Brown v. Stored Value Cards, 9th Circuit, Opinion, Debit Cards, 2020

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

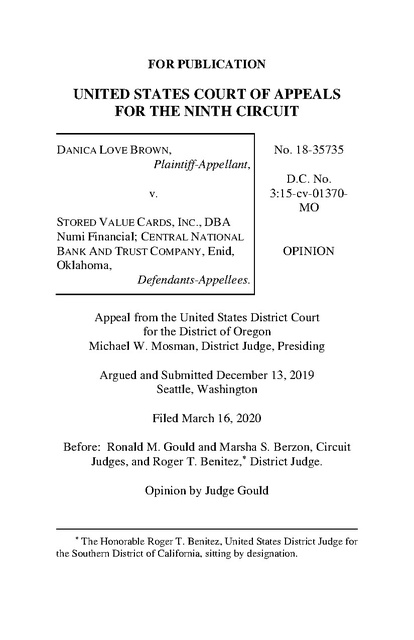

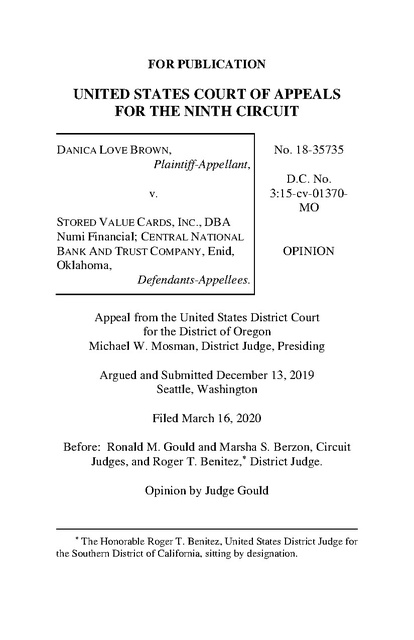

FOR PUBLICATION UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT DANICA LOVE BROWN, Plaintiff-Appellant, No. 18-35735 v. D.C. No. 3:15-cv-01370MO STORED VALUE CARDS, INC., DBA Numi Financial; CENTRAL NATIONAL BANK AND TRUST COMPANY, Enid, Oklahoma, Defendants-Appellees. OPINION Appeal from the United States District Court for the District of Oregon Michael W. Mosman, District Judge, Presiding Argued and Submitted December 13, 2019 Seattle, Washington Filed March 16, 2020 Before: Ronald M. Gould and Marsha S. Berzon, Circuit Judges, and Roger T. Benitez, * District Judge. Opinion by Judge Gould * The Honorable Roger T. Benitez, United States District Judge for the Southern District of California, sitting by designation. 2 BROWN V. STORED VALUE CARDS, INC. SUMMARY ** Electronic Fund Transfers Act / Constitutional Law The panel reversed the district court’s partial dismissal and partial summary judgment on claims under the Electronic Fund Transfers Act, the Takings Clause, and Oregon state law concerning a private company’s return of released jail or prison inmates’ money via a prepaid debit card loaded with the balance of their funds. Defendants assessed fees on the cards. The panel held that plaintiff stated a claim under EFTA § 1693l-1, which prohibits charging service fees to “general-use prepaid cards.” A general-use prepaid card does not include a card that “is not marketed to the general public.” The panel held that the released inmates belonged to the general public, which they rejoined upon release, and defendants indirectly marketed the cards to the released inmates. The panel further held that the district court abused its discretion in denying plaintiff leave to file a third amended complaint reinstating her EFTA claims under both § 1693l-1 and § 1693i, which prohibits the issuance, absent certain disclosures, of unsolicited validated cards that provide access to a “consumer’s account.” The panel held that a consumer account includes the sort of prepaid account that the released inmates received. The panel reversed the district court’s grant of summary judgment to defendants on plaintiff’s per se takings claim. ** This summary constitutes no part of the opinion of the court. It has been prepared by court staff for the convenience of the reader. BROWN V. STORED VALUE CARDS, INC. 3 Assuming without deciding that defendants were state actors, the panel concluded that the release cards were not the functional equivalent of cash or a check because the value of the cards quickly and permanently deteriorated. The panel remanded for the district court to consider in the first instance the reasonableness of the fees assessed on the cards. The panel also reversed the district court’s grant of summary judgment on plaintiffs’ state law claims, and remanded the case to the district court for further proceedings. COUNSEL Karla Gilbride (argued), Public Justice, P.C., Washington, D.C.; Mark Adam Griffin and Daniel Parke Mensher, Keller Rohrback LLP, Seattle, Washington; Benjamin Wright Haile, Attorney, Portland, Oregon; for Plaintiff-Appellant. Eric Nystrom (argued), John C. Ekman, and Natalie I. Uhlemann, Fox Rothschild LLP, Minneapolis, Minnesota, for Defendants-Appellees. Hassan Zavareei, Anna C. Haac, and Tanya S. Koshy, Tycko & Zavareei LLP, Washington, D.C., for Amici Curiae International CURE, Equal Justice Under Law, The Florida Institutional Legal Service Project of Florida Legal Service, The Legal Aid Society, National Police Accountability Project, Public Counsel, San Francisco Public Defender's Office, Southern Poverty Law Center, Texas Civil Rights Project, Working Narratives, and University Of California Davis School of Law Immigration Law Clinic. 4 BROWN V. STORED VALUE CARDS, INC. OPINION GOULD, Circuit Judge: When a person is arrested and detained, the detention facility confiscates his or her personal property, including any cash. Detention facilities safeguard an inmate’s money throughout the duration of his or her incarceration, typically in an inmate trust account. When an inmate is released, the facility has traditionally returned the inmate’s money. For local governments, handling inmates’ cash is expensive and time consuming. In recent years, many local governments have begun delegating the function of returning the property of released inmates to private, for-profit companies. One such company, Stored Value Cards d/b/a Numi (“Numi”), returns released inmates’ money via a prepaid debit card loaded with the balance of their funds. Numi does not charge most local governments for its services. Instead, Numi earns revenue by charging fees to the cardholders. This case illustrates some of the hazards and risks that may arise when prisons transfer what formerly were government functions to for-profit enterprises. Danica Brown (“Brown”) 1 brought suit against Numi and its partner Central National Bank and Trust Company (“CNB”) (collectively, “Defendants”), alleging that they violated the Electronic Fund Transfers Act (“EFTA”), violated the Fifth Amendment Takings Clause, and were liable for conversion and unjust enrichment under Oregon state law. The district court dismissed Brown’s EFTA claim for failure to state a claim, denied leave to file a third 1 Throughout this opinion, we use the terms “Brown” or “Danica Brown” to refer to Plaintiff Danica Love Brown. When we refer to shooting victim Michael Brown, we include his first name. BROWN V. STORED VALUE CARDS, INC. 5 amended complaint, and granted summary judgment to Defendants on Brown’s takings and state law claims. Brown appeals, and we reverse and remand. I A The Multnomah County jail confiscates any cash carried by an arrestee upon incarceration. The inmate’s funds are kept in an inmate trust account until he or she is released. Before 2014, Multnomah County returned a released inmate’s money in the form of cash if the total was less than $60, or a check if the total was greater than $60. This process was considered by Multnomah County to be expensive and time consuming: Multnomah County estimates that it spent about $275,000 in labor costs annually and two to three staff hours per day handling inmates’ cash. In 2014, Multnomah County contracted with Numi to return released inmates’ funds via prepaid debit cards, which are sometimes referred to as “release cards.” 2 Multnomah County pays nothing at all to participate in Numi’s debit card program. Numi contracts with CNB to issue the release cards and hold the card funds in a master funding account. When an inmate is released, the money in his or her inmate trust account is transferred into the CNB master funding account. The released inmate receives a prepaid release card loaded with his or her funds, and the card is activated and ready for immediate use. 2 Numi is a subcontractor through Multnomah County’s contract with Securus Technologies. Securus Technologies contracts with Multnomah County as a commissary partner offering a range of services in the County’s jails. 6 BROWN V. STORED VALUE CARDS, INC. Numi earns revenue from the fees that it charges to cardholders. Counties and municipalities that contract with Numi have a choice of several fee schedules, distinguished by how often maintenance fees are charged. P7C cards charge maintenance fees once per month, and P1C cards charge maintenance fees once per week. Some counties and municipalities have negotiated deviations from the standard fee schedules to lighten the burden on cardholders. Other counties and municipalities, including Napa County, California and Broward County, Florida, pay a flat fee to subsidize each card instead of passing on the fees to cardholders. When it contracted with Numi, Multnomah County adopted a P7C fee schedule with no deviations or subsidies. The schedule it adopted contemplated that the County would pay no fees itself and Numi’s compensation would come from fees paid by the former inmates released into the public. Under the fee schedule adopted by Multnomah County, Defendants charge cardholders a $5.95 monthly maintenance fee, first charged only five days after card activation. There is also a $2.95 fee for every ATM withdrawal in addition to any fee charged by the ATM itself. Other fees include a $0.50 fee for contacting the automated customer service system more than three times per month, a $9.95 fee for requesting the balance of the card by check, a $1.00 fee for each ATM balance inquiry made by the cardholder, and a $0.95 fee for each attempted transaction that was declined due to insufficient funds or an incorrect PIN. According to Defendants, a released inmate can avoid these fees. The back of the release card states in small print that a $5.95 monthly service fee will be charged five days after the card’s activation. Released inmates are also BROWN V. STORED VALUE CARDS, INC. 7 supposed to receive a Card Usage Tips wallet card with a section entitled “How to avoid Service Fees.” The wallet card states that there is no fee to transfer their funds to a personal bank account on Numi’s website, receive cash back after making a purchase from a retailer, or withdraw funds over the counter at a bank. The wallet card does not disclose that not all retailers will provide cash back, or that bank withdrawals are free only at Mastercard-affiliated banks. Multnomah County also gave the departing former inmates a document entitled “Debit Release Card Information” with a list of designated “surcharge-free ATMs,” but this list was inaccurate at the time Brown was released because some of the listed ATMs charged fees. B On November 25, 2014, Brown was arrested in Portland, Oregon. She was participating in a public protest after a Missouri grand jury had decided not to indict Darren Wilson for the police-shooting death of Michael Brown. 3 At the time of Danica Brown’s arrest, she carried $30.97 in cash. Her cash in that amount was confiscated along with the rest of her personal belongings when she was taken into Multnomah County custody. She was released around 2:30am on November 26, about seven hours after her arrest. The charges against her were later dropped. Upon her release, Brown did not receive her previously confiscated money in the form of cash. Instead, she was 3 On August 9, 2014, Michael Brown, an unarmed black teenager, was shot and killed by Wilson, a white police officer, in Ferguson, Missouri. Timothy Williams, Five Years After Michael Brown’s Death, His Father Wants a New Investigation, N.Y. Times (Aug. 15, 2019). The fatal shooting and the failure to indict Wilson sparked nationwide protests. Id. 8 BROWN V. STORED VALUE CARDS, INC. given a Numi debit card loaded with $30.97. Along with the card, Brown received some paperwork with card information, including the Card Usage Tips wallet card, and the Debit Release Card Information sheet. She did not read the paperwork because she did not have her eyeglasses. The debit card was not Brown’s immediate concern upon her release. On November 26, the day after her arrest, Brown spent most of her time attending her arraignment and retrieving her other confiscated belongings. November 27 was Thanksgiving Day. When Brown finally examined the release card and the associated paperwork, she learned that there was a monthly service charge. She assumed, incorrectly as it turned out, that the charge would occur after she had been using the card for a month. She visited Numi’s website, where she learned that she could transfer the balance of her card to her personal bank account. But she chose not to make this transfer because she did not want to provide her personal bank account information to Numi. Instead, she used the release card to make small purchases like buying coffee. On December 1, Brown attempted to make a $15 purchase and the transaction was declined. Brown learned that her card had insufficient funds for the purchase because Defendants had debited a $5.95 monthly service fee earlier that day, which was only five days after she originally received the card. Due to the declined transaction, Defendants debited another $0.95 from her card. Brown made two more small purchases in early December. On January 1, Defendants debited the remaining $0.07 from the card toward her monthly service fee. In total, Defendants debited $6.97, or twenty-two percent of the card’s original $30.97 value. BROWN V. STORED VALUE CARDS, INC. 9 C In July 2015, Brown filed a complaint against Defendants on behalf of herself and a proposed class of formerly incarcerated people who received Defendants’ debit cards upon release and who paid fees associated with the use or maintenance of those cards. In her original complaint, she alleged four claims: (1) a violation of section 1693i of EFTA, which prohibits the issuance of unsolicited debit cards absent certain requirements; (2) a violation of the Oregon Unfair Trade Practices Act; (3) conversion under Oregon state law; and (4) unjust enrichment under Oregon state law. Defendants moved to dismiss. In response to the motion to dismiss, Brown filed her first amended complaint. She removed any reference to section 1693i and eliminated her claim under the Oregon Unfair Trade Practices Act. She added two new claims: a violation of section 1693l-1 of EFTA, which prohibits service fees on general-use prepaid cards, and a 42 U.S.C. § 1983 claim for a violation of the Fifth Amendment’s Takings Clause. She realleged her state law claims for conversion and unjust enrichment. Defendants again moved to dismiss. This time, the district court granted Defendants’ motion as to Brown’s EFTA claim and her takings claim, and it denied the motion as to Brown’s state law claims. The court granted Brown leave to amend her takings claim. Brown filed a second amended complaint, realleging her takings claim and her state law claims. Defendants moved to dismiss, and the district court denied that motion. The case proceeded to discovery. 10 BROWN V. STORED VALUE CARDS, INC. Before the close of discovery, Defendants filed a motion for summary judgment. 4 While the motion for summary judgment was pending, Brown filed a motion for leave to file a third amended complaint to reinstate her EFTA claims as arising under both section 1693i and section 1693l-1, based on new evidence obtained in discovery. The district court denied leave to amend without written opinion or explanation. After hearing oral argument, the district court granted Defendants’ motion for summary judgment on Brown’s takings and state law claims. Brown filed this appeal challenging the district court’s orders (1) dismissing her EFTA claims; (2) denying her leave to file a third amended complaint reinstating her EFTA claims; and (3) granting summary judgment to Defendants on the takings and state law claims. We consider these issues in turn. II EFTA protects the rights of consumers in electronic fund transfers. 15 U.S.C. § 1693(b). The Consumer Financial Protection Bureau (“CFPB”) has regulatory authority over most provisions of EFTA. Id. § 1693b(a)(1). At various points in this litigation, Brown alleged claims under sections 1693i and 1693l-1 of EFTA. Section 1693i prohibits the issuance, absent certain disclosures, of unsolicited validated cards that provide access to a “consumer’s account.” Id. § 1693i. A card is 4 Pursuant to Rule 56 of the Federal Rules of Civil Procedure, a motion for summary judgment can be filed “at any time until 30 days after the close of all discovery.” BROWN V. STORED VALUE CARDS, INC. 11 “validated when it may be used to initiate an electronic fund transfer.” Id. § 1693i(c). Section 1693l-1 prohibits charging service fees to “general-use prepaid cards” unless the card has not been used for 12 months and other requirements have been met. Id. § 1693l-1(b). A general-use prepaid card is (1) “redeemable at multiple, unaffiliated merchants or services providers, or automated teller machines”; (2) “issued in a requested amount”; (3) “purchased or loaded on a prepaid basis”; and (4) “honored . . . by merchants for goods or services, or at automated teller machines.” Id. § 1693l1(a)(2)(A). Relevant for this appeal, a general-use prepaid card does not include a card that “is not marketed to the general public.” Id. § 1693l-1(a)(2)(D)(iv). We review de novo a dismissal for failure to state a claim under Rule 12(b)(6). Puri v. Khalsa, 844 F.3d 1152, 1157 (9th Cir. 2017). All well-pleaded allegations of material fact are taken as true and construed in the light most favorable to the non-moving party. Id. The plaintiff must plead facts to state a claim for relief that is “plausible on its face.” Bell Atl. Corp. v. Twombly, 550 U.S. 544, 570 (2007). Brown contends that the district court erred by dismissing her claim under section 1693l-1. 5 Defendants 5 Brown also contends that the district court erred in dismissing her claim under section 1693i. However, Brown did not cite to section 1693i in her first amended complaint. An amended complaint supersedes the original complaint and renders it without legal effect. Lacey v. Maricopa County, 693 F.3d 896, 925 (9th Cir. 2012) (en banc). Although Brown alleged a section 1693i claim in her original complaint, she removed any reference to that subsection in her first amended complaint. Even assuming that Brown could state a claim under section 1693i without citing to that exact provision, she did not plead facts sufficient to state a 12 BROWN V. STORED VALUE CARDS, INC. respond that section 1693l-1 does not apply because the release cards are not marketed to the general public. Specifically, they contend that (1) inmates are not the general public, and (2) Defendants did not directly market the cards to inmates. Defendants’ contentions lack merit. The CFPB’s official commentary to section 1693l-1 acknowledges that a subset of the population may constitute the general public. See 12 C.F.R. § 1005.20(b)(4) (Supp. I 2019). Whether current inmates as a subgroup constitute the general public is irrelevant. The release cards are issued to inmates when they are released from jail or prison, rejoining the general public. Second, although at the time of the motion to dismiss there was no evidence of direct marketing to released inmates, the CFPB defines “marketing” to include indirect marketing. See 12 C.F.R. § 1005.20(b)(4) (Supp. I 2019) (stating that a card is “marketed” if “the potential use of the card . . . is directly or indirectly offered, advertised, or otherwise promoted”). Factors to be considered when determining whether a card is marketed to the general public include “the means or channel through which the card . . . may be obtained by a consumer, the subset of consumers that are eligible to obtain the card . . . and whether the availability of the card . . . is advertised or otherwise promoted in the marketplace.” Id. Applying these factors, Defendants indirectly market the cards to released inmates. Here, Defendants market the card program to municipalities and correctional facilities, and plausible claim for relief under section 1693i. Accordingly, we need not address Brown’s contention that the district court erred in dismissing her claim under section 1693i. BROWN V. STORED VALUE CARDS, INC. 13 Multnomah County does not give released inmates a choice of whether to accept the cards. Defendants know, expect, and intend that Multnomah County will give the cards to released inmates. That is the only way Defendants assure the use of and obtain payment for the cards. So Defendants indirectly “offer[], advertise[], or . . . promote[]” the cards to the released inmates. Id. When inmates are released from jail or prison, they reenter the general public. And when Defendants marketed the cards to Multnomah County, they indirectly marketed them to these released inmates. Because Defendants marketed their cards to the general public, section 1693l-1 applies. We hold that Brown plausibly stated a claim for relief under section 1693l-1 and that the district court erred in dismissing that claim. III We next consider the district court’s denial of Brown’s motion for leave to file a third amended complaint. We review denial of leave to amend for an abuse of discretion. Curry v. Yelp Inc., 875 F.3d 1219, 1224 (9th Cir. 2017). In March 2018, Brown sought leave to file a third amended complaint reinstating her EFTA claims under both section 1693i and section 1693l-1. She proposed to include new paragraphs detailing Defendants’ direct marketing of their prepaid cards in jails and prisons based on new evidence obtained during discovery. In particular, Brown obtained evidence that Defendants displayed “large, color posters” in each facility “extoll[ing] the benefits” of the card as a way for released inmates to access their funds “immediately.” 14 BROWN V. STORED VALUE CARDS, INC. Requests for leave to amend should be granted with “extreme liberality.” Moss v. U.S. Secret Serv., 572 F.3d 962, 972 (9th Cir. 2009) (quoting Owens v. Kaiser Found. Health Plan, Inc., 244 F.3d 708, 712 (9th Cir. 2001)). When considering whether to grant leave to amend, a district court should consider several factors including undue delay, the movant’s bad faith or dilatory motive, repeated failure to cure deficiencies by amendments previously allowed, undue prejudice to the opposing party, and futility. Foman v. Davis, 371 U.S. 178, 182 (1962). Of the Foman factors, prejudice to the opposing party carries the most weight. Eminence Capital, LLC v. Aspeon, Inc., 316 F.3d 1048, 1052 (9th Cir. 2003). The Foman factors weigh decidedly against denying leave to amend. There is no indication that allowing the amendment would prejudice Defendants, and Defendants do not contend that they would be prejudiced. There is also no indication of undue delay, bad faith, or dilatory motive by Brown: she filed her motion for leave to amend just two days after a deposition revealed new evidence of direct marketing to released inmates. Likewise, Brown has not repeatedly failed to cure deficiencies. Rather, Brown sought leave to amend based on newly discovered evidence. Defendants’ central argument on appeal is that any amendment would be futile because Brown’s EFTA claims fail as a matter of law. This is incorrect. Brown’s proposed third amended complaint alleging evidence of direct marketing to released inmates rejoining the general public plausibly states a claim for relief under section 1693l-1. Brown also states a claim for relief under section 1693i, plausibly alleging that Defendants issued unsolicited, validated prepaid cards. Defendants contend that section 1693i does not cover the card that Brown received because BROWN V. STORED VALUE CARDS, INC. 15 that card did not provide access to a “consumer’s account,” 15 U.S.C. § 1693i, as the term “account” was defined by the CFPB at the time, see id. § 1693a (noting that the CFPB has the authority to define “account”). In support of this argument, Defendants note that the regulation implementing section 1693i, 12 C.F.R. § 1005.2, was amended recently to state that “[t]he term [account] includes a prepaid account.” 12 C.F.R. § 1005.2(b)(3). Although the change announced that prepaid cards of the kind that Brown received fall within section 1693i’s coverage, the former regulation did not state otherwise. See 12 C.F.R. § 1005.2 (2014). The question is a statutory interpretation issue for the court. The text of section 1693i in no way indicates that a “consumer[] account” cannot encompass the sort of prepaid account that Brown received access to through her Numi card; if it did, the subsequent amendment to section 1005.2 would be invalid. Both then and now, section 1005.2 defined “account” as “a demand deposit (checking), savings, or other consumer asset account . . . held directly or indirectly by a financial institution and established primarily for personal, family, or household purposes.” What Brown received was an account “held directly or indirectly by a financial institution”—through Mastercard—that she could use for her own “personal, family, or household purposes.” We acknowledge that Brown sought leave to amend long after she filed her original complaint and after two previous amendments. But the Federal Rules call for liberal amendment of pleadings before trial. Fed. R. Civ. P. 15(a)(2) (“The court should freely give leave [to amend] when justice so requires.”). And a district court’s denial of leave to amend without explanation is subject to reversal: “Such a judgment is ‘not an exercise of discretion; it is merely abuse of that discretion and inconsistent with the 16 BROWN V. STORED VALUE CARDS, INC. spirit of the Federal Rules.’” Eminence Capital, LLC, 316 F.3d at 1052 (quoting Foman, 371 U.S. at 182). A liberal approach to amendment seems particularly appropriate where other persons throughout the nation could benefit from a resolution of novel issues that also apply to them, especially when there is a vast mismatch of resources between released inmates and well-funded national companies and the amendment does not prejudice defendants. As the use of Numi’s debit release cards increases, so has the litigation challenging the card fees. See Humphrey v. Stored Value Cards, 355 F. Supp. 3d 638 (N.D. Ohio 2019); Regan v. Stored Value Cards, Inc., 85 F. Supp. 3d 1357 (N.D. Ga. 2015). The parties in this case and others would benefit from a decision by the district court on the merits as opposed to leaving the issue unresolved by denying leave to amend. We hold that the district court abused its discretion when, without written explanation or opinion, it denied Brown leave to file a third amended complaint, and Defendants suffer no significant prejudice from amendment. IV We finally turn to the district court’s grant of summary judgment to Defendants on Brown’s takings claim. As a preliminary matter, Defendants did not contest that they were state actors in their motion for summary judgment. Defendants previously contested the state action issue in their motions to dismiss, and the district court found that Brown sufficiently pleaded that Defendants and the state were joint participants in the challenged activity. For purposes of this appeal, we assume without deciding that Defendants are state actors. BROWN V. STORED VALUE CARDS, INC. 17 The district court held that there was no per se taking because the release cards are the functional equivalent of cash or a check. This analysis is misguided. The release cards are not the functional equivalent of cash or a check because the value of the cards quickly and permanently deteriorates. We hold that Defendants were not entitled to summary judgment on the per se takings claim. 6 We review de novo a district court’s grant of summary judgment. Branch Banking & Tr. Co. v. D.M.S.I., LLC, 871 F.3d 751, 759 (9th Cir. 2017). Summary judgment is proper when, viewing the evidence in the light most favorable to the non-moving party, “there is no genuine dispute as to any material fact and the movant is entitled to judgment as a matter of law.” Fed. R. Civ. P. 56(a). The district court mistakenly reasoned that the release card is the functional equivalent of cash. According to the district court, the release card is a “highly transferable, usable liquid” form of currency, similar to cash. The district court acknowledged certain transaction costs and practical difficulties that come with the card, such as the fact that to avoid paying a fee, a card recipient must go to a Mastercardaffiliated bank to receive the cash value of the card from a bank teller, but it concluded that such costs and difficulties were de minimis. There is at least one crucial difference between the release card and cash: the ticking clock. From the moment Brown received her release card, she had only five days to either spend the money or retrieve the card’s cash value 6 Because we conclude that the district court erred in granting summary judgment to Defendants on Brown’s per se takings theory, we do not address her regulatory takings theory. 18 BROWN V. STORED VALUE CARDS, INC. before being charged a $5.95 monthly service fee. Cash does not similarly deteriorate in value in five days. If Brown put $30.97 in cash in her wallet and did not spend it, then she would still have $30.97 in cash after six months’ time. By contrast, if Brown did not spend the $30.97 on the release card, then the card would have no value six months later because of the monthly service fees. Similarly, a check does not deteriorate in value if it is not cashed within such a very short time. And although a particular check may not be negotiable after several months, see U.C.C. § 4-404, the debt meant to be paid is not cancelled, and the maker of the check still owes the full amount. Because the release card deteriorates in value quickly and permanently, the district court was incorrect to conclude that the release card is the functional equivalent of cash or of a check. The district court erred in granting summary judgment to Defendants on Brown’s takings claim. 7 The next step in a fees-for-services takings analysis is to determine whether the fees are a “fair approximation of the cost of benefits supplied.” United States v. Sperry Corp., 493 U.S. 52, 60 (1989) (quoting Massachusetts v. United States, 435 U.S. 444, 463 n.19 (1978)). The district court explicitly declined to rule on the reasonableness of the fees. We decline to opine at length upon an issue not decided below, see Foti v. City of Menlo Park, 146 F.3d 629, 638 (9th Cir. 1998). We note that the extent to which the fees 7 The district court also erred in granting summary judgment to Defendants on Brown’s Oregon state law claims for conversion and unjust enrichment. The district court based its ruling on its analysis that the release cards were the functional equivalent of cash. Having explained why this analysis was incorrect, see supra, we vacate that ruling and remand for the district court to evaluate Brown’s state law claims in the first instance. BROWN V. STORED VALUE CARDS, INC. 19 were avoidable might be a factor for the district court to consider in the next step of the takings analysis. 8 We reverse and remand so that the district court may consider the reasonableness of the fees in the first instance. V There can be little doubt that Multnomah County’s release card program with Numi has changed the simple government function of returning confiscated money to a released inmate into a venture in which the released inmate’s money can be eroded or lost by the charge of profit-oriented fees. Numi is entitled to fair compensation for its services, but that does not mean that it should be able without restriction to provide cards to released inmates who have not asked for them and who are likely to end up with less money than was taken from them. Similarly, the government of Multnomah County should not so easily be able to shift the burden of securing and returning released inmates’ funds to the released inmates themselves, many of whom, like Brown, are never charged with a crime. We hold that (1) Brown’s section 1693l-1 claim should not have been dismissed for failure to state a claim; (2) the district court abused its discretion when it denied Brown leave to file a third amended complaint; (3) summary judgment was not proper on Brown’s takings claim; and (4) summary judgment was not proper on Brown’s state law 8 As this issue is not pertinent to our holding, we do not decide at this point whether the district court was correct in determining that the fees were voluntarily incurred by Brown. 20 BROWN V. STORED VALUE CARDS, INC. claims. We reverse and remand for further proceedings not inconsistent with this opinion. REVERSED AND REMANDED.