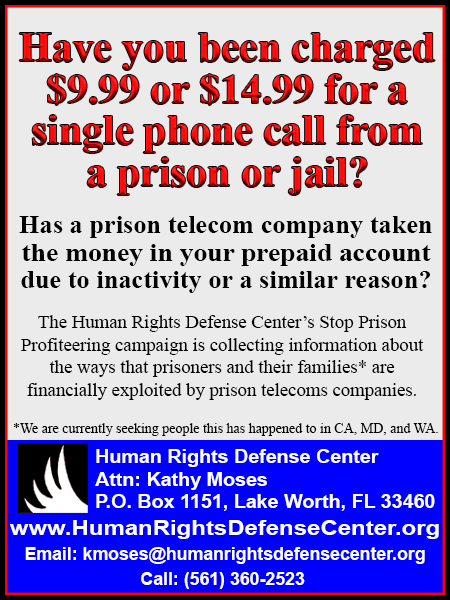

Albert, et al. v. Global Tel*Link Corp., Securus Technologies, 3Cinteractive Corp., MD, class action complaint, prison phone calls, 2020

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.