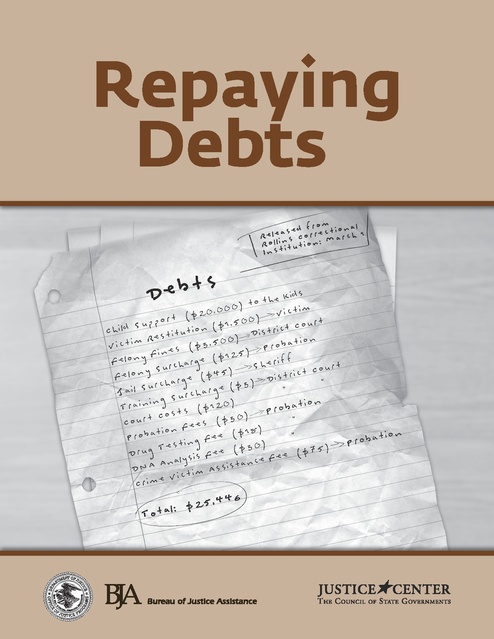

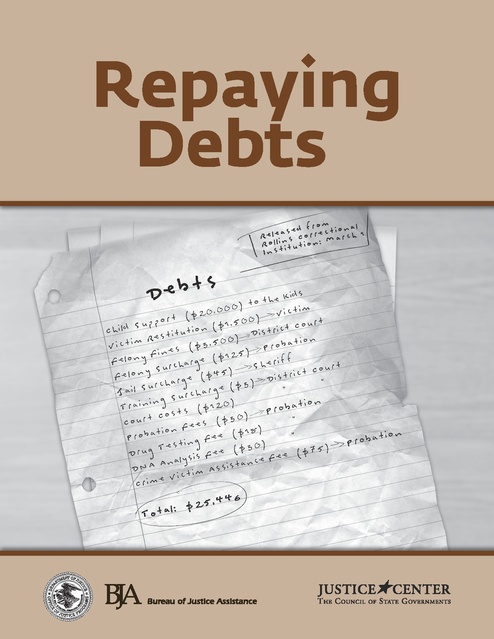

Repaying Debts, BJA, 2007

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.