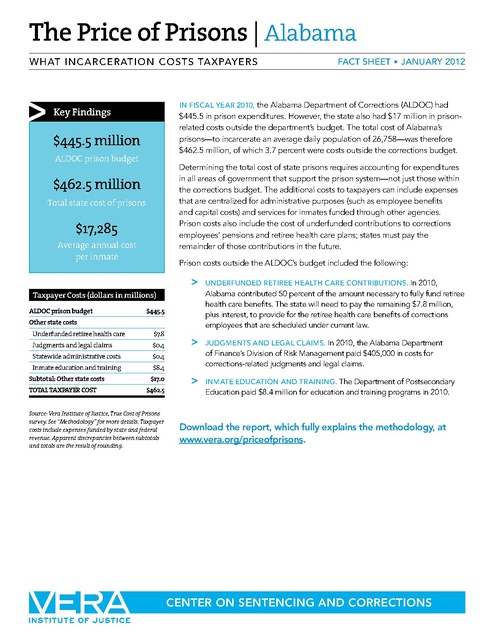

Vera Institute Price of Prison by State Jan 2012

Download original document:

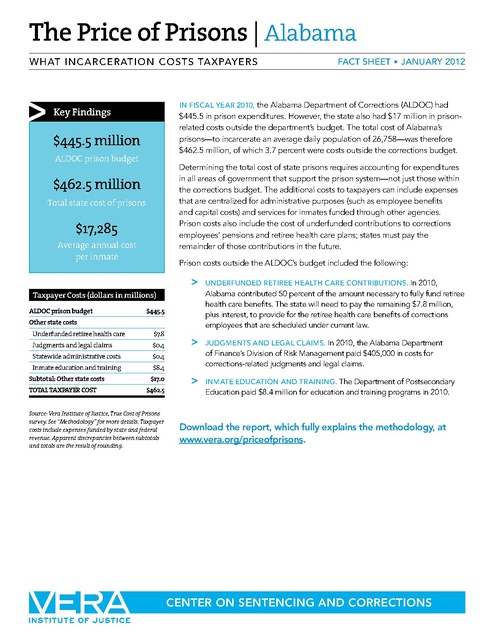

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.