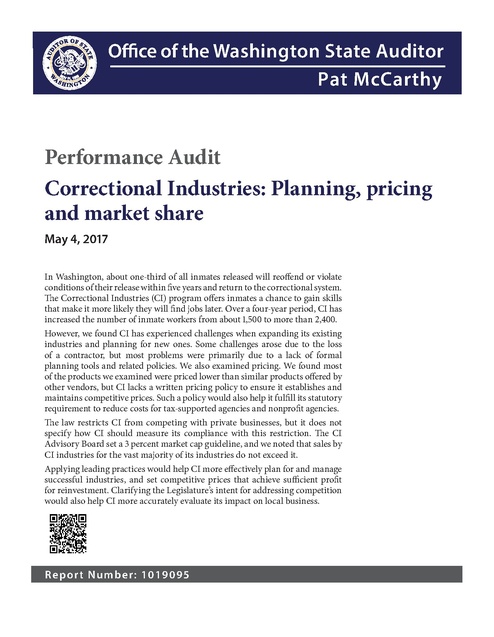

Office of the Washington State Auditor - Correctional Industries Planning, Pricing and Market Share, 2017

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.