PLN managing editor quoted re Keefe prison contractor

Prison services are profitable niche for Bridgeton company

A little-known St. Louis-area company has turned prisons into a business opportunity — and it’s done so by providing services that critics say come at too stiff a price.

The 40-year-old Keefe Group is one of the larger players in a cottage industry that provides inmates with everything from food and condiments to music players and phone service. It handles deposits to prisoner accounts and runs an operation that allows family and friends an easy way to send approved — as in containing no contraband or potential weapons — care packages.

Companies such as Bridgeton-based Keefe, which won a contract last year with the Missouri Department of Corrections, offer prisons a way to be more than just rooms with cages. They offer inmates a few of the pleasures of the outside world and, more importantly, a way to stay in touch with society.

But critics see the companies as profiteers, making money off the family and friends of a captive clientele.

“They find so many ways to milk these people for every penny they can,” said Michael Campbell, assistant professor of criminology at the University of Missouri-St. Louis. “You are talking about people who are extremely poor.”

Clearly, that’s an observation not shared by Keefe.

“You’ve got a very high cost of doing business,” said Jim Theiss, chief executive of the Centric Group, Keefe’s parent holding company. “I can assure you we believe in providing a value.”

CUP OF COFFEE

The company, now with $1 billion in annual revenue, got its start in 1963 as the Jack Keefe Coffee Bar, a small St. Louis firm that sold coffee to hotels around the country. It was purchased in 1974 by the Taylor family of Enterprise Rent-A-Car fame. That was just two years before a Florida prison sent the company down its current path when it started buying the same single-serve coffee packs Keefe sold to hotels.

Seeing an opportunity, the company expanded rapidly into the corrections market, developing a series of packaged drink mixes and other commissary offerings. It quickly proved adept at modifying popular foods for prison consumption.

Because of their potential as weapons, bottles and cans are nonstarters in prison. So the company pioneered the use of pouches for pretty much everything — macaroni and cheese, roast beef, chili and refried beans.

“StarKist in a pouch? We had it first,” Theiss said.

By 1982, the prison side of the business had become so strong that the company divided into two distinct units, one focused on prisons, the other on hotels. In the late 1990s, both units were spun off from their Enterprise parent to become the Centric Group, which has 2,800 employees.

The company is still owned by the Taylors. Enterprise Holdings Executive Chairman Andrew Taylor, who once served as a Keefe vice president and treasurer, is one of the company’s directors, as was his father, Jack Taylor, in the 1990s.

Enterprise referred questions about Keefe and the Taylors to Theiss, who said the family has no involvement in day-to-day operations and that there is no affiliation with the rental car empire.

Still, it’s clear that ties remain.

For example, in its successful bid last year to provide email and deposit services to Missouri prisons, the company referred to itself both as an affiliate and a subsidiary of Enterprise.

Asked about it, Theiss said, “That’s a habit we need to stop doing.”

And when it comes to public relations, Enterprise handles those duties for Keefe. The reason, a spokeswoman said, is that Keefe seldom has dealings with the public or the media and doesn’t have its own staff.

Since Keefe and its parent Centric are private companies, it’s difficult to gain a clear picture of their finances. The veil was lifted somewhat last year, when the Missouri Department of Corrections insisted that Keefe include a variety of financial information as part of its bid.

Keefe has six subsidiaries and 17 distribution centers around the country, shipping more than 25 million pounds of goods and supplies each month. In 2012, its Keefe Commissary Network, along with two other subsidiaries, recorded a robust $41 million net income on $375 million in sales.

‘A RELATIVE TERM’

The company has contracts with more than 800 public and private prisons, with the bulk of its business in commissaries. In Missouri, for example, Keefe has contracts to provide everything from strawberry Twizzlers and precooked long grain rice to creamy peanut butter and vanilla iced oatmeal cookies.

In recent years, however, the company has increasingly looked for new opportunities, pushing into financial services, portable music players and, next up, tablets.

Under its new three-year contract with Missouri’s prisons, it handles deposits made to inmate accounts and runs an email system and related security.

That contract is expected to pay Keefe somewhere around $8.5 million a year, according to the Missouri Office of Administration’s evaluation of bids.

As is typical with these types of contracts, the prison system pays nothing for the services. Instead, costs are covered by fees charged to families and friends using the services.

Deposits are subject to a range of fees, depending on how the money is moved into an inmate’s account.

Cash deposits made through the company’s network of retail partners cost $2.50. Depositing money by phone or computer costs anywhere from 95 cents to $5.75, with the largest fees attached to deposits of $50 or less. Money orders sent directly to the corrections department are still free.

It’s that fee structure, one that can claim 20 percent or more of a deposit, that draws the ire of those who criticize the small group of private firms serving this niche market.

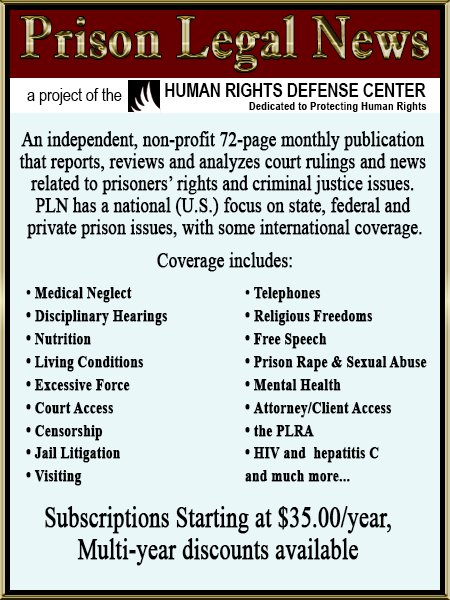

“That’s price gouging,” said Alex Friedmann, managing editor of Prison Legal News, an advocate for prisoners’ rights. “I would submit that this kind of business is kind of like printing your own money.”

Still, Keefe points out that it won the Missouri contract by offering rates considerably lower than those proposed by several competitors. Deposit industry leader JPay, for example, submitted a bid on which it was expected to make $17 million — double Keefe’s rates — from deposit fees each year, according to the Office of Administration’s evaluation.

“When they say these things are too expensive, that’s a relative term,” said Theiss, the Centric executive.

He also points to ongoing efforts by the Federal Communications Commission to slash the cost of prison phone calls as further proof of Keefe’s pricing sensitivity.

The commission has ordered caps — 25 cents per minute on collect calls and 21 cents a minute for debit card calls — for long-distance charges and is now looking at doing the same with in-state rates. The action, which has been challenged by the industry in federal court, follows years of complaints by inmate advocates over phone rates that can top $1 a minute.

Inmate calling rates are driven by three key factors: Per-minute charges, fees and commissions often paid to the jails and prisons, which consider them a source of revenue.

In filings with the FCC, Keefe’s phone division, Inmate Calling Solutions, has pushed for the use of rate caps and the elimination of fees to bring prices down.

“We ran counter to the entire industry,” Theiss said.

The phone division has contracts to provide service to more than 200 facilities around the nation. Included in those is the St. Louis County jail, where it charges as much as 25 cents a minute for domestic collect, prepaid and debit card calls. The company also charges a $6.95 fee whenever funds are deposited into a prepaid account. But 73.1 percent of the money is paid to the county as a commission, according to its contract.

And while the company may oppose the various fees charged by its competitors, that hasn’t gained Keefe much in the way of goodwill from phone critics.

“We would not consider them one of the good guys just because they advocated change,” said Friedmann, whose organization is pushing for 5 to 7 cents per-minute rates. “They might be the bully that punches you — just not as much.”

STAYING CONNECTED

The push for lower phone rates is driven largely by advocates’ belief that prisoners and the society at large will benefit by keeping these incarcerated men and women in touch with a world they will eventually rejoin. They make the same argument about access to email and other bits of technology.

“The more isolated we make the prisoners, the more difficult it is for them to re-enter society,” said Michael Mushlin, a professor at Pace University’s law school in New York. “It’s bewildering in ways that are hard for us to understand. They’re like historic relics.”

That’s one of the reasons, Keefe said, why it offered free email in its bid for the Missouri contract. The service, as requested by the state, is one-way only. Emails sent to prisoners are printed by prison staffers and delivered to inmates.

All five of the other bidders were going to charge fees for emails, but Keefe said in its contract that it “understands the importance of easing the financial burden that this communication can have on both the inmate and the loved one.”

But that’s not always the case with Keefe’s contracts. In Arkansas, for example, it costs as much as 38 cents to send an email. It’s as high as 31 cents in Oregon and 25 cents in Wyoming.

The reason for Missouri’s free pass, Theiss said, is that the state already had a system making delivery easy. “Other states have more complicated systems that require additional software and hardware to meet the state requirements,” he said.

DATA DETECTIVE

It’s probably not surprising that technology offerings geared toward prisons and jails would take into account the possibility that these services could be used for illegal activities.

Keefe’s bid includes information on the measures it uses to watch for fraud and hints of criminal activity. It has a team of 12 investigators, combined with a data mining service called Data Detective, that keeps an eye on activity inside and outside the prison.

They compare deposit activity against email traffic and information from public databases to establish relationships and social networks involving prisoners and people on the outside. Anything suspicious is reported to prison officials, according to the bid documents.

It’s the part about watching people outside the prison that raises concerns among privacy advocates, even if those users are told that their activity may be monitored.

“They’re overreaching by invading the privacy of people who have committed no crimes and have done nothing wrong,” said Sarah Rossi, director of advocacy and policy for the American Civil Liberties Union of Missouri.

It’s unclear, though, whether the Data Detective service will be used in Missouri, even though the Department of Corrections asked for something like it when it sought bids.

A corrections spokesman said in an email that it’s not being used and is under review.

As for the privacy concerns, said Theiss: “That’s their opinion.”