Review of Farm Operations, Arkansas Legislative Audit, 2016

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

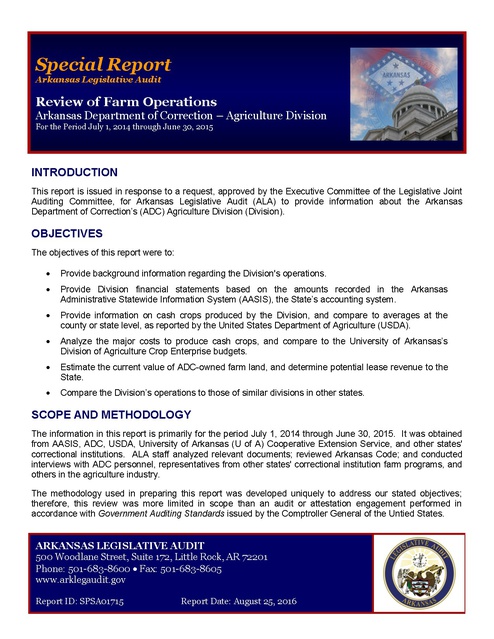

Special Report Arkansas Legislative Audit Review of Farm Operations Arkansas Department of Correction – Agriculture Division For the Period July 1, 2014 through June 30, 2015 INTRODUCTION This report is issued in response to a request, approved by the Executive Committee of the Legislative Joint Auditing Committee, for Arkansas Legislative Audit (ALA) to provide information about the Arkansas Department of Correction’s (ADC) Agriculture Division (Division). OBJECTIVES The objectives of this report were to: Provide background information regarding the Division's operations. Provide Division financial statements based on the amounts recorded in the Arkansas Administrative Statewide Information System (AASIS), the State’s accounting system. Provide information on cash crops produced by the Division, and compare to averages at the county or state level, as reported by the United States Department of Agriculture (USDA). Analyze the major costs to produce cash crops, and compare to the University of Arkansas’s Division of Agriculture Crop Enterprise budgets. Estimate the current value of ADC-owned farm land, and determine potential lease revenue to the State. Compare the Division’s operations to those of similar divisions in other states. SCOPE AND METHODOLOGY The information in this report is primarily for the period July 1, 2014 through June 30, 2015. It was obtained from AASIS, ADC, USDA, University of Arkansas (U of A) Cooperative Extension Service, and other states' correctional institutions. ALA staff analyzed relevant documents; reviewed Arkansas Code; and conducted interviews with ADC personnel, representatives from other states' correctional institution farm programs, and others in the agriculture industry. The methodology used in preparing this report was developed uniquely to address our stated objectives; therefore, this review was more limited in scope than an audit or attestation engagement performed in accordance with Government Auditing Standards issued by the Comptroller General of the Untied States. ARKANSAS LEGISLATIVE AUDIT 500 Woodlane Street, Suite 172, Little Rock, AR 72201 Phone: 501-683-8600 Fax: 501-683-8605 www.arklegaudit.gov Report ID: SPSA01715 Report Date: August 25, 2016 Arkansas Department of Correction – Agriculture Division BACKGROUND AND OPERATIONS Large-scale farming operations in Arkansas’s penitentiary system began around 1902 with the purchase of approximately 10,000 acres for the Cummins farm. Since that time, farming has been expanded to include the Tucker, East Arkansas, Wrightsville, and North Central Units. As of June 30, 2015, ADC had jurisdiction over 18,813 inmates1 and, excluding those housed outside ADC facilities, was responsible for providing meals for these inmates. ADC's Agriculture Division (Division) is designed to be a selfsupporting program and had an annual budget of $20.3 million and operating expenses of $16.4 million in fiscal year 2015. The Division's primary goals are to provide useful and meaningful work for inmates, cost-effectively produce sufficient food for inmate consumption, and maximize revenues from production and sales of marketable field crops and livestock. In an effort to achieve these goals, the Division produces cash crops and raises livestock on 20,439 acres throughout the State. The distribution of acreage farmed by location, as reported by ADC to the USDA Farm Service Administration for calendar year 2015, is provided in Exhibit I. Exhibit I Arkansas Department of Correction (ADC) Distribution of Acreage Farmed by Unit For Calendar Year 215 Cummins (Lincoln) Cash Crops Soybeans Corn Wheat Rice Totals Livestock Feed Hay/Grazing Sorgham Corn Wheat Oats Total Other Inmate Gardens Idle* Total Acreage Totals Acreage Farmed by Unit (County) Tucker Wrightsville East Arkansas (Jefferson) (Pulaski) (Lee) 4,676 1,968 1,790 659 9,093 1,567 224 627 852 3,270 2,362 91 135 446 371 176 3,355 226 555 379 934 13,382 North Central (Izard) Acreage Totals 1,793 0 1,793 0 2,637 169 387 254 8,036 2,192 2,417 1,511 14,156 254 5,513 522 446 756 176 7,413 0 57 57 0 573 934 1,507 2,637 2,791 254 ** 23,076 385 2,637 941 18 498 516 4,012 *Idle land includes water impound structures, conservation reserve program, turnaround rows, and other unused lands. **Due to some areas being double-planted in a single calendar year, the total acreage shown here and reported to the U.S. Department of Agriculture Farm Service Administration is greater than the 20,439 in total acreage owned by ADC. Source: United States Department of Agriculture Farm Service Administration (unaudited by Arkansas Legislative Audit) 1 This inmate population is comparable to the populations of the cities of Bryant (19,986), El Dorado (18,386), Maumelle (17,931), or Siloam Springs (16,081). 2 Arkansas Legislative Audit The Division is overseen by the Deputy Director, a Farm Administrator, and Managers over various functions, as shown in Exhibit II. The Farm Administrator is required to have a bachelor's degree in agriculture or a related field, seven years experience in agriculture management, and two years in a supervisory capacity; Managers must meet the same education requirements but may have fewer years of management and supervisory experience. Exhibit II Arkansas Department of Correction (ADC) – Agriculture Division Organizational Chart Deputy Director Farm Administrator Administrative Assistant East Arkansas Unit Head Farm Manager Budget Analyst Tucker Unit Head Farm Manager Head Farm Manager I Vegetable Processing Unit Agri. Unit Supervisor Cold Storage Agri. Unit Supervisor Outside Livestock Head Farm Manager Cummins Farm Head Farm Manager Wrightsville Agri. Unit Supervisor Confined Livestock Head Farm Manager Creamery Agri. Unit Supervisor Dairy Asst. Head Farm Manager Poultry Production Supervisor Source: Davey Farabough, ADC Farm Administrator 3 Swine Agri. Unit Supervisor Feed Mill Agri. Unit Supervisor Arkansas Department of Correction – Agriculture Division In fiscal year 2015, 64 positions were paid from the Farm Fund, with an average salary of $39,318. When health insurance, retirement matching, and other benefits were included in this amount, average compensation increased to $53,813. These positions included farm supervisors and managers, administrative support staff (e.g., purchasing, accounting, and secretarial), and security. In addition to these positions, operations are supported by inmate labor. According to ADC, 350 inmates are allowed to work daily in the Division. Although the number of inmates and the number of hours worked by inmates are reported to the Board of Corrections, ALA staff were unable to verify this information since the Division does not have a consistent reporting mechanism in place among the various Units (Finding 1). Agricultural operations also rely on equipment and facilities available. In fiscal year 2015, the Division capitalized buildings and equipment totaling $5.1 million. Based on the amounts recorded in AASIS, Exhibit III illustrates the original cost and average age of capital assets used in the Division’s operations. Exhibit III Arkansas Department of Correction (ADC) – Agriculture Division Original Cost and Average Age of Capital Assets Category Original Cost Land and land improvements Buildings and building improvements Implements and other farming equipment Tractors and combines Assets under construction Irrigation Personnel vehicles Other equipment Trucks and trailers Total $ 10,138,533 9,764,986 6,790,569 6,185,559 3,873,633 1,255,413 884,950 609,103 509,569 $ 40,012,315 Average Age (In Years) N/A 27.09 17.45 14.82 N/A 11.02 7.46 17.29 19.31 Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) Farm Production Cummins Unit The Cummins Unit contains the largest farm and is home to the swine, dairy, feed mill, and egg production facilities, as well as a portion of the beef cattle herd. Cash crops produced include soybeans, corn, wheat, and rice. At June 30, 2015, ADC owned 2,400 swine and 462 dairy cattle. Hogs are normally harvested at 230-250 pounds for inmate consumption, with the Division harvesting 150 per month on average. The dairy cattle are milked twice daily, with milk production ranging from 500 to 800 gallons per day. The milk is processed on-site, blended with powder to achieve 1.5% to 2% milk fat, and packaged in 8 ounce pouches for inmate consumption. The feed mill provides feed for swine, dairy and beef cattle, and poultry. It produces an average of 430 tons of feed per month, with corn as the primary ingredient in feed produced. Soybean meal, cotton seed, vitamins, and mineral packs are added to make a complete ration. 4 Arkansas Legislative Audit Cash crops, beef cattle, and eggs are discussed in greater detail in the Production and Sales section, beginning on page 6 of this report. Other Units The Tucker and East Arkansas Units produce cash crops as well as livestock feed, similar to the Cummins Unit but on a smaller scale. The Wrightsville Unit operates the beef cattle herd not maintained at Cummins, and the North Central Unit operates the horse breeding/training facilities. FINANCIAL STATEMENTS AND RESULTS The Agriculture Division operates similarly to a private enterprise, except that it is governed by the rules and regulations of state government. The Division’s full accrual financial statements for fiscal year 2015 are presented as Schedules 1 and 2 on pages 23-26. These statements are based on the information recorded in AASIS, with one exception: The amount of inventory recorded for crops in progress (CIP) was decreased and expenses were increased by $706,317 to reflect a misstatement noted during the audit of ADC's departmental financial statements (Finding 2). Operating and Non-Operating Revenues and Expenses Based on the information recorded in AASIS and the $706,317 adjustment noted above, the Division incurred a net loss of $2.6 million in fiscal year 2015. Operating revenues from the sale of products produced totaled $9.5 million, with operating expenses totaling $16.4 million. Additional nonoperating revenue included consumption certification income2 of $4.6 million and transfers in from the Inmate Care and Custody fund of $1.25 million. The complete income statement is shown in Schedule 1 on pages 23-24. The major factors that contributed to this loss were the relationship between the value of products produced on the farm for inmate consumption and the amount reimbursed, as well as the non-operating expenses for the transfer out of capital assets to other ADC funds. The transfer out of capital assets from the Division was a one-time entry in AASIS made by the Department of Finance and Administration (DFA) to correct recording errors in prior periods. In total, this entry caused no net effect for ADC; however, there was a loss of assets totaling $1.4 million to the Farm Fund. When these factors are taken into consideration, as shown in Exhibit IV, it is estimated that in fiscal year 2015, the Division could have generated a net income of $1.8 million. Exhibit IV Arkansas Department of Correction (ADC) – Agriculture Division Income Statement Summary For Fiscal Year 2015 Income Statement Entry Amount Change in net position Transfer out of capital assets to other ADC funds Farm commodities consumed by inmates DFA-reimbursed consumption costs ADC-reimbursed consumption costs Adjusted Net Income $ (2,598,211) 1,443,307 8,795,399 (4,600,000) (1,250,000) $ 1,790,495 DFA = Department of Finance and Administration Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) 2 Ark. Code Ann. § 19-5-501(b)(1)(B) authorizes a reduction in ADC's budget revolving loan of the previous fiscal year for the value of products produced or processed on the farm and consumed by inmates. Determination of this income is certified by the Legislative Auditor to the Chief Fiscal Officer of the State. 5 Arkansas Department of Correction – Agriculture Division Assets and Liabilities Division assets and liabilities totaled $37 million and $9.6 million, respectively, in fiscal year 2015. Assets are primarily comprised of (a) land, equipment, and other capital assets and (b) inventories. The major liabilities are loans payable of $5.6 million to the Budget Stabilization Trust Fund for inmate consumption and $3.8 million to the Prison Construction Trust Fund for constructing and equipping the egg production facility. The complete balance sheet is provided in Schedule 2 on pages 25-26. PRODUCTION AND SALES Two of the Division’s objectives are to (a) maximize revenues through the production and sales of marketable field crops and livestock and (b) cost-effectively produce sufficient food for inmate consumption. In calendar year 2015, the Division grew soybeans, corn, wheat, and rice as marketable commodities. Sorghum, corn, wheat, and oats were produced as feed for livestock, with the intent to reduce expenses associated with the purchase of feed. Beef cattle were raised for sale, and proceeds were used to purchase ground beef for inmate consumption. Egg production began in fiscal year 2015 with the dual purpose of producing enough eggs to sustain all Units and selling any excess to generate revenue. Inmates consume eggs, vegetables, pork, milk, and other beverages produced by the Division as well as ground beef purchased by the Division. Cash Crops In fiscal year 2015, total sales of the Division's field crops totaled $7.2 million, as shown in Exhibit V. Exhibit V Arkansas Department of Correction (ADC) – Agriculture Division Total Sales of Field Crops For Fiscal Year 2015 Unit Cummins Tucker East Arkansas Totals Rice Field Crop* Corn 903,104 594,477 $ 1,123,755 162,097 $ $ 1,497,581 $ 1,285,852 $ Soybeans $ 2,550,217 654,235 335,615 $ 3,540,067 $ Wheat 366,797 283,313 141,577 791,687 Sorghum $ $ 53,187 53,187 Totals $ 4,943,873 1,694,122 530,379 $ 7,168,374 *It should be noted that some field crops produced were used as livestock feed rather than sold. Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) ALA staff evaluated the Division’s production of field crops for soybeans, rice, corn, wheat, and sorghum by compiling consignment sheets and weight tickets3 for calendar year 2015 and verifying the results with Division management. These results were then compared to the estimated yields per acre at the county and/or state level, based on surveys conducted by the USDA National Agriculture Statistics Service (USDA-NASS). Exhibit VI on page 7 compares the crop yield averages to the USDA-NASS averages. 3 Consignment sheets are used to document any movement of any farm products (i.e., animals, crops, etc.). Weight tickets are used to document weight of farm products before and after movement from one location to another. 6 Arkansas Legislative Audit Exhibit VI Arkansas Department of Correction (ADC) – Agriculture Division Crop Yield Averages Compared to USDA-NASS Averages For Calendar Year 2015 USDA-NASS Estimated Yield Unit (County) and Crops ADC Yield Difference Difference from Estimate Cummins (Lincoln) Corn Soybeans Rice Wheat bu bu lbs bu 465,452 272,641 4,991,506 100,232 432,818 164,236 5,200,400 62,369 (32,634) (108,405) 208,894 (37,863) -7.01% -39.76% 4.18% -37.78% Tucker (Jefferson) Corn Soybeans Rice Wheat Sorghum bu bu lbs bu bu 44,699 96,381 6,333,778 35,115 13,230 37,723 58,806 6,856,674 25,603 11,181 (6,976) (37,575) 522,896 (9,512) (2,049) -15.61% -38.99% 8.26% -27.09% -15.49% East Arkansas (Lee) Soybeans Wheat Sorghum bu bu bu 92,371 21,566 42,302 33,274 20,060 31,442 (59,097) (1,506) (10,860) -63.98% -6.98% -25.67% USDA-NASS = United States Department of Agriculture National Agriculture Statistics Service bu = bushels lbs = pounds Source: USDA-NASS and ADC consignment sheets and weight tickets As Exhibit VI shows, the Division's production level for all crops, except rice, was lower at all locations than USDA-NASS estimates. Division management stated that the primary reason for the yield differences was the lack of wells and irrigation capacity at all farms. According to the Farm Administrator, a well normally exists for every 80 to 100 acres; however, Cummins has a well every 190 acres, while Tucker and East Arkansas have a well every 140 acres. According to Cooperative Extension Service personnel, a well for every 140-190 acres would limit production. For fiscal year 2015, ALA staff's objectives related to cash crops were to: Determine if ADC is using the available field crop acreage to its maximum capacity by double planting areas in the same year. Obtain documentation supporting bids provided by non-winning bidders. Compare the consignment sheets and weight tickets to the vendor settlement statements to verify accuracy and to verify that ADC received payment for all crops sold. According to information filed with the Farm Service Administration, ADC double planted approximately 2,637 acres in calendar year 2015: 1,978 acres at Cummins, 274 acres at Tucker, and 385 acres at East Arkansas. The majority was planted with soybeans after wheat was harvested; other fields were planted with corn after wheat was harvested. ALA staff inquired of personnel at the Cooperative Extension Service to determine if ADC is using the available field crop acreage to its maximum capacity by double planting areas in the same year. Personnel responded that the 7 Arkansas Department of Correction – Agriculture Division determination to double plant areas is a local decision or even a field-by-field decision due to multiple factors, including weather and timing of harvest for the first crop. Economic factors would also be considered. For example, yields are typically lower in a field that has been double planted, and if soybeans are selling at a good price, it might be advantageous to plant full season soybeans. A common practice is for farmers to double plant approximately 25% of their fields. In calendar year 2015, ADC double planted 20% of acreage that was used for crop production. ADC Administrative Directive 12-28 requires field and horticultural crops to be offered to as large a number of potential buyers from both the statewide and regional area, as is practical, to generate the best price possible for ADC commodities. All sales or bids should be awarded on the basis of the most revenue generated for ADC and in a manner consistent with Arkansas procurement laws. Although ALA staff requested documentation of the bids submitted by the non-winning buyers on all crop sales in fiscal year 2015, ADC could not provide this information (Finding 3). Based on testing conducted by ALA staff, there were no material differences between the ADC consignment sheets and the vendor settlement statements. However, ALA staff could not determine a complete population of consignment sheets because the forms were not prenumbered but were generated as needed from a Microsoft Excel template (Finding 4). Additionally, ALA staff noted one instance in which ADC was overcompensated for the sale of crops and failed to report the error. (Finding 5). Beef Cattle As of June 30, 2015, ADC had approximately 2,100 head of beef cattle. The cattle are raised to be sold, with the proceeds used to purchase ground beef for inmate consumption. In fiscal year 2015, ADC sold a total of 1,512 animals for $2.0 million at livestock auctions in Oklahoma and Arkansas as shown in Exhibit VII. Exhibit VII Arkansas Department of Correction (ADC) – Agriculture Division Beef Cattle Sales For Fiscal Year 2015 Auction Venue Location Oklahoma City, OK Oklahoma City, OK OK Sales Totals Morrilton, AR Ola, AR Waldron, AR Morrilton, AR AR Sales Totals Sales Totals Units Sold 611 507 1,118 Gross Sales a $ 880,060 662,130 1,542,190 219 83 83 9 394 318,343 121,504 117,547 15,358 572,752 1,512 $ 2,114,942 Commissions and Fees Paid b $ $ 25,598 21,073 46,671 Net Sales (a-b) $ 854,462 641,057 1,495,519 11,467 5,921 5,234 721 23,343 306,876 115,583 112,313 14,637 549,409 70,014 $ 2,044,928 Estimated Gross Sale Price in AR (Note 1) c $ $ 784,985 593,250 1,378,235 Variance (a-c) $ $ 95,075 68,880 163,955 (Note 2) (Note 2) (Note 2) (Note 2) Note 1: Prices obtained from the United States Department of Agriculture (USDA) - Arkansas Cooperative Extension Service Arkansas Weekly Livestock Summary. It should be noted that prices vary each week. Note 2: ADC did not obtain Oklahoma prices for these Arkansas sale dates. Source: ADC sales receipts and USDA-Arkansas Cooperative Extension Service Arkansas Weekly Livestock Summary (unaudited by Arkansas Legislative Audit) 8 Arkansas Legislative Audit ALA staff objectives related to cattle production and sales were to: Determine if ADC is using the beef cattle grazing acreage at its maximum capacity by comparing animals per acre to statewide data. Determine the state average for the number of animals that should have been sold and compare to actual sales, based on the size of the beef cattle herd. Determine if there was documented approval to sell the cattle. Examine transporting procedures. Compare the weight tickets from ADC to the weight documented by the sale barn. Examine ADC’s determination of whether to sell the animals in Oklahoma or Arkansas. As mentioned previously, as of June 30, 2015, ADC had 2,100 head of beef cattle located at the Cummins and Wrightsville Units and a grazing capacity of approximately 5,000 acres. ALA staff evaluated the Division’s use of beef cattle grazing areas by comparing the number of beef cattle per acre to the average number of animals per acre at the state level. The average animals per acre calculated for ADC was 2.4, and the statewide average, provided by the Arkansas Beef Council, was 2.5, indicating that the Division’s use of pasture and grazing areas is comparable with other operations in the State. ALA staff evaluated other data from the beef cattle operations by comparing the number of animals sold in fiscal year 2015 to a statewide average of similar-sized operations. As shown in Exhibit VII on page 8, the Division sold 1,512 animals in fiscal year 2015. Based on statistical information provided by the Arkansas Beef Council and knowledge of the Division’s operations, ALA staff estimated the average number of animals that should have been sold to be 1,382. Based on this surface analysis, Arkansas Beef Council personnel believe that ADC’s operation is performing at a level typical for the State. Procedures implemented by Administrative Directive 12-28 required the Division's Deputy Director, or his or her designee, to determine the need to sell livestock, with final approval coming from the ADC Director. ALA staff requested documentation of approvals to sell cattle for all transactions during fiscal year 2015. ADC could not provide documentation to support decisions made by the Division's Deputy Director or the ADC Director. Based on the information received by ALA staff, all decisions were made by the Farm Administrator. ADC subsequently amended Administrative Directive 12-28 with Administrative Directive 15-22, effective July 31, 2015, and Administrative Directive 16-07, effective March 30, 2016, which allow the Division's Deputy Director or the Farm Administrator, if designated, the authority to authorize sales, with notification provided to the ADC Director (Finding 6). Procedures implemented by ADC also require that two employees not affiliated with the beef herd monitor and count the animals as they are loaded for transport and then sign off on the consignment sheet to document that the procedure has been completed. These procedures were not followed for two of the six sales in fiscal year 2015. In one instance, there was only one signature, and in the other instance, the two employees who signed off on the consignment sheet were both employed in the beef herd section (Finding 7). As mentioned above, ALA staff compared the weight tickets from ADC to the weight documented for the cattle by the sale barns and found a total difference in weight of 19,215 pounds (2.08%). ADC management stated that the industry standard for shrinkage caused by the stress involved in transporting the animals is 2% to 5%, which was confirmed by the Arkansas Livestock and Poultry Commission (ALPC). 9 Arkansas Department of Correction – Agriculture Division ALA staff also evaluated the practice of ADC selling cattle in Oklahoma by examining the two sales in Oklahoma City during fiscal year 2015. ADC supported its decisions to sell in Oklahoma by comparing the prices received to averages obtained from the USDA-Arkansas Cooperative Extension Service Arkansas Weekly Livestock Summary Reports. ALA staff again requested ALPC’s professional opinion concerning if the animals sold in Oklahoma were comparable to feeder steers and heifers, which ALPC confirmed. In both instances, ADC appeared to generate greater revenue in Oklahoma than when selling similar animals in Arkansas. No documentation was available to support the determination to sell at the Arkansas locations for four sales during fiscal year 2015 (Finding 8). According to the ADC Farm Manager, the animals sold in Arkansas were cull or inferior cattle that do not sell well in Oklahoma. Each livestock auction assesses commissions and other fees to sellers. For ADC cattle sales during fiscal year 2015, ALA staff determined an average assessment per head sold for the four sales in Arkansas and compared it to the average assessment per head for the two sales in Oklahoma. The fees charged by Arkansas auction houses averaged $59.25 per head, while the fees charged by the Oklahoma auction house averaged $41.75 per head. The $17.50 per head difference contributes to the profitability of selling animals in Oklahoma. Egg Production and Sales ADC's final purchase of powdered eggs occurred in March 2015, as it transitioned to in-house production and sale of eggs beginning that same month, with the completion of three layer houses and one pullet house. Total cost of the project through April 30, 2016, was $5.5 million. The facility has the capacity to grade up to 25,000 eggs per hour and generally operates seven days per week, from 6 a.m. to 3 p.m. From March 2015 through April 2016,4 the Division produced 34 million eggs, for a daily average of 82,000. Of this 34 million, 20.6 million were sold to outside parties, 12.9 million were consumed by inmates, and 500,000 remained on-hand. Egg sales to outside purchasers from March 2015 through April 2016 totaled $1.7 million, with the largest buyers being McCall Sanders Marketing and the Oklahoma Department of Corrections (ODC). Through a contract with ADC, ODC purchases white medium eggs for a minimum of 10% less than the Urner Barry spot market price for the south central area; the contract also allows ADC to purchase meat from ODC at a reduced cost, although no purchases were made. ADC has no other contracts with outside purchasers, and all other sales are made by competitive bid. ALA staff examined the 15 highest sales to outside purchasers (eight awarded to highest bidder and seven to ODC on contract) to ensure the following: The sale was awarded to the highest bidder or in accordance with the contract terms. The sale price was calculated correctly and agreed with the bid or contract price. The sale quantity agreed with the bid quantity. Examination of the seven sales to ODC under contract revealed no exceptions. Review of the eight sales awarded to the highest bidder revealed one instance in which the price on the bid sheet did not agree with the final sale price, resulting in a loss to ADC of $2,016. ALA staff also noted five other instances in which the bid quantity did not agree with the amount received by the purchaser. All of the quantity differences seemed to result from a logistical issue related to hauling capacity. At ALA staff's request, ADC management confirmed with the purchaser that all sale orders were complete. 4 Since egg production was operational for less than three months in fiscal year 2015, ALA staff expanded evaluation of production and testing of sales through April 2016. 10 Arkansas Legislative Audit Food Consumption by Inmates Because the Division is responsible for producing sufficient food for inmate consumption in a cost-effective manner, ADC is annually provided a loan from the Budget Stabilization Trust Fund for farm production purposes, in accordance with Ark. Code Ann. § 19-5-501. The outstanding amount of the loan is reduced by the value of products produced or processed on the farm and consumed by inmates. This determination is certified by the Legislative Auditor to the Chief Fiscal Officer of the State. The fiscal year 2015 loan amount was $5.6 million, and the full amount was forgiven based on ALA’s Report on Certification of Consumption of Farm Produce, which stated that the value of farm commodities consumed by inmates was $8.8 million. Additionally, Ark. Code Ann. § 12-30-307 states the ADC Inmate Care and Custody Fund may make payments to the Farm Fund not to exceed 50 cents on each dollar’s worth of food produced by ADC farms for consumption by inmates. In fiscal year 2015, the Inmate Care and Custody Fund reimbursed the Farm Fund $1.25 million. COSTS OF PRODUCTION ALA staff evaluated the Division’s production costs for soybeans, rice, corn, wheat, and sorghum for calendar year 2015. Expenses by crop were based on the information recorded in AASIS and compared to the U of A Division of Agriculture’s 2015 Crop Enterprise Budgets, as shown in Exhibit VIII. It should be noted that the information presented in the income statement found in Schedule 1 on pages 23-24 is for fiscal year 2015 and includes all expenses of the farm program presented on a full accrual basis. The expenses shown in Exhibit VIII are only for production of row crops during calendar year 2015. Around $8.6 million was coded to activities other than row crops, including livestock, gardens, dairy, feed mill, eggs, and processing. ALA staff did not test the account coding of any expenses. Based on comparison of expenses coded by ADC to row crop production, costs associated with producing field crops were 9.8% less than U of A estimates. Exhibit VIII Arkansas Department of Correction (ADC) – Agriculture Division Comparison of ADC Crop Expenses to University of Arkansas (U of A) Estimated Expenses For Calendar Year 2015 Crop Soybeans Corn Rice Wheat Sorghum Totals U of A Enterprise Budget Estimated Expenses ADC Expenses $ $ $ 3,375,933 1,727,660 1,119,750 1,008,690 184,640 7,416,673 $ 2,475,732 1,284,062 1,137,711 1,602,139 184,622 6,684,266 Difference $ $ 900,201 443,598 (17,961) (593,449) 18 732,407 Percentage Difference from Estimate 26.67% 25.68% -1.60% -58.83% 0.01% 9.88% Source: U of A Division of Agriculture - 2015 Crop Enterprise Budgets and Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) 11 Arkansas Department of Correction – Agriculture Division Vendor Selection Other objectives of ALA staff review of farm expenses included evaluating vendor selection for seed, feed, fertilizer, and chemical expenses; aerial application of chemicals; and farm equipment leases. ALA staff also analyzed the terms and cost benefits of leasing farm equipment. Seed, Feed, Fertilizer, and Chemical Expenses Based on Ark. Code Ann. § 19-11-203(14)(DD), fertilizers, seed, seedlings, and agricultural-related chemicals purchased by ADC do not have to be obtained through the Office of State Procurement (OSP). ALA staff examined 15 transactions totaling $923,800 with vendors that provided these products to ensure that the lowest price was selected and to verify that the actual amount paid agreed with the bid documentation provided by ADC. ALA staff noted one exception in which ADC did not maintain documentation of bids received. The test was expanded to include an additional 25 transactions totaling $679,300, and no additional errors were noted. Aerial Application of Chemicals For each location where row crops are farmed, a vendor provides aerial application of chemicals to fields as needed. During fiscal year 2015, three vendors provided these services to ADC. OSP administered the bidding and vendor selection for these contracts based on the specifications provided by ADC. All three contracts are term contracts for one year from the date issued and are eligible for up to six annual extensions. The term contracts guarantee a specific price per gallon/ pound for the duration of the contract period; therefore, the total contract amount is dependent upon actual quantities used. Exhibit IX discloses the relevant terms of these contracts and amounts expended. According to documentation provided by OSP, only one vendor responded to the invitation to bid on each of the contracts. ALA staff verified that any extensions were approved by both ADC management and the vendor, with no exceptions. Exhibit IX Arkansas Department of Correction (ADC) – Agriculture Division Vendors for Aerial Application of Chemicals For the Fiscal Year Ended June 30, 2015 Original contract date Amount expended Cummins Unit Tucker East Arkansas Vendor A 7/17/2014 $225,214 Vendor B 6/5/2013 $107,987 Vendor C 4/15/2013 $37,396 Note: The term contracts guarantee a specific price per gallon/pound for the duration of the contract period; therefore, the total contract amount is dependent upon actual quantities used. Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) Farming Equipment With assistance from OSP, ADC developed bid specifications to lease 21 pieces of farming equipment, which included a combine, a header, and multiple tractors and attachments. The lease was issued in December 2012 as a term contract for 12 months. Upon mutual agreement, the contract could be extended for up to six additional one-year periods or a portion thereof. Three vendors responded to the invitation to bid. 12 Arkansas Legislative Audit According to OSP, if the vendor could not supply all of the equipment meeting the bid specifications, then the vendor's bid was not considered. Bids by Vendors A and B were rejected by OSP because they submitted specifications for a tractor with horsepower that exceeded the bid specifications. Specifically, item three on the invitation to bid was for an agriculture tractor with an engine horsepower rating between 129 and 135, while the vendors whose bids were rejected provided specifications for tractors with 140 horsepower, leaving only one qualified vendor, Vendor C, which was awarded the contract.5 Vendors A and B both objected to the award, and the Director of OSP denied their objections. Exhibit X shows each vendor's bid amount and the payments that have been made in accordance with the contract. At the end of each 12-month period, one of the options allowed was terminating the lease and purchasing any or all of the equipment at fair-market value. ADC did purchase equipment it had leased; however, it did not do so through this particular option since the terms prohibited ADC from leasing that type of equipment in the future. In fiscal year 2014, ADC purchased four tractors through sole source procurement from Vendor C for $669,477. In fiscal year 2015, two tractors were purchased through an invitation to bid issued by OSP for a total of $231,500. Vendor C was the only vendor that responded to the bid. All six tractors had previously been used by ADC through the lease agreement. ALA staff analyzed these purchases by adding the lease payments to the purchase price and comparing this total to the invoice price for a new tractor, as provided by the vendor. The results are shown in Exhibit XI on page 14. Exhibit X Arkansas Department of Correction (ADC) – Agriculture Division Vendors for Leased Farming Equipment Fiscal Years 2013 through 2016 Vendor A Bid Amount Payments Year 1 Year 2 Year 3 Total $ 379,467 Vendor B $ 336,958 Vendor C* $ 379,656 $ 379,656 397,922 401,444 1,179,022 $ *When the contract was renewed in subsequent years, price increases were allowed as long as they were substantiated to the Office of State Procurement prior to billing ADC, which the vendor did. Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) Overall, the leasing and subsequent purchase of the tractors shown in Exhibit XI on page 14 resulted in a cost savings to the Division. Regarding the benefits of leasing or purchasing farm equipment, economists at the Cooperative Extension Service noted that row crop farmers vary in their leasing and purchasing practices. If there are depreciation and tax advantages to purchasing, farmers tend to buy equipment; otherwise, they tend to lease equipment. With the downturn in crop prices over the past several years, equipment dealers' sales have decreased, and many new and innovative lease options are being tried and may make leasing more attractive. 5 According to ADC management, the range of horsepower on this tractor was small because there is a difference in the quality of tractors in the lower horsepower ranges, and ADC wanted to ensure it received a true row crop tractor. 13 Arkansas Department of Correction – Agriculture Division Exhibit XI Arkansas Department of Correction (ADC) – Agriculture Division Cost Comparison of Purchasing Previously-Leased Tractors to New Tractors Tractors Purchased FY2014 Case Magnum 340 Case Magnum 290 Case Magnum 290 Case Puma 130 Fiscal Year 2014 Total Lease Payments $ 24,634 22,735 22,735 18,892 88,996 Purchase Price $ 199,630 177,578 177,578 114,691 669,477 Tractors Purchased FY2015 Case Puma 130 with Loader Case Puma 130 with Loader Fiscal Year 2015 Total 23,110 23,110 46,220 115,750 115,750 231,500 138,860 138,860 277,720 134,580 134,580 269,160 900,977 $ 1,036,193 $ 1,096,027 Totals $ 135,216 $ $ Total 224,264 200,313 200,313 133,583 758,473 New Purchase Gain/(Loss) Price on Transaction $ 257,663 $ 33,399 224,258 23,945 224,535 24,222 120,411 (13,172) 826,867 68,394 (4,280) (4,280) (8,560) $ 59,834 Source: ADC and Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) VALUE OF LAND AND LEASE INCOME Value of Land Parcels of land farmed by ADC have been accumulated over the past 100-plus years. The cost of these assets, which is reflected on the balance sheet found in Schedule 2 on pages 25-26, is not indicative of their present market value. ALA staff estimated current market value using estimates reported in the Land Values 2015 Summary published by the USDA-NASS, dated August 2015. The USDA-NASS includes Arkansas in the delta economic region, along with Mississippi and Louisiana. The report provides an average value per acre for farm real estate, farm cropland, and pasture, determined as follows: Farm real estate: the value at which all land and buildings used for agriculture production, including dwellings, could be sold under current market conditions if allowed to remain on the market for a reasonable amount of time. Farm cropland: the value of land used to grow field crops or vegetables or land harvested for hay. Pasture: the value of land that is normally grazed by livestock. Over the five-year period from 2011 to 2015, farm real estate values in the delta economic region increased from an estimated per-acre value of $2,300 in 2011 to $2,780 in 2015, an increase of 21%. Values per acre in Arkansas increased more dramatically over this same period, from $2,440 to $3,050 (25%). Exhibit XII on page 15 shows the increase in value of farm real estate, irrigated and non-irrigated cropland, and pasture used by ADC from 2011 to 2015. Appendices A, B, and C show nationwide changes in values for farm real estate, farm cropland, and pasture, respectively, from 2014 to 2015. 14 Arkansas Legislative Audit Exhibit XII Arkansas Department of Correction (ADC) – Agriculture Division Value of Farm Real Estate, Cropland, and Pasture Calendar Years 2011 through 2015 $70,000,000 $60,000,000 $50,000,000 $40,000,000 $30,000,000 $20,000,000 $10,000,000 $0 Farm Real Estate 2011 $49,828,240 2012 $53,504,094 2013 $55,137,807 2014 $58,201,019 2015 $62,285,300 Cropland: Irrigated 28,880,916 31,769,008 35,033,807 37,670,760 38,926,452 Cropland: Non-irrigated 3,884,717 4,240,027 4,168,965 4,358,463 4,500,587 Pasture 11,870,842 11,596,054 11,870,842 12,310,502 12,585,290 Source: United States Department of Agriculture National Agriculture Statistics Service (USDA-NASS) Land Values 2015 Summary (unaudited by Arkansas Legislative Audit) Potential Lease Income Ark. Code Ann. § 12-30-308 allows the Board of Corrections, with the Governor’s approval, to offer for rent or lease any land owned by the State and under the jurisdiction of the Board that is not needed in the operation of the penal system. If ADC ceased farming operations or determined that it was not necessary or feasible to cultivate all areas, the Board has the authority to enter into lease agreements with other entities. ALA staff obtained estimated annual cash rent per acre for irrigated land, non-irrigated land, and pasture from the USDA-NASS and from AgHeritage Farm Credit Services, who were recommended by the U of A Cooperative Extension Service to provide a range of rental prices. The acres used were obtained from the Report of Commodities (FSA-578) filed by ADC with the Farm Service Administration. These FSA forms require ADC to certify that the acreage of crops/commodities and land uses listed are true and correct. ALA staff then calculated an estimated range of rental income if all acreage as reported on the FSA-578 forms were rented. Based on these sources, potential rent revenue to the State in one year would range from $1.7 million to $2.6 million, as shown in Exhibit XIII on page 16. 15 Arkansas Department of Correction – Agriculture Division Exhibit XIII Arkansas Department of Correction (ADC) – Agriculture Division Potential Revenue from Rent or Lease of Farm Land Unit (County) Acres Cummins (Lincoln County): Irrigated 7,750 Non-irrigated 1,293 Pasture 2,362 Total Cummins 11,405 Tucker (Jefferson County): Irrigated 2,778 Non-irrigated 869 Pasture 91 Total Tucker 3,738 East Arkansas (Lee County): Irrigated 2,029 Non-irrigated 207 Pasture 169 Total East AR 2,405 Wrightsville (Pulaski County): Pasture 2,637 North Central (Izard County): Pasture 254 Totals 20,439 USDA-NASS Per Acre $ $ 774,920 55,589 28,339 858,848 Estimated Annual Cash Rent (Note) AgHeritage Farm Credit Service Low Per Acre High 100 43 12 $ 1,278,618 116,348 35,424 1,430,390 419,531 76,901 1,454 497,886 151 88 16 225,260 14,906 2,538 242,704 $ Per Acre 165 90 15 $ 1,356,110 148,667 70,847 1,575,624 $ 175 115 30 458,428 78,205 1,363 537,996 165 90 15 486,211 99,928 2,726 588,865 175 115 30 111 72 15 334,846 18,633 2,539 356,018 165 90 15 355,140 23,809 5,077 384,026 175 115 30 61,971 24 39,556 15 79,112 30 2,536 $ 1,663,945 10 3,805 $ 2,367,765 15 7,610 $ 2,635,237 30 USDA-NASS = United States Department of Agriculture National Agriculture Statistics Service Note: The USDA-NASS conducts a survey of farm operators to determine an average by geographic location. The most recent survey available was for 2014. AgHeritage Farm Credit Service (AFCS) is a financial cooperative that focuses on the financial needs of the agricultural community in 24 central Arkansas counties. AFCS provided estimates based on observations of market conditions. Source: USDA-NASS, AgHeritage Farm Credit Services, and USDA Farm Service Administration (unaudited by Arkansas Legislative Audit) An additional revenue stream that could result from selling or leasing ADC farm land would be the tax revenue to the State as well as local governmental entities. It should be noted that any lease agreement for farm land would create logistical and security issues involved in moving equipment and labor into a prison facility. FARM PROGRAMS IN OTHER STATES ALA staff requested information from officials in Mississippi, Louisiana, Tennessee, Oklahoma, and Missouri on the agriculture activities within their correctional systems in order to compare current practices and determine how other states financially contribute to their respective correctional departments. The information received from these states is shown in Exhibit XIV on page 17. Based on information provided from each state’s respective correctional system, Arkansas has the largest farming operation in terms of acreage, livestock, and sales. 16 Arkansas Legislative Audit Exhibit XIV Agricultural Activities in Departments of Correction in Arkansas and Five Surrounding States Fiscal Year 2015 State Arkansas Crops and Gardens Acreage Soybeans Wheat Corn Rice Sorghum Vegetable gardens Oats Total Producing Acres Livestock Beef Cattle Dairy Cattle Pork Chickens Total Livestock 8,037 3,173 2,638 1,511 521 572 176 16,628 2,100 462 2,400 142,284 147,246 Revenue and Inmate Consumption Sales $ 9,458,105 Rental income Inmate consumption3 8,795,399 Total Revenue and $ 18,253,504 Inmate Consumption Mississippi Louisiana 2,638 1,116 Tennessee1 Missouri2 Oklahoma 2,014 316 360 100 561 913 180 5,328 2,870 3,650 0 477 1,650 475 2,622 477 2,125 $ 1,105,620 689,280 782,967 $ 4,721,365 $ 2,288,000 $ 2,577,867 $ 4,721,365 2,622 12,000 12,000 0 0 (Note) $ 11,129,557 $ 2,288,000 $ 11,129,557 $ 0 1 Tennessee provided totals rather than information by activity. Additionally, Tennessee operates a dairy that produces milk for inmate consumption but did not provide a value for this commodity. 2 Missouri does not have an Agriculture Division within its correctional system. 3 Inmate consumption is the value of products produced or processed on correctional system farms and consumed by inmates. Note: The amount reported by Oklahoma as revenue from sales appears to be incomplete. Source: Various states' correctional systems (unaudited by Arkansas Legislative Audit) OTHER ISSUES Accident at Egg Production Facility According to ADC, in July 2015, a power outage at the egg production facility resulted in the death of approximately 41,000 chickens, with a replacement cost of $202,950. The incident was caused by an electrical power pole being hit by an inmate who was operating farm equipment, resulting in loss of power to the Cummins farming area. The egg production facility had a generator in place that had been refurbished by the Construction Division. Although the generator was periodically tested, it did not produce electricity as designed on this day, and ADC employees were unable to correct the problem. A generator was rented and delivered to the Cummins facility as soon as possible, but the birds could not be saved. As a result, a new primary generator was purchased at a cost of $116,057. The primary generator is tied to a secondary generator to provide multiple layers of backup power. The generators are tested weekly, according to the Farm Administrator. Land Leases ALA staff reviewed any instances in which ADC was leasing land for farming and found these to be minimal. During fiscal year 2015, ADC leased approximately 190 acres at a cost of $1,816. 17 Arkansas Department of Correction – Agriculture Division Inmate Cost per Day and Prison Accreditation Due to prison overcrowding, ADC entered into a contract with Bowie County, Texas, to house up to 288 male inmates at a fixed rate of $36 per inmate per day. According to ADC, in fiscal year 2015 the average cost per inmate per day was $62.90 in an ADC correctional facility and $28 in a county jail in Arkansas. ADC attributed the difference in costs to level of service: Compared to a county jail, ADC correctional facilities have a higher level of staffing and provide more programs to inmates. Although ADC is accredited by the American Correctional Association, accreditation is not required for all facilities that house inmates (e.g., county jails). The accreditation process offers the opportunity to evaluate ADC operations against national standards and remedy any deficiencies. Accreditation benefits could include defense against lawsuits through the documentation required by accreditation standards and an improved environment for ADC personnel and inmates. The total amount paid to the American Correctional Association for accreditation fees in fiscal year 2015 was $61,800. Inspections of Processing Facilities ADC’s processing facilities are subject to the following inspections by the Arkansas Livestock and Poultry Commission and the Arkansas Department of Health: Arkansas Livestock and Poultry Commission Swine herd tested annually for brucellosis and pseudorabies. Egg facilities tested quarterly for compliance with USDA standards. Arkansas Department of Health Raw milk and processed milk both tested four times in a six-month period in accordance with Food and Drug Administration (FDA) standards for a Grade A permit. Milk processing equipment tested quarterly in accordance with FDA standards for a Grade A permit. Vegetable processing facilities inspected annually in accordance with the State’s standards for a Retail Food Establishment license. ALA staff examined the results of the inspections over various time periods, depending on when the tests were required (i.e., quarterly, annually, etc.) and noted the following: Swine – Negative for brucellosis and pseudorabies. Eggs – Noncompliance was noted, but ADC corrected deficiencies at that time. Milk and milk processing equipment – Noncompliance was noted. ADC received four warning letters, and its permit was suspended three times. Vegetables – No instances of noncompliance. 18 Arkansas Legislative Audit NOTEWORTHY ACCOMPLISHMENTS Cost-Savings to the State The Division provides produce and other commodities at a savings to the State by supplying these items at a reduced cost. Over the five-year period ending with fiscal year 2015, ALA staff estimated this savings to be $7.8 million, as shown in Exhibit XV. This amount was determined by comparing the value of items produced or purchased by the Division, as noted in ALA's Report on Certification of Consumption of Farm Produce, to the amount of state funding provided to achieve these tasks. Exhibit XV Arkansas Department of Correction (ADC) - Agriculture Division Cost-Savings to the State from Commodities Produced and Purchased by ADC For Fiscal Years 2011 through 2015 Value per Report on Certification of Consumption of Farm Produce State Funding: Budget Stabilization Trust Fund loan Reimbursement from Inmate Care and Custody Fund Cost-Savings to the State 2015 2014 Fiscal Year 2013 2012 2011 $ 8,795,399 $ 7,220,067 $ 6,883,215 $ 7,310,208 $ 6,079,035 (5,600,000) (1,250,000) $ 1,945,399 (4,600,000) (250,000) $ 2,370,067 (4,600,000) (1,000,000) $ 1,283,215 (4,600,000) (1,000,000) $ 1,710,208 (4,600,000) (1,000,000) $ 479,035 Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) and Arkansas Legislative Audit Report on Certification of Consumption of Farm Produce Inmate Incentives As an incentive to work in ADC farming operations, inmates are provided with meritorious good time in accordance with Ark. Code Ann. §§ 12-29-201 – 12-29-202, namely the reduction of parole or transfer eligibility date based on good discipline, behavior, work practices, job responsibilities, and involvement in rehabilitative activities while under the control and supervision of ADC. Inmates in the Agriculture Division are awarded good time based upon becoming proficient in the job skills related to their work assignment. Each job skill contains three levels: beginner, intermediate, and senior. Each inmate is reviewed and tested for advancement at a minimum of every 90 days, and after successful completion of each level, the inmate is recommended for the following good time award: Beginner level – 10 days. Intermediate level – 20 days. Senior level – 60 days. Upon completion of the senior level, inmates should be expected to perform the designated job at a reasonable level upon their return to society. In fiscal year 2015, 94 inmates from the Division completed a program achievement of beginner, intermediate, and/or senior, resulting in 1,680 days of meritorious good time awarded and applied against these inmates' parole or transfer eligibility dates. 19 Arkansas Department of Correction – Agriculture Division FINDINGS AND RECOMMENDATIONS As a result of review of ADC Agriculture Division operations, ALA staff issue the following findings, which were previously noted in the report, and their accompanying recommendations: Finding 1: According to ADC, 350 inmates are allowed to work daily to support Division operations. Although the number of inmates and the number of hours worked by inmates are reported to the Board of Corrections, ALA staff were unable to verify this information since the Division does not have a consistent reporting mechanism in place among the various Units. ALA staff recommend ADC management establish procedures to ensure that information reported to the Board of Corrections or outside entities is fully documented and supported by source data. Finding 2: As part of the annual close-out, the ADC records a journal entry for an estimated amount of crops that have not been harvested as of year-end. ADC management did not review and approve the estimation of crops in progress (CIP), and as a result, CIP was overstated by $706,317. The amount of inventory recorded for CIP was decreased and expenses were increased by $706,317 to reflect the misstatement. This lack of internal controls over the CIP calculation and entry in AASIS limits ADC's ability to provide assurance that the estimation of CIP was accurate. ALA staff recommend ADC management implement internal controls that incorporate proper segregation of duties between the calculation and approval of estimations and the related journal entries. Finding 3: ADC Administrative Directive 12-28 requires field and horticultural crops to be offered to as large a number of potential buyers from both the statewide and regional area as is practical to generate the best price possible for ADC commodities. All sales or bids should be awarded on the basis of the most cash generated for ADC and in a manner consistent with Arkansas procurement laws. Although ALA staff requested documentation of the bids submitted by the non-winning buyers on all crop sales in fiscal year 2015, ADC could not provide this information. Without maintaining complete documentation of sales transaction, ADC limits its ability to support its decisions to management, the Board of Corrections, and others. ALA staff recommend ADC management follow procedures for maintaining documentation of all bids submitted for farm commodity sales. Finding 4: The consignment sheets that ADC used to document and/or summarize the movement of all farm products were not pre-numbered but were generated as needed from a Microsoft Excel template. Pre-numbering or electronically generating unique numbers that cannot be manipulated by management allows for the determination of a complete population for any given time period. ALA staff recommend ADC management develop consignment sheets that include pre-numbering to provide assurance that all forms have been accounted for within a fiscal year or other time period. 20 Arkansas Legislative Audit Finding 5: ADC was overcompensated $20,779 for soybeans and corn and failed to report the error. Procedures had been implemented to detect these discrepancies by matching ADC weight tickets to the buyer weight tickets and other documentation provided with the payment; however, ADC personnel performing the controls did not report these errors. ALA staff recommend ADC management ensure that controls are understood and followed in order to provide assurance that all revenue is recorded accurately and in the correct period. Finding 6: ADC could not provide documentation that procedures were followed regarding the sale of beef cattle. Internal controls implemented by management, as documented by ADC's Administrative Directive 12-28, require the Division's Deputy Director, or his or her designee, to determine the need to sell produced livestock, with final approval provided by the ADC Director. ALA staff examination of all beef cattle sales in fiscal year 2015 revealed that no documentation was maintained to support any decisions made by the Division's Deputy Director, nor was there any documentation of approval by the ADC Director. Based on the information provided, all decisions to sell animals were made by the Farm Administrator. By not following the directives and procedures implemented, upper management had limited ability to monitor the Division's beef cattle operations. These procedures were modified March 30, 2016, with the issuance of Administrative Directive 16-07. This new directive allows the Division's Deputy Director or the Farm Administrator, if designated by the Deputy Director, to make the decisions to sell produced livestock. Notification of sales are provided to the ADC Director and the Board of Corrections’ liaison. ALA staff recommend ADC management follow its administrative directives and maintain all documentation that supports procedures performed and decisions made, including the determination of designees. Finding 7: Internal control procedures implemented by ADC require that two employees not affiliated with the beef herd monitor and count the animals as they are loaded for transport and then sign off on the consignment sheet to document that the procedure has been completed. These procedures were not followed for two of the six sales in fiscal year 2015. In one instance, there was only one signature, and in the other instance, the two employees who signed off on the consignment sheet were both employed in the beef herd section. ALA staff recommend ADC management design and implement internal controls that cannot be circumvented by employees. Finding 8: In fiscal year 2015, the Division sold beef cattle at auction houses in both Arkansas and Oklahoma. Documentation was provided to support the decisions to sell cattle in Oklahoma to maximize revenue; however, documentation could not be provided to support the decisions to sell within the State. Division management stated to ALA staff that the cattle sold in Arkansas were cull cattle that did not sell well in Oklahoma; however, without documenting any evaluations made, ADC limits its ability to support its decisions to ADC management, the Board of Corrections, and others. ALA staff recommend ADC management establish procedures to document any evaluations made regarding the most profitable methods for selling livestock. 21 Arkansas Department of Correction – Agriculture Division SUMMARY The purpose of ADC's Agriculture Division is to provide useful and meaningful work for inmates, cost-effectively produce sufficient food for inmate consumption, and maximize revenues from production and sales of marketable field crops and livestock. The Division produces cash crops and livestock on over 20,000 acres throughout the State, with the Cummins Unit containing the largest farm. According to ADC, 350 inmates are allowed to participate in agricultural operations. The Division incurred a net loss of $2.6 million in fiscal year 2015. This loss is attributable to non-operating expenses for the transfer out of capital assets to other ADC funds and commodities produced and consumed by inmates rather than sold. Operating revenues from the sale of commodities produced totaled $9.5 million, with operating expenses totaling $16.4 million. Additional non-operating revenue included consumption certification income of $4.6 million and transfers in from the Inmate Care and Custody fund of $1.25 million. Sales of cash crops in fiscal year 2015 totaled $7.2 million. The Division's production levels were lower than USDA-NASS estimated yields for all crops but rice. Additionally, the Division sold 1,512 head of beef cattle for $2.0 million in fiscal year 2015 and produced 34 million eggs from March 2015 to April 2016, with 38% being consumed by inmates and 61% being sold to outside parties. The total value of the Division's farm real estate, cropland, and pasture totaled approximately $62 million in 2015. If all acreage were rented out, yearly revenue could potentially range from an estimated $1.7 million to $2.6 million. Compared to surrounding states, Arkansas has the largest farming operation in terms of acreage, livestock, and sales. Overall, the Division provides produce and other commodities at a savings to the State by supplying these items at a reduced cost. From fiscal years 2011 through 2015, estimated savings to the State was $7.8 million. CONCLUSION Best practices, technology, and other variables in any industry change over time, and as a result, it may be necessary to request outside assistance to evaluate an entity's operations. Ark. Code Ann. § 12-30-303 establishes a duty of cooperation between the U of A Cooperative Extension Service and the ADC Director. Therefore, based on this review, ALA staff recommend ADC management consider the need for the U of A Cooperative Extension Service or another outside organization to evaluate all farming operations and activities conducted by ADC and to provide recommendations that may be used to maximize revenues from production and sales of marketable field crops and livestock and allow for the costeffective production of sufficient food for inmate consumption. MANAGEMENT RESPONSE Management response is provided in its entirety in Appendix D. 22 Arkansas Legislative Audit Schedule 1 Arkansas Department of Correction (ADC) Agriculture Division Income Statement For the Year Ended June 30, 2015 Total OPERATING REVENUES Soybean sales Rice sales Corn sales Wheat sales Sorghum sales Cattle sales Juice sales Egg sales Other livestock sales Other sales $ TOTAL OPERATING REVENUES 3,540,067 1,497,581 1,285,852 791,687 53,187 2,044,928 89,842 59,508 51,493 43,960 9,458,105 Less: State Treasury service charge (170,894) NET OPERATING REVENUES 9,287,211 OPERATING EXPENSES Salaries and benefits Communication and transportation of commodities Printing and advertising Repairing and servicing Utilities and rent Travel and subsistence Professional services Insurance and bonds Other expenses and services Shop and industrial supplies Seed and fertilizer control agent Agriculture, horticulture, and wildlife supplies Commodities, materials, and supplies Refunds, taxes, and claims Meat for inmate consumption Depreciation 3,444,039 39,959 10,158 1,115,352 677,759 6,986 129,302 111,581 416,901 319,669 104,016 6,215,832 1,609,118 44,765 1,536,270 651,046 TOTAL OPERATING EXPENSES 16,432,753 23 Arkansas Department of Correction – Agriculture Division Schedule 1 (continued) Arkansas Department of Correction (ADC) Agriculture Division Income Statement For the Year Ended June 30, 2015 OPERATING INCOME (LOSS) $ Total (7,145,542) NONOPERATING REVENUES (EXPENSES) Consumption certification income1 Transfers from ADC Grants and reimbursements Interest income Loss on fixed asset disposal 4,600,000 1,250,000 119,641 15,890 (5,844) (1,443,307) 7,137 698 3,116 Transfer out of capital assets to other ADC units 2 Marketing and redistribution sale proceeds Prior-year warrants outlawed and cancelled Prior-year refund to expense TOTAL NONOPERATING REVENUES (EXPENSES) 4,547,331 CHANGE IN NET POSITION (2,598,211) TOTAL NET POSITION - JULY 1 29,891,069 TOTAL NET POSITION - JUNE 30 1 $ 27,292,858 In fiscal year 2015, the loan from the Budget Stabilization Trust Fund increased by $1 million to $5.6 million. 2 This expense was a non-recurring journal entry unique to fiscal year 2015: a correcting entry processed by the Department of Finance and Administration in AASIS to reclassify fixed assets to other ADC funds. In total, the entry caused no net effect for the ADC financial statements. Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) 24 Arkansas Legislative Audit Schedule 2 Arkansas Department of Correction (ADC) Agriculture Division Balance Sheet For the Year Ended June 30, 2015 Total ASSETS Current Assets: Cash and cash equivalents Memberships in cooperative organizations Receivables: Accounts receivable Due from other governments Due from other funds Inventories: Livestock Crop in progress Feed, seed, fertilizer, and chemicals Finished goods Fuel Farm parts Total Current Assets $ 1,946,489 1,212,428 748,287 111,676 17,334 4,540,930 3,615,136 1,147,898 600,271 100,207 59,061 14,099,717 Noncurrent Assets: Capital Assets: Land and land improvements Infrastructure Buildings Equipment Assets under construction Less accumulated depreciation Total Noncurrent Assets 9,850,918 585,012 9,416,542 16,286,208 3,873,634 (17,183,228) 22,829,086 TOTAL ASSETS $ 25 36,928,803 Arkansas Department of Correction – Agriculture Division Schedule 2 (continued) Arkansas Department of Correction (ADC) Agriculture Division Balance Sheet For the Year Ended June 30, 2015 Total LIABILITIES Current Liabilities: Accounts payable Accrued payroll Due to other funds of ADC Due to other agencies Due to other governments Total Current Liabilities $ Noncurrent Liabilities: Loan payable to Budget Stabilization Trust Fund1 Loan payable to Prison Construction Trust Fund Claims and judgments Total Noncurrent Liabilities 5,600,000 3,810,124 3,075 9,413,199 TOTAL LIABILITIES 9,635,945 NET POSITION Net investment in capital assets Unrestricted Total Net Position 22,829,086 4,463,772 27,292,858 TOTAL LIABILITIES AND NET POSITION 1 116,783 85,408 19,014 1,098 443 222,746 $ In fiscal year 2015, the loan from the Budget Stabilization Trust Fund increased by $1 million to $5.6 million. Source: Arkansas Administrative Statewide Information System (unaudited by Arkansas Legislative Audit) 26 36,928,803 APPENDICES Appendix A – 2015 Farm Real Estate Value by State – Dollars Per Acre and Percent Change from 2014 Appendix B – 2015 Cropland Value by State – Dollars Per Acre and Percent Change from 2014 Appendix C – 2015 Pasture Value by State – Dollars Per Acre and Percent Change from 2014 Appendix D – Arkansas Department of Correction – Management Response A-1 Source: United States Department of Agriculture National Agriculture Statistics Service (USDA-NASS; unaudited by Arkansas Legislative Audit) Appendix A B-1 Source: United States Department of Agriculture National Agriculture Statistics Service (USDA-NASS; unaudited by Arkansas Legislative Audit) Appendix B C-1 Source: United States Department of Agriculture National Agriculture Statistics Service (USDA-NASS; unaudited by Arkansas Legislative Audit) Appendix C Appendix D Arkansas Department of Correction Management Response D-1 Appendix D (continued) D-2 Appendix D (continued) D-3 Appendix D (continued) D-4 Appendix D (continued) D-5 Appendix D (continued) D-6 Appendix D (continued) D-7 Appendix D (continued) D-8 Appendix D (continued) D-9 Appendix D (continued) D-10 Appendix D (continued) D-11