a fee be assessed for the labor associated with gathering records responsive to a public records request when the requestor only wants to inspect the records? I. Background Your request for an opinion is based upon correspondence that you received from an attorney who represents Corrections Corporation of America (hereinafter “CCA”). In April 2007, Alex Friedmann made a public records request to CCA for a variety of records related primarily to lawsuits and settlements involving CCA and certain contracts between CCA and Tennessee state and local governmental entities. Friedmann v. Corrections Corporation of America, 310 S.W. 3d 366, 369-370 (Tenn. Ct. App. 2009). Mr. Friedmann subsequently filed a public records lawsuit due to the fact that CCA denied his request based upon the corporations belief that: (1) that it was a private corporation and not subject to the Public Records Act; (2) CCA was not operating as the functional equivalent of a governmental agency; (3) even if CCA was subject to the Public Records Act, many of the requested documents nevertheless exceeded the scope of the Public Records Act because they were protected by the attorney work product doctrine or sealed by order of a court; (4) many of the requested documents were obtainable by Plaintiff either through the applicable court clerk's office or the governmental agency with which CCA had contracted; and (5) gathering all of the requested documents would be overly burdensome. Id. The trial court held that “ . . . Corrections Corporation of America (hereafter CCA) contracted with the State of Tennessee to build and operate some of its prisons . . . for purposes of the Tennessee Public Records Act, CCA is operating as the functional equivalent of a state agency.” Id. at 371. Certain records maintained by CCA were held to open to public inspection. Id. An appeal was filed and on September 16, 2009, the Tennessee Court of Appeals released the Friedmann v. Corrections Corporation of America opinion. 1 The court affirmed the lower courts ruling with regard to the functional equivalency issue and again determined that certain records maintained by CCA are to be 1 The Court of Appeals originally released an opinion in this case on August 5, 2009. However, the Court granted Mr. Friedmann’s Petition to Rehear and as a result, withdrew its original opinion and addressed the new arguments made in the opinion released September 16, 2009. Id. at 368. Phone (615) 401-7891 ● Fax (615) 741-1551 ● E-mail open.records@tn.gov September 3, 2010 Page 2 of 3 open to inspection. Id. at 380. The case was remanded to the lower court for a determination as to whether or not any of the requested records do not constitute “public records” and whether or not any of the requested records are confidential because they constitute attorney-client privilege communications or attorney work product. Id. at 381. Based upon the correspondence between the attorney representing Mr. Friedmann and the attorney representing CCA (Attached “Exhibit 1” and “Exhibit 2”), it appears that significant discussion has taken place regarding Mr. Friedmann’s ability to inspect certain of the requested records; however, it also appears that CCA is taking the position that it will only make those records available for Mr. Friedmann’s inspection if he agrees “to cover CCA’s production costs in excess of one hour.”2 II. Analysis When the Tennessee Public Records Act (hereinafter referred to as the “TPRA”) was amended in 2008 with the passage of Public Chapter 1179, Acts of 2008 (Attached “Exhibit 3”), several significant changes were made. First, the General Assembly declared through language that is clear and unambiguous that “A records custodian may not . . . assess a charge to view a public record unless otherwise required by law.” Tenn. Code Ann. Section 10-7503(a)(2)(7)(A). Additionally, this office was established pursuant to Tenn. Code Ann. Section 8-4-601 et. seq. Tenn. Code Ann. Section 8-4-604 directed the office to establish the Schedule of Reasonable Charges. The provision reads in part: (a) The office of open records counsel shall establish: (1) A schedule of reasonable charges which a records custodian may use as a guideline to charge a citizen requesting copies of public records pursuant to Title 10, Chapter 7, Part 5. Tenn. Code Ann. Section 8-4-604. As is clearly indicated by the language of this provision, the Schedule of Reasonable Charges is only applicable when copies or duplicates or records are requested. Tenn. Code Ann. Section 10-7-503 was amended to address how fees for copies of records could be assessed until the Schedule of Reasonable Charges was developed. When passed, Tenn. Code Ann. Section 10-7-503(a)(2)(C) read: (i) Until the office of open records counsel develops a schedule of reasonable charges in accordance with § 8-4-604(a), a records custodian may require a requestor to pay the custodian's actual costs incurred in producing the requested material; provided that no charge shall accrue for the first five (5) hours incurred by the records custodian in producing the requested material. Such actual costs shall include but not be limited to: (a) The making of extracts, copies, photographs or photostats; and (b) The hourly wage of employee(s) reasonably necessary to produce the requested information. (ii) When such schedule of reasonable charges is developed, the provisions of subsection (a)(7)(C)(1) shall become effective. (iii) Following the development of the schedule of reasonable charges by the office of open records counsel, the office of open records counsel shall notify the Tennessee Code Commission and when the code commission receives such notice this subdivision (C) shall no longer apply and the language in this subdivision (C) shall be repealed and deleted by the code commission as volumes are replaced or supplements are published. 3 2 In the letter attached as Exhibit 2, the attorney for CCA discusses the fact that Mr. Friedmann has agreed, within the context of another public records request, that CCA can assess him a fee for the production costs associated with producing records responsive to his request to inspect. Even if Mr. Friedmann has made such an assertion, CCA has no legal authority to assess a fee for “collection and production costs (in excess of one hour)” based upon several statutory provisions that are discussed later in the opinion as well as the language of the Schedule of Reasonable Charges. 3 Once the Schedule of Reasonable Charges was developed, the Codes Commission was contacted and Tenn. Code Ann. Section 10-7-503(a)(2)(C) was deleted in its entirety. Phone (615) 401-7891 ● Fax (615) 741-1551 ● E-mail open.records@tn.gov September 3, 2010 Page 3 of 3 While the language in the abovementioned provisions addressed how fees relative to copies or duplicates of public records were to be established and how the fees were to be assessed prior to the development of the Schedule of Reasonable Charges, the language in Tenn. Code Ann. Section 10-7-503(a)(7)(C)(1) addresses how fees are to be assessed now that the Schedule of Reasonable Charges has been developed. The provision reads “A records custodian may require a requestor to pay the custodian's reasonable costs incurred in producing the requested material and to assess the reasonable costs in the manner established by the office of open records counsel pursuant to § 8-4-604.” Tenn. Code Ann. Section 10-7-503(a)(7)(C)(1). On October 1, 2008, this office released the instructions for use of the Schedule of Reasonable Charges (Attached “Exhibit 4”) and the Schedule of Reasonable Charges (Attached “Exhibit 5”). The introductory language to the instructions reads: . . . Public Chapter 1179, Acts of 2008, required the OORC to establish the schedule which a records custodian may use as a guideline to charge a citizen requesting copies of public records pursuant to the Tennessee Public Records Act, T.C.A. Sections 10-7-501 et seq. T.C.A. Section 10-7-503(a) as amended by Public Chapter 1179, Acts of 2008, effective July 1, 2008, specifically states in (7)(A) that a records custodian may not charge for inspection of public records unless otherwise required by law. Until the development of the schedule, Section 10-7-503(a)(2)(C) allowed a records custodian to charge a requestor the actual costs incurred in producing a copy or duplication, which can include any labor incurred after five (5) hours is spent producing the requested material. With the development of the schedule, a records custodian is authorized by TCA Section 10-7-503(a)(7)(C)(1) to charge reasonable costs assessed in a manner consistent with the schedule. The introductory language of the Schedule of Reasonable Charges reads: Section 6 of Public Chapter 1179, Acts of 2008 (“Public Chapter 1179”) adds T.C.A. Section 8-4604(a)(1) which requires the Office of Open Records Counsel (“OORC”) to establish a schedule of reasonable charges (“Schedule of Reasonable Charges”) which may be used as a guideline in establishing charges or fees, if any, to charge a citizen requesting copies of public records under the Tennessee Public Records Act (T.C.A. Sections 10-7-503, et seq.)(“TPRA”). . . The TPRA grants Tennessee citizens the right to request a copy of a public record to which access is granted under state law. Public Chapter 1179 adds T.C.A. Section 10-7-503(a)(7)(A) which expressly prohibits a records custodian from charging a fee for inspection under the TPRA unless otherwise required by law. However, the TPRA in T.C.A. Section 10-7-506 does permit records custodians to charge for copies or duplication pursuant to properly adopted reasonable rules. Based upon the above-cited provisions and based upon the fact that this office is unaware of any other provision that would allow CCA to charge a fee for the inspection of the requested records, it is the opinion of this office that CCA cannot assess Mr. Friedmann a fee “to cover CCA’s production costs in excess of one hour.” As is clearly indicated by the language in the above-cited statutory provisions and the language developed by this office, the Schedule of Reasonable Charges is only applicable when copies or duplicates or records are requested. However, if Mr. Friedmann determines that he wants copies of all the records or a portion thereof after he inspects them, CCA is permitted to assess him the cost of the requested copies, as well as a fee for labor that is proportional to the time that it took to locate, retrieve, review, redact, and copy or duplicate any of the records for which he requests a copy, as long as the fee is calculated in accordance with the Schedule of Reasonable Charges. Elisha D. Hodge Open Records Counsel Phone (615) 401-7891 ● Fax (615) 741-1551 ● E-mail open.records@tn.gov