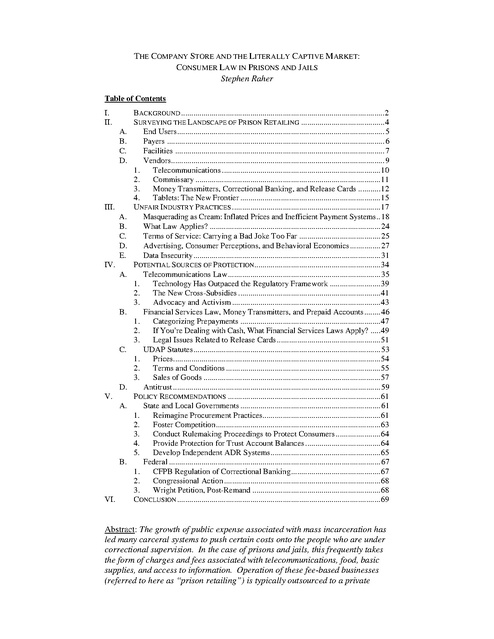

The Company Store and the Literally Captive Market, Raher, 2019

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.