Reichert v. Keefe Commissary Network, WA, Complaint, Debit Release Cards, 2017

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

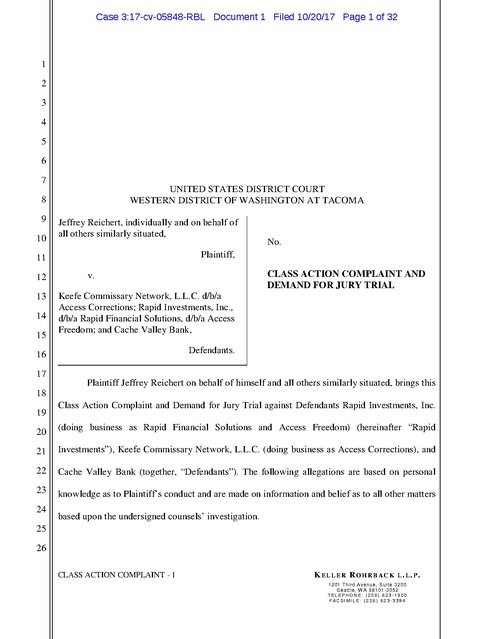

Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 1 of 32 1 2 3 4 5 6 7 UNITED STATES DISTRICT COURT WESTERN DISTRICT OF WASHINGTON AT TACOMA 8 9 10 Jeffrey Reichert, individually and on behalf of all others similarly situated, Plaintiff, 11 12 13 14 15 No. CLASS ACTION COMPLAINT AND DEMAND FOR JURY TRIAL v. Keefe Commissary Network, L.L.C. d/b/a Access Corrections; Rapid Investments, Inc., d/b/a Rapid Financial Solutions, d/b/a Access Freedom; and Cache Valley Bank, Defendants. 16 17 Plaintiff Jeffrey Reichert on behalf of himself and all others similarly situated, brings this 18 19 Class Action Complaint and Demand for Jury Trial against Defendants Rapid Investments, Inc. 20 (doing business as Rapid Financial Solutions and Access Freedom) (hereinafter “Rapid 21 Investments”), Keefe Commissary Network, L.L.C. (doing business as Access Corrections), and 22 Cache Valley Bank (together, “Defendants”). The following allegations are based on personal 23 knowledge as to Plaintiff’s conduct and are made on information and belief as to all other matters 24 based upon the undersigned counsels’ investigation. 25 26 CLASS ACTION COMPLAINT - 1 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 2 of 32 1 2 3 4 I. 1. INTRODUCTION Plaintiff Jeffrey Reichert was arrested on the Suquamish Reservation by Kitsap County Sheriff’s deputies on October 21, 2016 during a drive home from work. Mr. Reichert was jailed for just over four hours at the Kitsap County Jail. Upon arrest, Kitsap County officers 5 confiscated approximately $177.66 in cash from Mr. Reichert. Upon his release, they did not give 6 7 him back his cash. Instead, Kitsap County gave him a prepaid debit card loaded with the 8 confiscated amount. The card was issued by Cache Valley Bank and bore the insignia 9 “AccessFreedom,” a brand of prepaid card offered by Rapid Investments (hereinafter 10 11 12 “AccessFreedom Card”). 2. Mr. Reichert wanted to receive his cash back, but Kitsap County Jail officers forced the prepaid card upon him without offering any alternatives. That prepaid card required Mr. 13 14 15 Reichert to pay unreasonable and excessive fees to Defendants in order to access his own money. Mr. Reichert never assented to receiving the card instead of his cash and never assented to any 16 contract with Defendants. Kitsap County Jail did not give Mr. Reichert an opportunity to reject 17 the AccessFreedom Card or take immediate possession of his money in any other form, such as 18 cash or check. 19 3. Mr. Reichert’s experience is illustrative of the experience of thousands of other 20 individuals who have received AccessFreedom Cards across the country. 21 22 4. Mr. Reichert represented a captive consumer for Defendants, and Defendants took 23 full advantage of Mr. Reichert’s complete lack of bargaining power by requiring him to pay 24 various exorbitant, unreasonable fees to retrieve his own money. Of course, Mr. Reichert would 25 never have agreed to receive his money in the form of the extremely expensive AccessFreedom 26 Card if he had been given any choice or had any bargaining power. CLASS ACTION COMPLAINT - 2 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 3 of 32 1 2 3 5. Defendants have engaged in a pattern of unlawful, deceptive, unfair, and unconscionable profiteering and self-dealing with respect to the prepaid release cards that they force upon individuals who are released from jails and prisons. In so doing, Defendants have 4 violated the law, including the Fifth Amendment’s prohibition against the taking of property 5 6 7 8 without just compensation, the Electronic Fund Transfer Act, 15 U.S.C. §1693 (2010), and the Washington Consumer Protection Act, RCW 19.86 (2017). 6. As such, Mr. Reichert files this class action lawsuit to redress injuries that he and 9 other individuals have suffered and continue to suffer as a result of Defendants’ practices of 10 forcing prepaid release cards that carry unreasonable and excessive fees upon pretrial detainees 11 and former inmates who, like most consumers, would never agree to receive their property in such 12 a manner if given a choice. 13 II. 14 15 16 THE PARTIES 7. Plaintiff Jeffrey Reichert lives in and is a citizen of Kingston, Washington. 8. Defendant Keefe Commissary Network, L.L.C. (“Keefe”), a subsidiary of Keefe 17 Group, Inc., is a Missouri corporation that does business under various trade names, including 18 “Access Corrections.” Keefe Group, Inc.’s annual revenue totals $1 billion. Keefe is the nation’s 19 biggest operator of commissary stores inside correctional facilities and offers a wide array of 20 services to correctional institutions, including prepaid debit release cards. Keefe contracted with 21 22 Kitsap County to provide correctional commissary services to the County, including an inmate 23 release prepaid debit card program that was provided through a third-party company, Rapid 24 Investments, Inc. Keefe is located at 10880 Linpage Place, St. Louis, Missouri 63132. 25 26 9. Defendant Rapid Investments, Inc., (“Rapid Investments”) is a Utah corporation that does business as Rapid Financial Solutions and other various trade names, including “Access CLASS ACTION COMPLAINT - 3 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 4 of 32 1 Freedom.” Rapid Investments states on its website that “the Rapid Processing Engine is designed 2 to help your company process a variety of digital transactions including: direct deposit, payroll 3 cards, prepaid debit cards, wire transfers, mobile payments, structured payments, and e-checks.” 4 Rapid Investments markets its prepaid cards to government entities, including Kitsap County, 5 6 financial institutions, and other private enterprises. These entities in turn disseminate Rapid 7 Investments’ products to the general public. Rapid Investments contracted with Keefe to provide 8 AccessFreedom cards to individuals being released from Kitsap County Jail. Rapid Investments 9 is located at 3065 North 200 West, Ste. 200, North Logan, Utah 84341. 10 11 10. Defendant Cache Valley Bank is a state chartered bank based in Utah. Cache Valley Bank is a member of the Federal Deposit Insurance Corporation and has over $950 million in 12 assets and 13 offices throughout Utah. Cache Valley Bank has contracted with Rapid Investments 13 14 to issue prepaid debit cards nationwide and is located at 101 N. Main, Logan, Utah 84321. III. 15 16 11. JURISDICTION AND VENUE This Court has jurisdiction over the subject matter of this action pursuant to 28 17 U.S.C. § 1331 (1980) because this is a civil action arising under the laws of the United States, 18 namely 42 U.S.C. § 1983 (1996) and 15 U.S.C. §1693. 19 12. This Court may exercise supplemental jurisdiction over state law claims pursuant 20 to 28 U.S.C. § 1367 (1990). 21 22 13. Venue is proper in this District pursuant to 28 U.S.C. § 1391 (2011) because each 23 Defendant is subject to personal jurisdiction in this District and a substantial part of the events or 24 omissions giving rise to the claim occurred within this District. 25 26 CLASS ACTION COMPLAINT - 4 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 5 of 32 1 2 3 4 IV. A. FACTS Background 14. Over 650,000 individuals are released from state and federal prisons annually. Local jails nationwide process an estimated 11.6 million people each year. The vast majority of 5 these inmates are released from custody shortly after they are booked. Most of the people released 6 7 8 from jails are never convicted of any crime. A. Keefe is one of many for-profit players in an increasingly privatized prison 9 industry. State spending alone on corrections hit $52.4 billion in 2012. Hundreds of private- 10 sector contractors now provide food, clothing, riot gear, phone service, computers, and health 11 care, in addition to directly operating many correctional facilities. 12 B. At least 10 companies, including Rapid Investments, now offer prepaid release 13 cards to correctional systems. 14 15 15. Kitsap County, like all jails, prisons, and detention facilities, keeps an individual’s 16 confiscated cash until his or her release. These funds are kept with the understanding that the State 17 will protect the property on the individual’s behalf. 18 19 20 16. Traditionally, when inmates were released from jails, prisons, and other detention facilities, their jailers returned to them in the form of cash or check any cash that the jailers confiscated at booking. The jailers also traditionally returned to them, in the form of cash or 21 22 23 check, any monies that had accrued in the individual’s inmate trust account. 17. According to a 2014 Association of State Correctional Administrators survey, 24 government agencies across the United States that handle inmate funds are increasingly using 25 prepaid debit cards to return personal funds to former inmates. Over half of responding agencies 26 reported using prepaid debit cards to return inmates’ property, and a majority of those agencies CLASS ACTION COMPLAINT - 5 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 6 of 32 reported that a fee is charged when using the debit card to get cash from a bank. 1 1 2 18. 3 Unlike typical consumers, released individuals are not given the choice to accept a fee-laden financial product like the AccessFreedom Card, and they never fill out an application 4 for this financial product. 5 19. 6 Moreover, the typical released individual suffers from poor financial literacy. A 7 study by the University of Arkansas-Little Rock Anderson Institute on Race and Ethnicity of 8 inmates in Arkansas found that only 33.1 percent of inmates could correctly answer the question, 9 “If you put $100 in a bank account paying 5 percent interest, how much will you have in your 10 account after one year?” In contrast, 79.6 percent of non-incarcerated men got the same question 11 right.2 12 20. That Defendants market financial products rife with fees—all so released 13 individuals can access their own money—is both predatory, unfair, and deceitful. 14 15 B. Kitsap County’s Inmate Release Card Program 21. 16 Kitsap County contracted with Keefe (formerly known as Keefe Supply Company) 17 as early as January 1, 2007 for myriad correctional commissary services, including fair market 18 pricing of goods for inmates, an inmate banking system, inmate commissary order processing, as 19 well as other services. 20 22. The contract for correctional commissary services was subsequently renewed on 21 various occasions, and in March 2012, Kitsap County entered into an agreement with Keefe for 22 23 24 25 26 1 See Proposed Amendments to Regulation E: Curb exploitation of people released from custody, Prison Policy Initiative 2, March 18, 2015, https://static.prisonpolicy.org/releasecards/CFPB-comment.pdf (last visited October 20, 2017). 2 David Koon, ARKANSAS TIMES, New UALR survey finds a lack of basic ‘financial literacy’ among inmates, https://www.arktimes.com/arkansas/new-ualr-survey-finds-a-lack-of-basic-financial-literacy-amonginmates/Content?oid=3351524, June 19, 2017 (last visited October 20, 2017). CLASS ACTION COMPLAINT - 6 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 7 of 32 1 provision of prepaid debit cards to all released inmates. Under the contract, Keefe may change 2 the card brand, issuing bank, or program manager at any time without the County’s approval. 3 Keefe’s first contract with Kitsap County listed OutPay Systems, L.L.C. as the prepaid debit card 4 manager and First California Bank as the issuing bank. Since the initial 2012 contract, Keefe has 5 switched to Rapid Investments as the card manager and brand, and Cache Valley Bank as the 6 issuing bank. 7 23. 8 9 Under the Keefe contract and its amendments, the Kitsap County Sheriff’s Office implemented Defendants’ inmate release card program run to perform the traditional government 10 service of returning money relinquished by inmates at booking. 11 24. By no later than March 2012, Kitsap County began providing prepaid debit cards 12 to released inmates, in lieu of a check. 13 25. 14 Rapid Investments’ prepaid card services reach over 2 million consumers and span at least nine different prepaid card programs, including programs for correctional facilities.3 15 26. 16 17 Rapid Investments contracts with third party commissary companies like Keefe who, in turn, contract with detention facilities to provide prepaid card programs to various city, 18 county, and state agencies. 19 27. Rapid Investments also contracts with Cache Valley Bank as an issuing bank for its 20 cards, and with MasterCard as the payment network sponsor. 21 28. 22 Upon information and belief, prepaid card issuance agreements between banks and servicers like Rapid Investments provide for the marketing of prepaid cards to government entities 23 24 25 26 3 Rapid Financial Solutions Partners with Digiliti Money to Deliver Mobile Money Solutions to More Than 2 Million Cardholders, https://www.digilitimoney.com/news/press-releases/rapid-financial-solutions-partners-withdigiliti-money-to-deliver-mobile-money-solutions-to-more-than-2-million-cardholders, July 20, 2016 (last visited October 20, 2017). CLASS ACTION COMPLAINT - 7 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 8 of 32 1 for distribution to released inmates, and reference the Electronic Fund Transfer Act (15 U.S.C. 2 §§ 1693, et seq.) and Regulation E thereunder (12 C.F.R. Part 205, each as may be amended from 3 time to time). 4 29. Under the applicable terms and conditions, Defendants allow cardholders to request 5 periodic account statements under the Electronic Fund Transfer Act. 6 30. 7 Defendants market and distribute their prepaid debit cards to the general public and specifically market their products on their website and on Facebook. 8 9 31. 10 On their website, Rapid states, “Prepaid Debit Cards are one of the fastest growing segment [sic] in payment solutions. It is a must have for government, financial institutions, and 11 private enterprises looking to provide products and services to the under served and unbanked in 12 their markets. Whether you’re looking to reach the unbanked or under served markets in your 13 community, or you want an alternative product to offer an individual who does not qualify for a 14 credit or debit card—the Prepaid Debit Card serves multiple needs.”4 15 32. 16 17 On Facebook, Rapid Investments runs sponsored ads with the following representations. 18 19 20 21 22 23 24 25 26 4 See http://rpdfin.com/prepaid-cards-php/ (last visited October 20, 2017). CLASS ACTION COMPLAINT - 8 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 9 of 32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 33. 16 Defendants describe their program as a way for correctional facilities to avoid the costs associated with tracking down uncashed checks, escheatment, and laborious accounting 17 practices—all at no cost to the correctional facility. 18 34. In their marketing materials, Defendants tout their cards’ ability to save “time and 19 money:”5 20 21 22 23 24 25 26 5 How Access Freedom Works for FACILITIES, http://www.accessfreedomcard.com/howfacility.html (last visited October 20, 2017). CLASS ACTION COMPLAINT - 9 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 10 of 32 1 2 3 4 5 6 7 8 9 10 11 12 13 35. 14 According to Rapid Investments, prepaid debit cards like their AccessFreedom 15 Card lessen the burden on correctional officers and save correctional facilities time and money. 16 Cash- or check-based systems, it claims, are burdened by “tremendous costs” and administrative 17 hassles.6 18 36. Rapid Investments claims that the cost of issuing a paper check can be nearly $10 19 per check; in contrast, its prepaid card service costs approximately $1 per transaction. Incidentals 20 like printers, postage, toner, and envelopes are also eliminated by switching from a check-based 21 system to the AccessFreedom Card.7 22 37. 23 Apart from transaction costs, the personnel hours needed to manage a jail or 24 25 26 6 Case Study – Inmate Exit Cards, Rapid Financial Solutions, http://rpdfin.com/files/2017/08/Access-FreedomInmate-Exit-Cards-Case-Study.pdf (last visited October 20, 2017). 7 Id. CLASS ACTION COMPLAINT - 10 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 11 of 32 1 correctional facility’s inmate property system “comprise the largest expense incurred from in- 2 house payment operations.”8 3 38. Kitsap County chose to subcontract out its inmate property release system in order 4 to save the personnel time and money associated with check re-issuances, stop payments, fraud 5 prevention, and checking account maintenance. 6 39. 7 Kitsap County accepted Keefe’s assignation of the County’s duties and contracted 8 with Defendants to provide the inmate release card program. Pursuant to that contract, Defendants 9 enjoy a monopoly at the Kitsap County Jail. 10 40. 11 Kitsap County Sheriff’s Office Chief of Corrections, Ned Newlin, entered into the contract for prepaid debit card services with Defendant Keefe. 12 41. Per their contract, Defendant Keefe serves as Kitsap County’s contractor for 13 prepaid debit card services, and Keefe may choose the card branding, issuing bank, or prepaid 14 debit card release program manager at its discretion. 15 42. 16 17 On information and belief, before contracting with Defendants for maintenance and operation of its release card program, Kitsap County shouldered the costs associated with the 18 management of the inmate property program and its fiscal operations. 19 43. Prior to Defendants’ involvement, the County did not return an inmate’s cash via a 20 debit card. Instead, released inmates received their funds via a County-issued check. 21 44. 22 The County agreed to use the AccessFreedom Card in releasing inmates with as little as $0.01. 23 24 45. AccessFreedom Cards can be loaded with up to $9,700. 25 26 8 Id. CLASS ACTION COMPLAINT - 11 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 12 of 32 1 2 3 46. However, the County still issues checks to released inmates when the inmate is transferred to another facility; when the inmate chooses to release his/or her funds to someone else; when the inmate chooses to use his/her funds to post bail; or if Keefe’s debit card equipment 4 is not operational. 5 6 47. The cards are issued with stickers that say, “ATTENTION! This card has already 7 been activated. Your PIN = 7###.” Thus, the cards are activated and ready for immediate use 8 when released inmates receive them. Card recipients who receive the card do not assign their own 9 PIN to the card. 10 11 48. To resolve problems with the cards such as money being put on the wrong person’s account, Defendants have instructed Kitsap County to simply transfer money off the card of one 12 individual and onto the card of another, whether or not they are in custody. Or if a card was not 13 14 15 received by the inmate, but left on the counter, Defendants instructed Kitsap County to void the card and add it to a “destroy log.” 16 49. 17 population of 400. 18 19 50. Kitsap County Jail has over 500 beds and maintains an average daily inmate These prepaid release cards are extremely profitable for Defendants, who charge their unwitting and unwilling customers exorbitant fees to possess and/or use the cards. 20 21 22 51. According to the contract between Keefe and Kitsap County, Defendants charge a fee for their role in setting up the bank account with the bank issuing the cards and for 23 coordinating third party processing services. These so-called “Coordination Fees” are embedded 24 in the fee structure selected by Kitsap County and the other government entities for the cards, and 25 all fees are assessed to the card holder/inmate. 26 CLASS ACTION COMPLAINT - 12 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 13 of 32 1 52. 2 These user fees taken from cardholders are well in excess of the Defendants’ costs and are unreasonable and/or unrelated to the administration of each account. 3 53. When Defendants market their services to government entities, they present several 4 potential fee schedules, though the services offered remain the same. 5 54. 6 Rapid Investments publicizes at least two fee schedules for jails and correctional facilities to choose from:9 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 55. 22 23 Of these two offered fee schedules, Kitsap County has chosen the more fee-laden, with higher “weekly maintenance” fees starting just 72 hours after release, and more expensive 24 ATM fees. 25 26 9 Cardholder Fees, http://www.accessfreedomcard.com/releasefees.html (last visited October 20, 2017). CLASS ACTION COMPLAINT - 13 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 14 of 32 1 2 3 56. That Defendants offer multiple fee schedules for the same service indicates that the fees are not cost-based, but instead a bald-faced profit mechanism. 57. Upon information and belief, during negotiations between the contracting 4 government entity and Keefe and its subcontractors, the public entity selects an applicable fee 5 6 7 8 9 10 11 schedule. 58. Kitsap County negotiated the fee schedule that applies for various uses of the AccessFreedom Card. These fees were imposed on Plaintiff and the putative Class. 59. Defendants impose the following fees for their inmate release card program in Kitsap County: C. $2.50 “weekly maintenance fee,” which actually occurs only 72 hours after an 12 inmate receives the card, not after the inmate has kept a card balance for at least a week, and every 13 14 week the card holds a balance thereafter; 15 D. $1.50 “ATM account inquiry fee;” 16 E. $2.95 “domestic ATM fee” (which is in addition to any surcharges that the ATM 17 18 19 operator may assess); F. $2.95 “ATM Decline for Non-Sufficient Funds Fee” after a domestic ATM declines a withdrawal for insufficient funds; 20 21 22 23 24 25 26 G. $3.95 “International ATM Fee” (which is in addition to any surcharges that the ATM operator may assess); H. $3.95 “ATM Decline International Fee” after an international ATM declines a withdrawal for insufficient funds; I. $2.00 “Inactivity Fee” (purportedly after 90 days of inactivity); J. $10.00 “Replacement of lost or stolen card” fee; and CLASS ACTION COMPLAINT - 14 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 15 of 32 1 2 3 K. $10.00 “Account Closure Fee/Request for Balance by Check” which occurs when the cardholder requests account closure. Therefore, should an AccessFreedom Card recipient wish to not use the card and receive a check instead, it costs him or her $10.00 to do so. 4 60. The president of Rapid Investments, Daren Jackson, insists that the company 5 6 “provides a nice service, a convenient way for someone to get cash 24/7.”10 Yet this “nice service” 7 is far from “convenient.” For inmates in need of immediate cash to pay for a taxi after release, for 8 example, their money is simply not accessible because they likely cannot access their cash 9 through ATMs. 10 11 61. Inmates with $22.94 or less in their accounts cannot access their money because, assuming the inmate uses an ATM without its own fees, after Defendants’ $2.95 ATM fee, the 12 account balance dips below $20—the minimum withdrawal amount at nearly every ATM 13 14 15 machine. These low-balance cards are not just particularly lucrative for Defendants; they are also uniquely burdensome on the cardholder. 62. 16 17 18 19 Any claims by Defendants that the cards benefit consumers ignores the reality that the individual’s cash has been exchanged for a prepaid debit card that incurs fees mere hours after receipt. In short, an individual’s money is taken from them in the form of exorbitant fees, and the cards plainly lack the utility of the confiscated cash. 20 63. 21 22 23 On information and belief, individuals who are deported after their arrest and released back in their home country may not be able to access their funds at all—even before the $3.95 international ATM fee. Many released individuals report that prepaid debit cards and/or 24 25 26 10 NBC NEWS, March 24, 2015, http://www.nbcnews.com/business/consumer/inmates-charged-fee-after-leavingjail-n329151 (last visited October 20, 2017). CLASS ACTION COMPLAINT - 15 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 16 of 32 1 their PIN numbers do not work abroad, or that limits on international ATM withdrawals force 2 them to accrue additional withdrawal fees. 3 64. Defendants can charge and collect these exorbitant fees because their exclusive 4 contracts with government entities shield them from competitive market forces and because they 5 6 7 have absolute control over the funds once the funds are transferred to them by the government entity. 65. 8 Individuals who are released from Kitsap County Jail do not voluntarily engage the 9 company, enroll in the program, or take any affirmative steps to form any contractual relationship 10 with Rapid Investments, Keefe, Cache Valley Bank, or MasterCard. They have no choice but to 11 accept an AccessFreedom Card in lieu of receiving the return of their own money in the form of 12 cash or check. If an inmate refuses to accept a AccessFreedom Card, they simply lose their money 13 14 15 as the balance is depleted by imposition of the fees. C. Plaintiff Reichert’s Experience 16 66. Mr. Reichert resides in Kingston, Washington. 17 67. For the last 31 years he has worked as a research test mechanic for the Boeing 18 Company. 19 68. He was arrested by the Kitsap County, Washington, Sheriff on October 21, 2016. 69. After a 10½ hour day of work (beginning at 6:15 a.m.) at the Boeing Developmental 20 21 22 Center, Mr. Reichert was driving home when he was stopped by police. He had boarded the 8:10 23 p.m. ferry to Bainbridge Island. While on the ferry, he had a beer. At approximately 9 p.m., 24 enroute from the Bainbridge Island Ferry dock to his home in Kingston, Washington, Reichert 25 passed a slow-moving vehicle in the passing lane, and his dinner container slid across the 26 passenger seat toward the floor. When he attempted to catch the container, Mr. Reichert’s vehicle CLASS ACTION COMPLAINT - 16 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 17 of 32 1 veered out of its lane. Mr. Reichert later learned that another driver had called in a report after 2 seeing his vehicle veer out of its lane. Several miles later, Reichert was pulled over by a Tribal 3 Officer on Suquamish Reservation land. The officer asked him if he had had anything to drink 4 that evening. Though Plaintiff Reichert did have a beer to drink on the Bainbridge Ferry, he was 5 6 7 not inebriated and told the officer as much. 70. Because the officer stopped him on the Suquamish Reservation, the officer required 8 that Plaintiff Reichert wait in his vehicle for approximately an hour and a half so that a deputy 9 from the Kitsap County Sheriff’s Department could question him. The newly arrived officer asked 10 Mr. Reichert to “walk the line” before taking him to the Suquamish Station around midnight, 11 where he was asked to submit to a breathalyzer test. Mr. Reichert then contacted his attorney and 12 was administered the breathalyzer test. Next, he was transported from Suquamish Station to 13 14 Kitsap County Jail in Port Orchard, Washington and booked into the jail in the early hours of the 15 morning of October 22. Mr. Reichert was subsequently charged with a DUI, but received a pretrial 16 diversion. 17 71. 18 19 Kitsap County confiscated $177.66 in cash and coins from Mr. Reichert when he was arrested. 72. As his representative, Kitsap County Jail accepted Plaintiff Reichert’s cash and 20 21 22 23 24 25 26 deposited it in a trust account. 73. After approximately four hours in Kitsap County’s custody, Plaintiff Reichert was released around 5 a.m. on October 22, 2016. 74. Upon his release, he received his personal effects back, but he did not get his cash and coins. Instead, a Kitsap County Jail officer gave him a prepaid debit release card loaded with the confiscated amount. CLASS ACTION COMPLAINT - 17 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 18 of 32 1 2 3 75. The prepaid Mastercard Mr. Reichert received from Kitsap County Jail bore the insignia “AccessFreedom Member,” the brand name of the AccessFreedom Card, and was issued by Cache Valley Bank. 4 76. Plaintiff Reichert was not given any paperwork explaining the card; nor did anyone 5 6 from Kitsap County explain how to use the card or why he was being given the piece of plastic 7 in lieu of his cash. When Mr. Reichert asked the releasing officer for his cash, the officer replied, 8 “oh, you don’t get your cash back, you get a debit card.” When Mr. Reichert asked how the card 9 worked the officer informed Mr. Reichert that he needed to “put these set of numbers in” to get it 10 11 to work, referring to his PIN number. 77. Plaintiff Reichert was released around 5 a.m. into a parking lot with no jacket. He 12 called a cab and managed to persuade the cab driver that he would pay them when they arrived at 13 14 15 his home. He could not use the AccessFreedom Card for his cab fare. 78. Mr. Reichert would rather have received his cash back, but Kitsap County Jail 16 forced the prepaid card upon him without presenting any alternatives. Mr. Reichert was never 17 asked whether he wished to receive his monies in cash or in the form of a prepaid debit card for 18 19 which he would be assessed various exorbitant, unreasonable fees. 79. Mr. Reichert never applied for the AccessFreedom Card. 80. Mr. Reichert never agreed to receive the AccessFreedom Card instead of his cash 20 21 22 23 24 and never assented to the terms to any contract with Defendants. 81. Mr. Reichert had no choice but to accept the AccessFreedom Card instead of his cash. Mr. Reichert could not meaningfully object to receiving the prepaid debit card. Mr. 25 26 CLASS ACTION COMPLAINT - 18 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 19 of 32 1 Reichert’s receipt of his cash back in the form of the AccessFreedom Card was completely and 2 utterly involuntary. 3 82. Just three days after his release, on October 25, 2016, $2.50 was taken from his 4 AccessFreedom Card balance for a weekly maintenance fee. Another $2.50 weekly maintenance 5 6 fee was assessed a week later, on November 1, 2016. 83. 7 On November 2, 2016, Mr. Reichert visited his local branch of the Kitsap County 8 Credit Union to try to access his funds. At the bank’s ATM, Mr. Reichert requested an accounting 9 of his balance. This ATM inquiry was unsuccessful and did not tell him the balance. Mr. Reichert 10 was however charged a $1.50 “inquiry fee.” He then attempted to retrieve $180.00 in funds, and 11 12 the ATM screen said that there were insufficient funds for the transaction. Mr. Reichert then used the same ATM to withdraw $160. This transaction resulted in two $2.95 “issuer fees”11 and a 13 14 15 $3.00 “acquirer convenience fee,” that was likely charged by the local ATM provider—all within the span of 58 seconds. 84. 16 17 18 19 Knowing that he had more than $160 in cash at the time of his arrest, Mr. Reichert then visited the credit union to inquire regarding his missing account balance and to ask how to avoid fees. A credit union employee informed him that the credit union likewise could not determine the account balance, and urged him to go online or call the card issuer. 20 85. 21 22 Reichert’s account—the last few dollars and cents in the account. 86. 23 24 On November 8, 2016, a final $1.37 weekly maintenance fee was taken from Mr. Later, after calling Rapid Investments to inquire about his remaining balance, Mr. Reichert received via email a printout of the various charges, and learned that Defendants had 25 26 11 On information and belief, Mr. Reichert incurred one $2.95 fee for using the domestic ATM, and the other for attempting to withdraw additional funds—which resulted in a $2.95 insufficient funds ATM fee. CLASS ACTION COMPLAINT - 19 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 20 of 32 1 taken $17.66 in fees in the two weeks after his release—exactly 10 percent of his cash, and after 2 only approximately four hours in custody. 3 87. Had Mr. Reichert chosen not to use the AccessFreedom Card, and to close his 4 account and receive a check, Defendants would have charged him $10.00 to do so. 5 V. 6 88. 7 8 11 12 Defendants have engaged in the same conduct with respect to thousands of released inmates across the United States. 89. 9 10 CLASS CLAIMS Plaintiff Reichert brings this action on behalf of himself, and all others similarly situated pursuant to Fed. R. Civ. P. 23(a), 23(b)(2), and 23(b)(3) on behalf of the following nationwide Class: all persons who, upon release from a jail, prison, or detention facility, were provided with an inmate release card issued by Rapid Investments, or its affiliates, and/or Cache 13 14 15 Valley Bank or its affiliates, and paid a fee in conjunction with the use or maintenance of the card. (“Class”). 90. 16 Additionally, Plaintiff Reichert seeks to represent the following Washington 17 Subclass: all persons who, upon release from a jail, prison, or detention facility in the State of 18 Washington, were provided with an inmate release card issued by Rapid Investments, or its 19 affiliates, and/or Cache Valley Bank or its affiliates, and paid a fee in conjunction with the use or 20 maintenance of the card. (“Washington Subclass”). The Class and the Washington Subclass are 21 22 collectively referred to herein as the “Class.” 91. 23 Plaintiff reserves the right to modify or amend the definition of the proposed Class 24 before the Court determines whether certification is appropriate and as the Court may otherwise 25 allow. 26 CLASS ACTION COMPLAINT - 20 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 21 of 32 1 2 3 92. The Class is so numerous that joinder of all members is impracticable. Due to the nature of the commerce involved, the members of the Class are geographically dispersed throughout the United States. While the exact number of Class members is in the sole possession, 4 custody and control of Defendants, Plaintiff believes that there are well in excess of 100 members. 5 93. 6 Common questions of law and fact exist as to all members of the Class and 7 predominate over any questions solely affecting individual members of the Class. Questions of 8 law and fact common to the Class include but are not limited to: 9 A. Whether the AccessFreedom Cards that the Class received carried unlawful fees; 10 B. Whether the fees were a fair approximation of Defendants’ costs; C. Whether the fees were unreasonable or unrelated to the administration of each 11 12 user’s account; 13 D. 14 15 immunity protected by the Constitution or the laws of the United States; E. 16 17 Whether Defendants Rapid Investments and Cache Valley Bank violated the Electronic Fund Transfer Act, 15 U.S.C. 1693, et seq.; 18 19 Whether Defendants deprived Plaintiff and the Class of a right, privilege, or F. Whether Defendants engaged in unfair or deceptive acts or practices in the conduct of any trade or commerce and thus violated the Washington Consumer Protection Act, RCW 20 21 19.86; G. 22 23 practices; 24 H. 25 Whether Defendants were unjustly enriched through their prepaid card policies and Whether Defendants converted money belonging to the Class by taking unlawful fees; 26 CLASS ACTION COMPLAINT - 21 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 22 of 32 1 I. Whether and what form(s) of relief should be afforded to the Class; and 2 J. Whether the Class has suffered damages as a result of Defendants’ actions, and, if 3 so, the measure and amount of such damages, including any statutory damages. 4 94. Plaintiff’s claims are typical of the claims of the other members of the Class he 5 6 7 8 seeks to represent. Defendants’ practices have targeted and affected all members of the Class in a similar manner, i.e., they have all sustained damages arising out of Defendants’ practices. 95. Plaintiff will fully and adequately protect the interests of all members of the Class. 9 Plaintiff has retained counsel experienced in both complex class action and consumer fraud 10 litigation. Plaintiff has no interests which are adverse to, or in conflict with the interests of the 11 other members of the Class. 12 96. A class action is superior to other available methods for the fair and efficient 13 14 adjudication of this controversy since joinder of all Class members is impracticable. The 15 prosecution of separate actions by individual members of the Class would impose heavy burdens 16 upon the courts, and would create a risk of inconsistent or varying adjudications of the questions 17 of law and fact common to the Class. A class action, on the other hand, would achieve substantial 18 19 economies of time, effort, and expense, and would assure uniformity of decision with respect to persons similarly situated without sacrificing procedural fairness or bringing about other 20 21 22 undesirable results. 97. The interests of the members of the Class in individually controlling the prosecution 23 of separate actions are theoretical rather than practical. The Class has a high degree of cohesion, 24 and prosecution of the action through representatives would be unobjectionable. The damages 25 suffered by the individual Class members may be relatively small. Therefore, the expense and 26 burden of individual litigation make it virtually impossible for Class members to redress the CLASS ACTION COMPLAINT - 22 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 23 of 32 1 wrongs done to them. Plaintiff anticipates no difficulty in management of this action as a class 2 action. 3 98. The parties opposing the Class have acted or refused to act on grounds generally 4 applicable to each member of the Class, thereby making appropriate final injunctive or 5 6 corresponding declaratory relief with respect to the Class as a whole. VI. 7 8 FIRST CAUSE OF ACTION (Claim Pursuant to 42 U.S.C. § 1983 for Violation to the Fifth Amendment) (Against all Defendants) 9 99. Plaintiff re-alleges and incorporates by reference all of the allegations of this 10 11 Complaint with the same force and effect as if fully restated herein. 12 100. The Takings Clause of the Fifth Amendment to the United States Constitution states 13 in relevant part that “private property [shall not] be taken for public use, without just 14 compensation.” 15 16 101. The Takings Clause is applicable to the states through the Fourteenth Amendment. 102. A governmental user fee that fails to bear a sufficient relationship to the value 17 received or fails to provide a fair approximation of the costs of the benefits supplied—if any— 18 19 constitutes a taking within the meaning of the Takings Clause. 20 103. Defendants engaged in state action under color of law, in that Plaintiff’s and the 21 Class’s unconstitutional deprivation of their property resulted from a governmental policy. 22 Defendants are persons for whom the State is responsible in that: (a) Kitsap County, and other 23 24 governmental entities that issue Defendants’ prepaid debit release cards, bore an affirmative obligation upon release of Plaintiff and the Class to return monies confiscated from them; (b) the 25 26 State delegated that function to Defendants and gave to Defendants Plaintiff’s confiscated money; CLASS ACTION COMPLAINT - 23 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 24 of 32 1 and (c) Defendants voluntarily assumed that obligation by contract. Defendants thereby deprived 2 Plaintiff and the Class of a right, privilege, or immunity protected by the Constitution or the laws 3 of the United States. 4 104. The State benefited from the actions of its delegee, as Defendants’ business 5 6 practices allow the State to administer a “cashless” inmate property release system and save the 7 costs associated with its own management of the inmate property release system and issuance of 8 checks. The State negotiated its delegation contract with Defendants, and knowingly assented to 9 Defendants’ fee structure as a means to transfer its costs onto Plaintiff and the Class. 10 11 105. Plaintiff and the Class possessed a constitutionally protected interest in the monies Defendants took from them. 12 106. Defendants’ card user fees are excessive, unreasonable, unrelated to the 13 14 15 administration of the users’ accounts, and are imposed without regard to what, if any, benefit the users received. 16 107. Defendants’ excessive and unreasonable card user fees should be declared to 17 constitute a taking of property in violation of the Fifth Amendment of the United States 18 19 Constitution. 108. Defendants should be ordered to compensate Plaintiff and the Class for the taking 20 21 22 23 of property. 109. Plaintiff and the Class are entitled to their reasonable attorneys’ fees pursuant to 42 U.S.C. § 1988(b) (2000). 24 25 26 CLASS ACTION COMPLAINT - 24 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 25 of 32 1 2 3 4 5 VII. SECOND CAUSE OF ACTION (Electronic Fund Transfer Act, 15 U.S.C. § 1693, et seq.) (Against Defendants Rapid Financial and Cache Valley Bank) 110. Plaintiff re-alleges and incorporates by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 6 111. The primary objective of the Electronic Fund Transfer Act (“EFTA”) is to protect 7 consumer rights by providing a basic framework establishing the rights, liabilities, and 8 responsibilities of participants in the electronic fund and remittance transfer systems. 9 112. Defendants Rapid Financial and/or Cache Valley Bank are financial institutions as 10 11 defined by 15 U.S.C. § 1693(a)(9), and 12 C.F.R. §1005.2(a)(2)(i), because they directly or 12 indirectly hold accounts belonging to consumers and/or they issue an access device to consumers. 13 113. Defendants’ AccessFreedom cards are accounts pursuant to 15 U.S.C. §1693(a)(2) 14 15 16 and 12 C.F.R. §1005.3. 114. Defendants’ AccessFreedom cards are general-use prepaid cards pursuant to 15 U.S.C. § 1693l-1(2), and 12 C.F.R. §1005.20, because they are issued to consumers for personal, 17 family, or household purposes and are redeemable at multiple, unaffiliated merchants. 18 19 20 115. Defendants market their prepaid debit release cards to the general public by promoting the AccessFreedom Cards on the internet and Facebook. 21 116. Defendants’ AccessFreedom Card is distributed generally to any consumer whose 22 cash has been confiscated by Kitsap County, (or by any other governmental entities that have 23 24 contracted with Defendants for prepaid debit release cards). 117. Defendants violated 15 U.S.C. § 1693l-1 by imposing dormancy, inactivity and/or 25 26 service fees—including weekly maintenance fees, transaction fees, and ATM fees—on the CLASS ACTION COMPLAINT - 25 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 26 of 32 1 general-use prepaid cards of Plaintiff and members of the Class without satisfying 15 U.S.C. § 2 1693l-1(b)(2). 3 118. Among its consumer protection provisions, the EFTA also prohibits the 4 unsolicited issuance to a consumer of an electronic fund transfer card that does not meet all of 5 6 the EFTA’s unsolicited access device criteria. See 15 U.S.C. § 1693i. 7 119. Defendants Rapid Financial and/or Cache Valley Bank violated 15 U.S.C. § 1693i 8 by issuing to consumers already-validated, unsolicited electronic transfer cards that do not meet 9 all of the EFTA’s unsolicited access device criteria. 10 11 120. Defendants Rapid Financial’s and/or Cache Valley Bank’s violations of the EFTA have caused and continue to cause Plaintiff and the Class damages. 12 121. Plaintiff and the Class are entitled to their actual and statutory damages, as well as 13 14 reasonable attorneys’ fees and costs pursuant to 15 U.S.C. § 1693m(a)(3). 15 VIII. THIRD CAUSE OF ACTION 16 (Washington Consumer Protection Act, Wash. Rev. Code Ann. §§ 19.86, et seq.) (Against all Defendants) 17 122. Plaintiff re-alleges and incorporates by reference all of the allegations of this 18 19 20 21 22 23 Complaint with the same force and effect as if fully restated herein. 123. Plaintiff brings this action on behalf of himself and the Washington Subclass against all Defendants. 124. Defendants, Plaintiff, and the Washington Subclass members are “persons” within the meaning of Wash. Rev. Code § 19.86.010(1). 24 25 26 CLASS ACTION COMPLAINT - 26 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 27 of 32 1 125. Defendants are engaged in “trade” or “commerce” within the meaning of Wash. 2 Rev. Code § 19.86.010(2), because the unsolicited AccessFreedom cards are intended to be used 3 in commerce in Washington. 4 126. The Washington Consumer Protection Act (“Washington CPA”) makes unlawful 5 6 7 “[u]nfair methods of competition and unfair or deceptive acts or practices in the conduct of any trade or commerce.” Wash. Rev. Code § 19.86.020. 8 127. In the course of their business, Defendants, through their agents, employees, and/or 9 subsidiaries, violated the Washington CPA as detailed above. Specifically, in distributing 10 unsolicited prepaid debit cards, and then taking and keeping Plaintiff’s and the Washington 11 Subclass members’ money in the form of exorbitant fees, and in imposing fees for the return of 12 Plaintiff’s and the Washington Subclass members’ money without disclosing that fees would be 13 14 15 imposed, Defendants engaged in unfair and/or deceptive acts or practices in violation of Wash. Rev. Code § 19.86.020. 16 128. Plaintiff and the Washington Subclass members suffered ascertainable losses and 17 actual damages in the loss of their property as a direct and proximate result of Defendants’ unfair 18 19 and/or deceptive acts or practices. 129. Defendants’ violations present a continuing risk of injury to Plaintiff and the 20 21 22 Washington Subclass members, as well as to the general public. Defendants’ unlawful acts and practices complained of herein affect the public interest. 23 130. Pursuant to Wash. Rev. Code § 19.86.090, Plaintiff and the Washington Subclass 24 members seek an order enjoining Defendants’ unfair and/or deceptive acts or practices, and 25 awarding damages, treble damages, attorney fees and costs and any other just and proper relief 26 available under the Washington CPA. CLASS ACTION COMPLAINT - 27 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 28 of 32 1 IX. 2 (Conversion) (Against all Defendants) 3 4 5 FOURTH CAUSE OF ACTION 131. Plaintiff re-alleges and incorporates by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 6 132. Kitsap County Jail, and other correctional facilities that issue Defendants’ 7 AccessFreedom Cards have taken money from Plaintiff and other members of the Class to hold 8 during their incarceration, acting in the capacity of their representative. Upon their release, Kitsap 9 County Jail and other correctional facilities were obligated to return the full amount of their 10 11 12 money to them. Any purported agreement to use the AccessFreedom Card to return that money, less fees charged by the Defendants, lacks consideration and is unenforceable. 13 133. Conversion occurs when a person intentionally interferes with chattel belonging to 14 another, either by taking or unlawfully retaining it, thereby depriving the rightful owner of 15 possession. Money may be the subject of conversion if the Defendants wrongfully received it. 16 134. Defendants, exercising their control over the funds in the AccessFreedom Card 17 accounts, have wrongfully collected fees from Plaintiff and members of the Class, and have taken 18 19 20 specific and readily identifiable funds from Plaintiff and the members of the Class in payment of these fees. 21 135. Defendants, without proper authorization, assumed and exercised the right of 22 ownership over these funds, in hostility to the rights of Plaintiff and the Class, without legal 23 24 justification. 136. Defendants continue to retain these funds unlawfully and without the consent of 25 26 Plaintiff or the Class. CLASS ACTION COMPLAINT - 28 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 29 of 32 1 137. Defendants intend to permanently deprive Plaintiff and the Class of these funds. 2 138. These funds are properly owned by Plaintiff and the Class, not Keefe, Rapid 3 Investments or Cache Valley Bank, which now claim that they are entitled to their ownership, 4 contrary to the rights of Plaintiff and the Class. 5 6 139. Plaintiff and the Class are entitled to the immediate possession of these funds. 7 140. Defendants have wrongfully converted these specific and readily identifiable funds. 8 141. Defendants’ wrongful conduct is continuing. 9 142. As a direct and proximate result of Defendants’ wrongful conversion, Plaintiff and 10 11 the Class have suffered and continue to suffer damages. 143. Plaintiff and the Class are entitled to damages and prejudgment interest in an 12 amount to be determined at trial. 13 14 X. (Unjust Enrichment) (Against all Defendants) 15 16 FIFTH CAUSE OF ACTION 144. Plaintiff re-alleges and incorporates by reference all of the allegations of this 17 Complaint with the same force and effect as if fully restated herein. 18 19 20 21 22 23 24 145. Defendants have been unjustly enriched by taking funds from the AccessFreedom Card accounts under their control in the form of fees assessed upon Plaintiff and the Class. 146. The circumstances are such that it would be unjust and inequitable for Defendants to retain the benefit that they unjustly received from Plaintiff and the Class members. 147. Plaintiff and the Class members have conferred benefits on Defendants, which Defendants have knowingly accepted and retained. 25 26 CLASS ACTION COMPLAINT - 29 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 30 of 32 1 148. Plaintiff and the Class members have suffered and continue to suffer actual 2 damages as a result of Defendants’ unjust retention of proceeds from their acts and practices 3 alleged herein. 4 149. Plaintiff and the Class members seek to disgorge Defendants’ unlawfully retained 5 6 7 benefits resulting from their unlawful conduct, and seek restitution for the benefit of Plaintiff and the Class. 8 150. Plaintiff and the Class members are entitled to the imposition of a constructive trust 9 upon Defendants, such that their unjustly retained benefits are distributed equitably by the Court 10 to and for the benefit of Plaintiff and the Class members. 11 12 XI. DEMAND FOR JURY TRIAL Plaintiff respectfully requests jury trial of all claims that can be so tried. 13 XII. 14 15 WHEREFORE, Plaintiff, on behalf of himself and on behalf of the Class, prays for the 16 following relief: 17 1. 18 19 20 PRAYER FOR RELIEF An order certifying this case as a class action and appointing Plaintiff and the undersigned counsel to represent the Class; 2. Declaration, judgment, and decree that Defendants Keefe, Rapid Investments and/or Cache Valley Bank’s conduct alleged herein: 21 22 23 24 a. Violates the Fifth Amendment to the United States Constitution; b. Violates the Electronic Fund Transfer Act (as to Defendants Rapid Investments and Cache Valley Bank only); 25 c. Violates the Washington Consumer Protection Act; 26 d. Constitutes conversion; and CLASS ACTION COMPLAINT - 30 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 31 of 32 1 2 3 e. Constitutes unjust enrichment. 3. Damages to Plaintiff and the Class to the maximum extent allowed under state and federal law; including ordering Defendants to pay actual and statutory damages; 4 4. Costs and disbursements of the action; 5. Restitution and/or disgorgement of ill-gotten gains; 7 6. Pre- and post-judgment interest; and 8 7. Reasonable attorneys’ fees; 9 8. Except for the first cause of action, an injunction requiring corrective measures to 5 6 10 11 be taken to prevent Defendants from engaging in the above-described misconduct; and 9. Such other relief, in law and equity, as this Court may deem just and proper. 12 DATED this 20th day of October, 2017. 13 KELLER ROHRBACK L.L.P. 14 15 By /s/Mark A. Griffin /s/Laura R. Gerber Mark A. Griffin, WSBA #16296 Laura R. Gerber, WSBA # 34981 1201 Third Avenue, Suite 3200 Seattle, WA 98101 Telephone: (206) 623-1900 Facsimile: (206) 623-3384 mgriffin@kellerrohrback.com lgerber@kellerrohrback.com 16 17 18 19 20 21 KELLER ROHRBACK L.L.P. Lisa Faye Petak (Pro Hac Vice Pending) 801 Garden Street, Suite 301 Santa Barbara, CA 93101 Telephone: (805) 456-1496 Facsimile: (805) 456-1497 lpetak@kellerrohrback.com 22 23 24 25 26 CLASS ACTION COMPLAINT - 31 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384 Case 3:17-cv-05848-RBL Document 1 Filed 10/20/17 Page 32 of 32 6 THE HUMAN RIGHTS DEFENSE CENTER Sabarish Neelakanta (Pro Hac Vice Pending) Daniel Marshall (Pro Hac Vice Pending) Masimba Mutamba (Pro Hac Vice Pending) P.O. Box 1151 Lake Worth, FL 33460 Telephone: (561) 360-2523 Facsimile: (866) 228-1681 sneelakanta@humanrightsdefensecenter.org dmarshall@humanrightsdefensecenter.org mmutamba@humanrightsdefensecenter.org 7 Attorneys for Plaintiff 1 2 3 4 5 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 CLASS ACTION COMPLAINT - 32 K E L L E R R O H R B AC K L.L.P. 1201 Third A venue, Suite 3200 Seattle, W A 98101-3052 TELEPHONE: (206) 623-1900 FACSIMILE : (206) 623-3384