Inmate Accounts Policy - Metro-Davidson Co Detention Facility, CCA, 2009

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

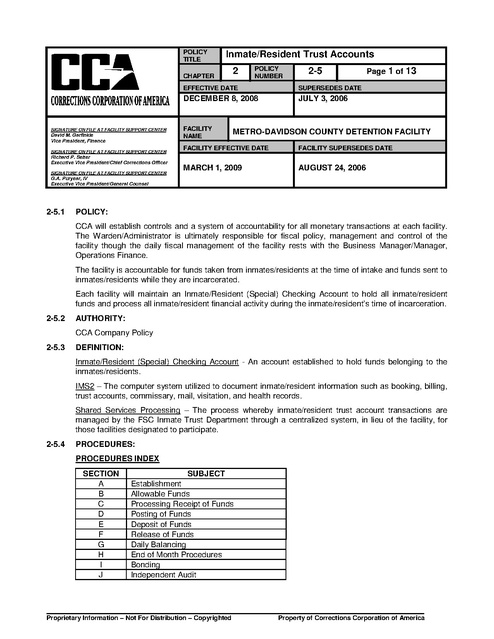

POLICY TITLE Inmate/Resident Trust Accounts CHAPTER SIGNATURE ON FILE AT FACILITY SUPPORT CENTER David M. Garfinkle Vice President, Finance SIGNATURE ON FILE AT FACILITY SUPPORT CENTER Richard P. Seiter Executive Vice President/Chief Corrections Officer SIGNATURE ON FILE AT FACILITY SUPPORT CENTER 2 POLICY NUMBER 2-5 EFFECTIVE DATE SUPERSEDES DATE DECEMBER 8, 2008 JULY 3, 2006 FACILITY NAME Page 1 of 13 METRO-DAVIDSON COUNTY DETENTION FACILITY FACILITY EFFECTIVE DATE FACILITY SUPERSEDES DATE MARCH 1, 2009 AUGUST 24, 2006 G.A. Puryear, IV Executive Vice President/General Counsel 2-5.1 POLICY: CCA will establish controls and a system of accountability for all monetary transactions at each facility. The Warden/Administrator is ultimately responsible for fiscal policy, management and control of the facility though the daily fiscal management of the facility rests with the Business Manager/Manager, Operations Finance. The facility is accountable for funds taken from inmates/residents at the time of intake and funds sent to inmates/residents while they are incarcerated. Each facility will maintain an Inmate/Resident (Special) Checking Account to hold all inmate/resident funds and process all inmate/resident financial activity during the inmate/resident’s time of incarceration. 2-5.2 AUTHORITY: CCA Company Policy 2-5.3 DEFINITION: Inmate/Resident (Special) Checking Account - An account established to hold funds belonging to the inmates/residents. IMS2 – The computer system utilized to document inmate/resident information such as booking, billing, trust accounts, commissary, mail, visitation, and health records. Shared Services Processing – The process whereby inmate/resident trust account transactions are managed by the FSC Inmate Trust Department through a centralized system, in lieu of the facility, for those facilities designated to participate. 2-5.4 PROCEDURES: PROCEDURES INDEX SECTION A B C D E F G H I J SUBJECT Establishment Allowable Funds Processing Receipt of Funds Posting of Funds Deposit of Funds Release of Funds Daily Balancing End of Month Procedures Bonding Independent Audit Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 2 of 13 K A. DECEMBER 8, 2008 2-5 ATF Section ESTABLISHMENT 1. Approval to open a new bank account or change banks for Inmate/Resident (Special) Checking Accounts must be received by the Vice President, Finance. 2. The Inmate/Resident (Special) Checking Account will be located in a properly chartered bank, insured by the FDIC, which has been approved by the Facility Support Center (FSC). 3. The color of the Inmate/Resident (Special) Checking Account checks will be different from other facility checks in an effort to help distinguish them from the other checking accounts. a. 4. Anytime the checks or the checkbook are not in use, they will be placed in a safe or locked location with access restricted to the Business Manager/Manager, Operations Finance or designated Business Office staff, who do not have check signing authority. Authorized Account Signatures A manual signature or IMS2 generated signature is required on all checks; signature stamps are prohibited. a. b. Facility Issued Checks i. The Warden/Administrator, Assistant Warden/Administrator(s), Assistant Controller, and Senior Director, Accounting are authorized to sign checks written from the Inmate/Resident (Special) Checking Account. ii. In addition, the Warden/Administrator has the authority to allow the Chief of Security to sign checks written from the Inmate/Resident (Special) Checking Account. Facility Support Center Issued Concentration Bank Account) Checks (Shared Services Processing The Assistant Controller and Senior Director, Accounting are authorized to sign checks written from the Inmate/Resident (Special) Checking Account. 5. Inmate/Resident Interest Bearing Accounts Based on contractual requirements, inmates/residents may establish personal interestbearing accounts and accrue interest earned on those funds with the approval of the Warden/Administrator. If applicable, arrangements for interest-bearing accounts are the responsibility of the inmate/resident. AT THIS FACILITY, CONTRACTUAL REQUIREMENTS FOR INMATE/RESIDENT INTEREST BEARING ACCOUNTS ARE: NONE B. ALLOWABLE FUNDS 1. Allowable funds may be received from various sources (e.g. funds received through intake, visitation, mail, off-site bank lockbox, wages, valid property claims, awards, Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 3 of 13 DECEMBER 8, 2008 2-5 Western Union or other approved electronic transfers, etc.). Funds will not be received through visitation unless required by the management contract. AT THIS FACILITY, FUNDS ARE ALLOWABLE THROUGH THE FOLLOWING SOURCES: INTAKE, MAIL, AND PROPERTY CLAIMS 2. Upon admission, each inmate/resident will receive information regarding allowable funds. Information may be disseminated via the Inmate/Resident Handbook. 3. Any funds received in a manner not authorized by this policy will be returned to sender. In the event a return address is not available, the funds will be disbursed according to contractual requirements or escheated to the appropriate state after a one (1) year waiting period. In the event the facility participates in shared services processing the funds will be forwarded to the FSC Inmate Trust Department. a. AT THIS FACILITY, CONTRACTUAL RETURNABLE FUNDS ARE: REQUIREMENTS FOR NON- NONE C. PROCESSING RECEIPT OF FUNDS 1. Arrival At the time of arrival, security personnel will search the inmate/resident's person for United States (U.S.) and non U.S. currency. All non U.S. currency will be listed on a property receipt and mailed out or stored in the property room with the inmate/resident’s other personal property. All U.S. currency will be handled in accordance with procedures outlined below. a. Facilities Utilizing IMS2 i. The officer processing arriving inmates/residents will complete a batch process deposit for all inmate/resident monies obtained during the arrival process. NOTE: If the inmate/resident arrives with more than twenty-five dollars ($25), two (2) officers are required to count the money. The money will be placed in a separate envelope from other money obtained and both officers are required to sign the envelope verifying the amount. ii. The system will print a temporary receipt of the transaction which will include the inmate/resident’s name, number, and transaction amount and the receipt will be given to the inmate/resident. iii. The processing officer will place all monies received in an envelope/bag and place the monies into the drop safe for the Business Manager/Manager, Operations Finance or designated Business Office staff to retrieve. iv. Upon completion of shift and/or processing of arrivals, the processing officer will close the batch process file in the system. Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 4 of 13 DECEMBER 8, 2008 v. vi. b. 2-5 Each business morning the Business Manager/Manager, Operations Finance or designated Business Office staff will print out a computer generated listing of the batch file, unless already included with the funds. • The print out will be used at the drop safe to verify all funds collected. • Two (2) people should be present for the verification process. • If there is a discrepancy, the officer(s) who processed the transaction will be held responsible. After all funds from the drop safe have been verified to ensure the total amount of funds retrieved from the safe is equal to the amount on the batch print out, the Business Manager/Manager, Operations Finance or designated Business Office staff will accept each item in the batch process and post the funds to the inmate/resident account(s). • The deposit slip prepared for deposit should equal the computer generated listing. • The total amount should also appear on the month-end deposit listing. All Other Facilities i. All funds obtained from the inmate/resident will be recorded on the property form. ii. A triplicate receipt book will be maintained by the processing officer for all U.S. currency and coin obtained during arrival. • The inmate/resident will receive the top copy of the receipt. • The second copy of the receipt will be placed in an envelope/bag with the inmate/resident’s currency and placed in a drop safe for the Business Manager/Manager, Operations Finance or designated Business Office staff to retrieve. • The third copy of the receipt will remain in the receipt book as an audit trail. NOTE: If the amount of currency exceeds twenty-five dollars ($25), two (2) officers are required to count the money and sign the receipt verifying the amount. iii. iv. Each business morning the Business Manager/Manager, Operations Finance or designated Business Office staff will: • Pull all envelopes/bag out of the drop safe and verify the money and receipt in each envelope/bag. • Two (2) people should be present for the verification. • If there is a discrepancy, the officer(s) who signed the receipt will be held responsible. After all funds from the drop safe have been verified, the Business Manager/Manager, Operations Finance or designated Business Office Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 5 of 13 DECEMBER 8, 2008 2-5 staff will prepare a computer generated listing of deposits which includes: v. 2. • The inmate/resident’s number; and • The amount of deposit. The Business Manager/Manager, Operations Finance or designated Business Office staff will verify that the total amount of funds received from the drop safe is equal to the total on the computer generated listing. • The deposit slip prepared for deposit should equal the computer generated listing. • The total amount should also appear on the month-end deposit listing. Visitation In the event the facility is contractually required to accept funds from visitors during visitation, the funds will be handled in accordance with procedures outlined below. a. Facilities Utilizing IMS2 i. The Visitation Officer will complete a batch process deposit for all inmate/resident monies received during visitation. NOTE: In the event the management contract requires the facility to accept cash, two (2) officers are required to verify amounts exceeding twenty-five dollars ($25). The money will be placed in a separate envelope from other money obtained and both officers are required to sign the envelope verifying the amount. ii. The system will print out a temporary receipt of the transaction which will include the inmate/resident’s name, number, and amount and the receipt will be given to the visitor. iii. The Visitation Officer will place all monies received in an envelope/bag and place the monies into the drop safe for the Business Manager/Manager, Operations Finance or designated Business Office staff to retrieve. iv. Upon completion of shift and/or completion of visitation, the Visitation Officer will close the batch file in the system. v. Each business morning the Business Manager/Manager, Operations Finance or Business Office Staff will print out a computer generated listing of the batch file, unless already included with the funds. vi. • The print out will be used at the drop safe to verify all funds collected. • Two (2) people should be present for the verification process. • If there is a discrepancy, the Visitation Officer(s) who processed the transaction will be held responsible. After all funds from the drop safe have been verified to ensure the total amount of funds retrieved from the safe is equal to the amount on the batch print out, the Business Manager/Manager, Operations Finance or Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 6 of 13 DECEMBER 8, 2008 2-5 designated Business Office staff will accept each item in the batch process and post the funds to the inmate/resident account(s). b. The deposit slip prepared for deposit should equal the computer generated listing. • The total amount should also appear on the month-end deposit listing. All Other Facilities i. In the event the management contract requires the facility to accept cash, two (2) officers are required to verify amounts exceeding twentyfive dollars ($25). The money will be placed in a separate envelope from other money obtained and both officers are required to sign the envelope verifying the amount. ii. A triplicate receipt book will be maintained for all funds received through visitation. iii. iv. v. 3. • • The visitor will receive the top copy of the receipt. • The second copy will be placed in the drop safe with the funds received. • The third copy will remain in the receipt book as an audit trail. Each business morning the Business Manager/Manager, Operations Finance or designated Business Office staff will: • Pull all envelopes out of the drop safe and verify the funds and receipt in each envelope. • Two (2) people should be present for the verification. • If there is a discrepancy, the officer(s) who signed the receipt will be held responsible. After all funds from the drop safe have been verified, the Business Manager/Manager, Operations Finance or designated Business Office staff will prepare a computer generated listing of deposits which includes: • The inmate/resident’s name; • The inmate/resident’s number; and • The amount of deposit. The Business Manager/Manager, Operations Finance or designated Business Office staff will then verify that the total amount of funds received from visitation is equal to the total on the computer generated listing. • The deposit slip prepared for deposit should equal the computer generated listing. • The total amount should also appear on the month-end deposit listing. Mail Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 7 of 13 DECEMBER 8, 2008 2-5 Funds received through the mail must be in the form of a money order or cashiers check made payable to the inmate/resident. All cash and personal checks received in the mail will be returned to the sender. In the event a return address is not available, the funds will handled as outlined in 2-5.4 B.3. a. Facilities Utilizing IMS2 i. ii. Shared Services Processing • Funds will not be accepted through facility mail. Funds must be sent to the off-site bank lockbox, at the address provided by the facility. • Funds must be in the form of money order or cashier check only and must contain the inmate/resident’s full name, ID number, and facility code. • Funds received at the off-site bank lockbox may not have any other documents included in the envelope. Other documents or personal items received at the off-site bank lockbox will be destroyed. • In the event funds are sent through the facility mail, the funds will be returned to the sender at the inmate/resident’s expense, along with directions to send the funds to the off-site bank lockbox. • The funds received at the lockbox will be processed each business day. All envelopes and contents received at the offsite bank lockbox will be scanned and available for review. Within one (1) business day of the off-site bank lockbox funds being deposited, the FSC Inmate Trust Department will review the deposit and post the funds to the inmate/resident trust account(s). • The FSC Inmate Trust Department will print receipts, for each inmate/resident receiving funds, to a designated printer at each respective facility (normally the mail room printer). The facility staff will be responsible for ensuring that the receipts are distributed to the inmates/residents. Facility Processing • Mail room staff will complete a batch process deposit for all inmate/resident money orders and cashier checks received through the mail. • The system will print out a temporary receipt of the transaction which will include the inmate/resident’s name, number, and amount and the receipt will be forwarded to the inmate/resident through the facility mail. • Once all mail has been processed, mail room staff will close the batch process file in the system. • Mail room staff will deliver a copy of the batch process file(s) and the money orders and cashier checks to the Business Office for posting to the inmate/resident account(s). Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 8 of 13 DECEMBER 8, 2008 b. 2-5 • The Business Office will verify the batch list with the money orders and cashier checks to ensure the total amount received is equal to the amount on the batch print out. • The Business Manager/Manager, Operations Finance or designated Business Office staff and mail room staff will both sign and date the copy of the batch process file(s). Two (2) people should be present for the verification. • If there is a discrepancy, mail room staff who processed the transaction will be held responsible. • The Business Manager/Manager, Operations Finance or designated Business Office staff will accept each item in the batch process and post the funds to the inmate/resident account(s). The deposit slip prepared for deposit should equal the computer generated listing. The total amount should also appear on the month-end deposit listing. All Other Facilities i. ii. iii. Mail room staff will complete a triplicate receipt book for all funds received through the mail. • The inmate/resident will receive the top copy of the receipt. • The second copy placed in an envelope/bag with the money order or cashiers check. • The third copy will remain in the receipt book as an audit trail. • Mail room staff will deliver all envelopes/bags containing receipts and money orders and cashiers checks to the Business Manager/Manager, Operations Finance or designated Business Office staff for verification prior to documented change of custody. • If there is a discrepancy, the mail room staff who processed the transaction will be held responsible. After all funds have been verified by mail room staff, the Business Manager/Manager, Operations Finance or designated Business Office staff will prepare a computer generated listing of deposits which includes: • The inmate/resident’s name; • The inmate/resident’s number; and • The amount of deposit. The Business Manager/Manager, Operations Finance or designated Business Office staff will then verify that the total amount of funds received from the mail room is equal to the total on the computer generated listing. Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 9 of 13 D. DECEMBER 8, 2008 2-5 • The deposit slip prepared for deposit should equal the computer generated listing. • This amount should also appear on the month-end deposit listing. POSTING OF FUNDS 1. All funds received should be posted to the inmate/resident’s account by the next business day unless a hold has been placed on the funds as outlined below. a. At the discretion of the FSC Inmate Trust Department or Warden/Administrator or contractual requirements, a hold may be placed on suspicious and/or high dollar cashier checks or money orders pending an investigation or bank clearance. b. In addition, at the discretion of FSC Inmate Trust or Warden/Administrator a ten (10) day hold may be placed on checks from third party government or federal government issuers. c. AT THIS FACILITY, CONTRACTUAL REQUIREMENTS FOR HOLDS ON INMATE/RESIDENT FUNDS ARE: NONE 2. E. Inmates/residents will be provided a receipt for all funds posted to their account. DEPOSIT OF FUNDS 1. Given the restrictive nature of access to inmates/residents and to ensure timely deposit of funds, money orders and cashier checks received for inmates/residents will be endorsed for deposit only into the Inmate/Resident (Special) Checking Account. 2. All funds received should be deposited by the next business day when practical. In the event it is not practical to deposit funds by the next business day, funds must be deposited anytime accumulation of funds reaches two thousand five hundred dollars ($2,500), but no less than once per week. a. 3. F. All funds for deposit require verification by two (2) CCA employees, prior to funds being provided to the bank or released to a transfer service. A bank verified deposit ticket should be received and reviewed for accuracy or alternatively the deposit reviewed using the online banking system. All funds deposited into the Inmate/Resident (Special) Checking Account must be directly related to an inmate/resident. RELEASE OF FUNDS 1. Inmate/Resident Authorized Deductions a. Each facility will develop a form (See 2-5AA Release of Funds Authorization Sample) for inmates/residents to use to request deductions from their trust accounts unless required to use a contracting agency form. Facility developed forms will be attached to this policy and be labeled as attachment 2-5A. AT THIS FACILITY, PER CONTRACTUAL REQUIREMENTS, THE FOLLOWING FORM IS UTILIZED BY INMATES/RESIDENTS TO REQUEST DEDUCTIONS FROM THEIR TRUST ACCOUNT: Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 10 of 13 DECEMBER 8, 2008 2-5 NONE NOTE: Inmates/residents may also authorize deductions from their trust accounts with forms other than the 2-5A or agency form listed above when a policy or procedure supports the deduction. Examples include, co-pays authorized through sick call slips, commissary purchases authorized through commissary order forms, etc. b. Unless a contracting agency form is utilized, the 2-5A will include, at a minimum, the following information: i. Date of Request; ii. Inmate/Resident’s Name; iii. Inmate/Resident’s Number; iv. Inmate/Resident’s Housing Location; v. Name and Address of Business/Individual to Receive Funds; vi. Reason for the Request; vii. Printed Name and Signature of Authorizing Inmate/Resident; viii. Disposition of Request (Approved or Denied); ix. Reason for Denial, when applicable; and x. Printed Name and Signature of Approving/Disapproving Authority. NOTE: The form must include a statement reflecting that the inmate/resident’s signature authorizes the deduction from the trust account and that personal property items ordered must comply with the facility’s allowable property list. c. All requests for deductions supported by a 2-5A or agency required form must be submitted to unit staff for approval/disapproval. In the absence of unit management, the Warden/Administrator will designate a staff member(s) to submit forms to for approval/disapproval. AT THIS FACILITY, THE 2-5A OR AGENCY REQUIRED FORM WILL BE SUBMITTED TO THE FOLLOWING POSITION(S) FOR APPROVAL/DISAPPROVAL: UNIT STAFF, CASE MANAGER, UNIT MANAGER OR BUSINESS MANAGER. d. Inmates/residents are not permitted to request the transfer of funds to another inmate/resident's trust account without prior written approval from the Warden/Administrator or designee from both the sending and receiving facility e. If the request is denied, the 2-5A or agency required form will be sent back to the requesting inmate/resident and will include written justification for the denial. f. Any form supporting the request for deduction from an inmate/resident’s trust account, will be processed as outlined below in F.5. Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 11 of 13 2. DECEMBER 8, 2008 2-5 Inmate/Resident Non-Authorized Deductions Deductions from inmate/resident trust accounts may be processed without authorization from the inmate/resident for contractual obligations, court costs/restitution, disciplinary restitution, etc. 3. 4. 5. Inmate/Resident Transfers a. When an inmate/resident is transferring from the facility, the inmate/resident’s trust account funds will be reconciled and forwarded to the receiving facility. b. When more than one (1) inmate/resident is transferred to a specific facility, one (1) check may be written to the receiving facility for all of the inmates/residents transferred. Inmate/Resident Releases a. Upon the release of an inmate/resident from the facility, any balance remaining in the inmate/resident's trust account will be returned to the inmate/resident in the form of a check written from the Inmate/Resident (Special) Checking Account unless the contracting agency requires issuance of cash. b. Upon receipt of trust account funds at release, the inmate/resident must sign a receipt stating that all funds due were paid in full or indicate a mailing address where the funds should be sent. The signed receipt will be placed in the inmate/resident’s institutional file for future reference. Processing of Approved Deductions a. b. G. Shared Services Processing i. The Business Office will submit the request along with supporting documentation, via email, to InmateRequest@correctionscorp.com or InmateRelease@correctionscorp.com, as appropriate. ii. The FSC Inmate Trust Department will review the request and confirm available funds. iii. The FSC Inmate Trust Department will print the check on a secured facility check printer for issuance. Facility Processing i. The request, along with supporting documentation, must be sent to the Business Office. ii. The Business Office will review the request and confirm available funds. iii. The Business Office will prepare a check from the Inmate/Resident (Special) Checking Account and attach supporting documentation for the requested withdrawal. The check along with the supporting documentation will be presented for appropriate signature. A manual signature is required on the check; signature stamps are prohibited. DAILY BALANCING Each business day, the Inmate/Resident (Special) Checking Account will be balanced by the FSC Inmate Trust Department or Business Office, as applicable. 1. Shared Services Balancing Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 12 of 13 2. DECEMBER 8, 2008 2-5 a. The Business Office will forward any deposit tickets to the FSC Inmate Trust Department each business morning. b. The FSC Inmate Trust Coordinator is responsible for balancing and accounting for all inmate/resident trust account funds. c. The current checkbook balance is added to any inmate/resident trust account funds in the safe to get a total for cash-on-hand. This figure is then reduced by accumulated commissary sales, inmate/resident balances, and any unclaimed funds to reach a balance of zero. If the balance is not zero, the FSC Inmate Trust Coordinator or FSC Bookkeeper will review the day's activity until the zero balance is reached by identifying the appropriate reconciling items. d. Upon completion of the daily balancing procedures, the documentation will be submitted to the FSC Manager, Inmate Trust for review and approval. The FSC Manager, Inmate Trust will sign/initial the Daily Balancing Sheet as evidence of the review. Facility Balancing a. The Business Manager/Manager, Operations Finance or designated Business Office staff is responsible for balancing and accounting for all inmate/resident funds. b. The current checkbook balance is added to any inmate/resident trust account funds in the safe to get a total for cash-on-hand. This figure is then reduced by accumulated commissary sales, inmate/resident balances, and any unclaimed funds to reach a balance of zero. If the balance is not zero, the Business Manager/Manager, Operations Finance or designated Business Office staff will review the day's activity until the zero balance is reached by identifying the appropriate reconciling items. c. Upon completion of the daily balancing procedures, the documentation will be submitted for review and approval. i. If the Business Manager/Manager, Operations Finance performed the balancing procedures, the documentation should be reviewed by the Warden/Administrator or other authorized check signer, in the absence of the Warden/Administrator. ii. If designated Business Office staff performed the balancing procedures, the documentation should be reviewed by the Business Manager/Manager. Operations Finance. NOTE: The reviewer will provide evidence of their review by signing/initialing the Daily Balancing Sheets. H. END OF THE MONTH PROCEDURES 1. Each facility will scan and email or fax a completed 2-10A Month End Checklist, along with all required supporting documentation, for each checking account to the FSC Facility Accounting Manager assigned to the facility by the date determined by the FSC. 2. For facilities using customer systems to maintain records of inmate/resident trust account funds, the facility needs to provide a system generated total page showing the total of all inmate/resident trust account balances as of the last day of the month. Only the last page of the report that shows the total balance of inmate/resident trust accounts is required to be submitted. 3. Bank Statements Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America Page 13 of 13 I. DECEMBER 8, 2008 2-5 a. Bank statements will be mailed directly to the FSC from the bank. b. Bank reconciliations will be performed by a FSC Bookkeeper and reviewed and approved by a FSC Facility Accounting Manager. BONDING The Inmate/Resident (Special) Checking Account is bonded under the company's crime insurance policy. J. K. INDEPENDENT AUDIT 1. An annual independent audit of the company will be conducted by an independent accounting firm. The Inmate/Resident (Special) Checking Account at the facility is included in the annual audit. 2. The accounting firm will issue an opinion on the entire company which includes the Inmate/Resident (Special) Checking Account. AT THIS FACILITY, ADDITIONAL CONTRACTUAL PROCEDURES ARE AS FOLLOWS: NONE 2-5.5 REVIEW: The Vice President, Finance will review this policy on an annual basis. 2-5.6 APPLICABILITY: All CCA Facilities (Provided contractual requirements do not mandate otherwise) 2-5.7 APPENDICES: 2-5AA Release of Funds Authorization (SAMPLE) 2-5.8 ATTACHMENTS: 2-10A Month End Checklist AT THIS FACILITY, ADDITIONAL ATTACHMENTS ARE: NONE 2-5.9 REFERENCES: CCA Policy 2-10 ACA Standards. The ACA Standards for this facility are: 4-4025 4-4027/4-ALDF-7D-11 4-4031 4-4033 4-4036/4-ALDF-7D-12 4-4045 4-4046 4-4047 Proprietary Information – Not For Distribution – Copyrighted Property of Corrections Corporation of America