HRDC comments to Consumer Financial Protection Bureau re Arbitration Agreements - Aug. 2016

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

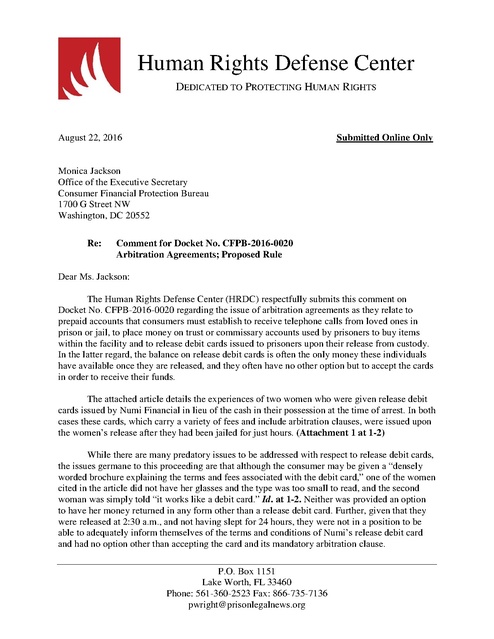

Human Rights Defense Center

DEDICATED TO PROTECTING HUMAN RIGHTS

August 22, 2016

Submitted Online Only

Monica Jackson

Office of the Executive Secretary

Consumer Financial Protection Bureau

1700 G Street NW

Washington, DC 20552

Re:

Comment for Docket No. CFPB-2016-0020

Arbitration Agreements; Proposed Rule

Dear Ms. Jackson:

The Human Rights Defense Center (HRDC) respectfully submits this comment on

Docket No. CFPB-2016-0020 regarding the issue of arbitration agreements as they relate to

prepaid accounts that consumers must establish to receive telephone calls from loved ones in

prison or jail, to place money on trust or commissary accounts used by prisoners to buy items

within the facility and to release debit cards issued to prisoners upon their release from custody.

In the latter regard, the balance on release debit cards is often the only money these individuals

have available once they are released, and they often have no other option but to accept the cards

in order to receive their funds.

The attached article details the experiences of two women who were given release debit

cards issued by Numi Financial in lieu of the cash in their possession at the time of arrest. In both

cases these cards, which carry a variety of fees and include arbitration clauses, were issued upon

the women’s release after they had been jailed for just hours. (Attachment 1 at 1-2)

While there are many predatory issues to be addressed with respect to release debit cards,

the issues germane to this proceeding are that although the consumer may be given a “densely

worded brochure explaining the terms and fees associated with the debit card,” one of the women

cited in the article did not have her glasses and the type was too small to read, and the second

woman was simply told “it works like a debit card.” Id. at 1-2. Neither was provided an option

to have her money returned in any form other than a release debit card. Further, given that they

were released at 2:30 a.m., and not having slept for 24 hours, they were not in a position to be

able to adequately inform themselves of the terms and conditions of Numi’s release debit card

and had no option other than accepting the card and its mandatory arbitration clause.

P.O. Box 1151

Lake Worth, FL 33460

Phone: 561-360-2523 Fax: 866-735-7136

pwright@prisonlegalnews.org

Page |2

Clearly, there was no agreement with respect to an arbitration clause in the issuance of

these release debit cards, which both contained mandatory arbitration agreements. There was no

meeting of the minds, these consumers never read the arbitration clause, and being handed a

brochure full of very small print as you are walking out of a jail before sunrise can hardly be

defined as adequate notice.

Consumers have no choice when release debit cards are literally foisted upon them by

armed police and jail or prison guards. There is no “opt in” whereby people willingly give up

their cash and choose to pay fees to access their own money on these debit cards. The companies

that are preying on the poorest and most vulnerable people in American society use mandatory

arbitration clauses in “agreements” where the consumers whose money is being taken from them

involuntarily have not, in fact, agreed to anything. It is merely a means and a vehicle to ensure

these companies cannot be held accountable by the courts, so they can continue to prey on the

weak and defenseless.

In the prison and jail context, mandatory arbitration clauses do nothing more than protect

corporations that prey on prisoners and their families who have no other market choice. JPay

offers money transfer services, which provide family members the ability to send money to

prisoners so they can make phone calls and purchase items from prison and jail commissaries.

Frequently, JPay is granted an exclusive contract with a correctional facility in exchange for

“commission” kickbacks, and families have few (or no) other options to send money to their

incarcerated loved ones. JPay’s mandatory arbitration clause is contained in Paragraph 14 of its

online Payment Terms and Service. Attachment 2 1

These families are in exactly the same position as prisoners being issued release debit

cards; they have no choice but to accept a condition that restricts their legal rights if they want to

send money to a loved one in prison or jail. The volume of money transferred and number of

consumers negatively affected by mandatory arbitration clauses is significant – in 2015 the

Florida Department of Corrections (FDOC) alone took in prisoner account deposits through JPay

totaling over $109 million. 2 JPay is the only option available for transferring funds to FDOC

prisoners, and is just one of several companies that offer money transfer services which force

consumers to accept mandatory arbitration clauses. Plus there are well over 3,100 jails in the

U.S. that accept and hold funds for prisoners, in addition to 50 state prison systems.

Arbitration clauses also appear in the terms and conditions that consumers must accept to

establish prepaid phone accounts to remain in contact with incarcerated loved ones. While the

terms and conditions that must be accepted to open a prepaid telephone account with Global

Tel*Link (GTL), the nation’s largest provider of prison phone services, purportedly allow

consumers to “opt out” of arbitration, they only permit actions to be brought on an individual

basis (i.e., no class actions). Attachment 3 at 1. This condition significantly limits the legal

rights of prisoners’ families by denying them the benefit of class-action representation. All

correctional facilities grant monopoly contracts to prison phone providers, so if families want to

talk with their incarcerated loved ones on the phone, they have no choice but to agree to the

arbitration clause, which is in the terms and conditions that few people actually read.

1

2

http://www.jpay.com/LegalAgreementsOut.aspx

http://www.dc.state.fl.us/pub/annual/1415/FDC_AR2014-15.pdf at 6

Page |3

There is no meaningful agreement or consent to arbitration agreements in the detention

facility context. All they do is immunize corporate predators from the legal consequences of their

unlawful actions, shield them from judicial review and preclude victimized consumers from

obtaining counsel and effective relief from our nation’s court system.

Regulation of mandatory arbitration clauses is both in the public interest and for the

benefit of consumers. While release debit cards are a relatively new product, the size of the

market and potential for growth is massive. Numi Financial is one of the top 10 providers of

prepaid cards nationwide, and issues more than 600,000 debit cards to consumers upon their

release from over 400 jails across the country. (Attachment 1 at 3). “The number of bookings

in jails in 2013, which approximates the number of releases and transfers, was 11.7 million.” Id.

at 4. Release debit cards are being foisted upon this very marginalized captive consumer group

when they are at their most vulnerable – when they are literally one step away from freedom and

have few other options to receive their account balances from prison or jail officials.

This reality, coupled with the facts that 1) “64% of jail inmates have a mental health

problem,” 3 many of whom may or may not be competent to understand what they are signing

and what an arbitration agreement is, and 2) a 2007 report by the National Center for Education

Statistics found that 39% of prisoners scored “below basic” for quantitative literacy testing while

another 39% scored at a “basic” level, 4 make mandatory arbitration agreements as they relate to

release debit cards an egregious, indefensible practice that must cease immediately. There are

also very high numbers of non-English speakers enmeshed in our nation’s criminal justice

system who have difficulty understanding the terms of mandatory arbitration agreements.

At the end of the day, the CFPB should hold that mandatory arbitration agreements

should be void or inapplicable in the criminal justice context whether applied to money transfer

services, phone services or release debit cards, for the simple reason that affected consumers

have no real choice in the matter. Absent free choice there can be no meeting of the minds or

agreement. Our free market system is predicated upon the notion that consumers have choice and

companies must earn their customers’ business. In the detention facility context, however, hedge

fund-owned corporations have learned that they only need to give kickbacks to the detention

agencies that hold prisoners captive to obtain exclusive, monopoly contracts and then force

prisoners’ families to pay whatever outrageous amounts they can charge for phone or money

transfer services, or to give people their own funds on debit cards. All because the affected

consumers, whose money is being taken and who are actually paying the bills, have no choice.

The CFPB should protect these captive consumers from mandatory arbitration agreements.

Thank you for your time and attention in this regard.

Sincerely,

Paul Wright

Executive Director, HRDC

Attachments

3

http://www.urban.org/sites/default/files/alfresco/publication-pdfs/2000173-The-Processing-and-Treatment-ofMentally-Ill-Persons-in-the-Criminal-Justice-System.pdf

4

http://nces.ed.gov/pubs2007/2007473.pdf

Attachment 1

The Financial Firm That Cornered the Market on Jails | The Nation

1 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

2 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

3 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

4 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

5 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

6 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

7 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

8 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

9 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

10 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

11 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

8/1/2016 10:10 AM

The Financial Firm That Cornered the Market on Jails | The Nation

12 of 12

https://www.thenation.com/article/the-financial-firm-that-cornered-the-m...

Enter a Name & Search for Free! View Background Check Instantly.

8/1/2016 10:10 AM

Attachment 2

Inmate Search

Home

Inmate Services

Email Terms of Service

Video Visitation Terms of Service

Subpoena Policy

Player Purchase Terms and

Conditions

Player Accessory Warranty

Privacy Policy

Help

Parole & Probation

Payments Terms of Service

Consumer Protection

Prison Search

Payments Terms of Service

As a condition to using JPay's payment services as described herein, you agree to this

Payments Terms of Service ("Agreement") and any future amendments.

1. NOTICE AND CONSENT. By using JPay's services, you agree to the terms and

conditions of this Agreement, the JPay Privacy Policy and any other documents

incorporated by reference. You further agree that this Agreement forms a legally binding

contract between you and JPay, and that this Agreement constitutes a writing signed by

you under any applicable law or regulation. Any rights not expressly granted herein are

reserved by JPay. We may amend this Agreement at any time by posting a revised

version on our website. The revised version will be effective at the time we post it. You

agree to be bound by the changed terms and conditions of this Agreement as of the

effective date of such changes. We last modified this Agreement on March 10, 2016. In

this Agreement, "You", "User" or "Customer" means any person or entity using the JPay

Service (as defined below).

2. THE JPAY SERVICE. A User may send money (the “Payment”) to an inmate’s account

at a JPayaffiliated correctional institution (a “Client”), to a JPay prepaid media account

(“JPay Credits”) or to a prepaid debit/phone account. A Client has the authority to

review, withhold or reject a Payment. Payments may be made (1) over the Internet or

telephone using a Visa or MasterCard branded credit card or debit card (collectively

“Bank Card"), (2) at a partner location using cash (i.e., MoneyGram), (3) at a JPay kiosk

located at a Client using cash or a Bank Card, or (4) by sending a money order to

JPay’s lockbox (collectively, the “JPay Service”).

Depending on the Client, Payments may be made to a variety of inmate accounts

including, but not limited to, inmate trust, restitution, temporary leave and funeral

expenses. In addition, each Client may accept Payments through select JPay Service

channels. If you are unsure of which inmate's account to send a Payment or which

JPay Service channels are available to you, please contact JPay or the Client. JPay

will not be liable for a Payment sent to the incorrect inmate account.

3. PAYMENT INFORMATION. To facilitate Payments, you will be required to provide JPay

with certain information to allow us, among other things: to verify your identity; to

receive appropriate Bank Card authorization if applicable; and to gather any other

information a Client shall require of you to send the Payment. Please refer to JPay's

Privacy Policy regarding JPay's use of this information. When required by applicable

law, Payments will be reported to federal, state or local authorities.

4. IDENTITY AUTHENTICATION. You authorize JPay, directly or through third parties, to

make any inquiries we consider necessary to validate your identity. This may include

asking you for further information, requiring you to provide your date of birth, and/or other

information that will allow us to reasonably identify you, requiring you to take steps to

confirm ownership of your email address, or verifying your Information against third party

databases or through other sources. We may also ask to see your driver's license or

other identifying documents at any time. JPay reserves the right to close, suspend, or

limit access to your account and/or the JPay Service in the event we are unable to

obtain or verify this Information.

5. FEES. In consideration for the use of the JPay Service, you agree to pay JPay a fee for

each Payment sent by you at the applicable rate then in effect (the "Service Fee"). All

Service Fees are nonrefundable.

6. MONEY ORDERS. Where the lockbox Payment method is available to you, JPay will

only accept money orders valued at $1,000.00 or less, depending on the Client. Any

money orders over $1,000.00 will be returned to you. All approved money orders will be

processed within up to ten (10) business days following receipt by JPay.

All money orders must be made payable to "JPay Inc.". A deposit slip and any

accompanying information required by the Client must be filled out and submitted with

every money order. Deposit slips can be found on JPay's Website All deposit slips must

be legible and completely filled out. Any materials sent with the money order other than

the deposit slip will be discarded.

7. JPAY CREDITS. Depending on the Client, JPay Credits can be used by the inmate to

purchase media related products. JPay Credits are nontransferrable and unused JPay

Credits will not be refunded.

8. PAYMENT. Service Fees and the principal Payment amount are due and payable before

JPay processes the Payment. By making a Payment with a Bank Card, you authorize

JPay to process the Payment. When using a Bank Card, if JPay does not receive

authorization from the card issuer, the Payment will not be processed and a hold may

be placed on your Bank Card which can only be removed by the issuing bank. Each

time you use the JPay Service, you agree that JPay is authorized to charge your

designated Bank Card account for the principal Payment amount, the Service Fee, and

any other applicable fees.

Login

9. OTHER CHARGES. JPay is not responsible for any fees or charges that may be

imposed by the financial institutions associated with your Payment. For example

(without limitation), some credit card issuers may treat the use of your credit card to use

the Service as a "cash advance" rather than a purchase transaction, and may impose

additional fees and interest rates for the transaction. JPay is not responsible for any

nonsufficient funds charges, chargeback fees, or other similar charges that might be

imposed on you by your bank, credit card issuer, or other provider.

10. RECURRING PAYMENT. A recurring payment is a Payment in which you authorize

JPay to charge your Bank Card on a regular or periodic basis (“Recurring Payment”).

This authorization is to remain in full force and effect until you cancel a Recurring

Payment. You may cancel a Recurring Payment at any time up to one (1) business day

prior to the date the Payment is scheduled to be processed. To cancel a Recurring

Payment, log into your account, access the “Money” tab, then access the “Recurring

Payments” tab and click “Delete.”

11. REFUNDS. You may not cancel a Payment. Under some circumstances, a Payment

may not be completed or a Client may refuse to accept a Payment. In such cases,

JPay will cancel the Payment transaction and refund the principal Payment amount

less the Service Fee to the Customer.

12. ESCHEATMENT LAWS. JPay must comply with each state's unclaimed property

(escheatment) laws. If, for whatever reason, JPay is unable to transfer your Payment to

a Client, JPay will attempt to contact you to issue you a refund. If JPay cannot get in

contact with you and you do not claim your Payment within the statutory time period,

JPay may be required to escheat the Payment to your resident state. JPay will

determine your state of residency based on the information provided by you at the time

of Payment. If you do not claim an unpaid Payment within one (1) month after the date

you made the Payment, where permitted by law, JPay shall hold the Payment in an

account and impose a $3.00 service fee per month until such time the unpaid Payment

must be escheated to the state.

13. GOVERNING LAW. This Agreement and the rights of the parties hereunder shall be

governed by and construed in accordance with the laws of the State of Florida,

exclusive of conflict or choice of law rules.

14. DISPUTE RESOLUTION.

a) Any dispute, claim or controversy among the parties arising out of or relating to

this Agreement ("Dispute") shall be finally resolved by and through binding

arbitration administered by JAMS pursuant to its Comprehensive Arbitration

Rules and Procedures and in accordance with the Expedited Procedures in those

Rules (the "JAMS Rules"), provided that failure to adhere to any of the time limits

set forth therein shall not be a basis for challenging the award. Both the foregoing

agreement of the parties to arbitrate any and all Disputes, and the results,

determinations, findings, judgments and/or awards rendered through any such

arbitration, shall be final and binding on the parties and may be specifically

enforced by legal proceedings in any court of competent jurisdiction.

b) The arbitration shall be conducted by three arbitrators. Each party shall select one

arbitrator within 30 days of commencement of the arbitration, failing which, upon

request of any party, JAMS shall appoint such arbitrator. The third arbitrator, who

shall serve as Chairperson of the arbitral panel, shall be appointed by JAMS

pursuant to Rule 15 of the JAMS Rules. The arbitrators must apply the terms of

this arbitration agreement, including without limitation, the waiver of classwide

arbitration set forth below.

c) The place of arbitration shall be Miami, Florida.

d) The cost of the arbitration proceeding, including, without limitation, each party's

attorneys' fees and costs, shall be borne by the unsuccessful party or, at the

discretion of the arbitrators, may be prorated between the parties in such

proportion as the arbitrators determine to be equitable and shall be awarded as

part of the award.

e) The arbitration provisions set forth herein, and any arbitration conducted

thereunder, shall be governed exclusively by the Federal Arbitration Act, Title 9

United States Code, to the exclusion of any state or municipal law of arbitration.

f) RESTRICTIONS ON ARBITRATION: ALL DISPUTES, REGARDLESS OF THE

DATE OF ACCRUAL OF SUCH DISPUTE, SHALL BE ARBITRATED ON AN

INDIVIDUAL BASIS. YOU ARE WAIVING YOUR RIGHT TO PARTICIPATE IN

A CLASS ACTION LAWSUIT, AND TO CERTAIN DISCOVERY AND OTHER

PROCEDURES THAT ARE AVAILABLE IN A LAWSUIT. YOU AND JPAY

AGREE THAT THE ARBITRATORS HAVE NO AUTHORITY TO ORDER

CONSOLIDATION OR CLASS ARBITRATION OR TO CONDUCT CLASS

WIDE ARBITRATION PROCEEDINGS, AND ARE ONLY AUTHORIZED TO

RESOLVE THE INDIVIDUAL DISPUTES BETWEEN YOU AND JPAY ALONE.

FURTHER, YOU WILL NOT HAVE THE RIGHT TO CONSOLIDATION OR

JOINDER OF INDIVIDUAL DISPUTES OR ARBITRATIONS, TO HAVE ANY

DISPUTE ARBITRATED ON A CLASS ACTION BASIS, OR TO PARTICIPATE

IN A REPRESENTATIVE CAPACITY OR AS A MEMBER OF ANY CLASS

PERTAINING TO ANY CLAIM SUBJECT TO ARBITRATION.

g) THE VALIDITY, EFFECT, AND ENFORCEABILITY OF THE FOREGOING

WAIVER OF CLASS ACTION LAWSUIT AND CLASSWIDE ARBITRATION,

IF CHALLENGED, ARE TO BE DETERMINED SOLEY AND EXCLUSIVELY

BY FEDERAL DISTRICT COURT LOCATED IN THE SOUTHERN DISTRICT

OF FLORIDA OR FLORIDA STATE COURT IN MIAMIDADE COUNTY AND

NOT BY JAMS OR ANY ARBITRATOR.

h) WITHOUT WAIVING THE RIGHT TO APPEAL SUCH DECISION, SHOULD

ANY PORTION OF SECTION 14(F) BE STRICKEN FROM THIS AGREEMENT

OR DEEMED OTHERWISE INVALID OR UNENFORCEABLE, THEN THIS

ENTIRE SECTION 14 (OTHER THAN THIS SENTENCE) SHALL BE

STRICKEN FROM THIS AGREEMENT AND INAPPLICABLE, AND ANY AND

ALL DISPUTES SHALL PROCEED IN FEDERAL DISTRICT COURT

LOCATED IN THE SOUTHERN DISTRICT OF FLORIDA OR FLORIDA STATE

COURT IN MIAMIDADE COUNTY AND BE DECIDED BY A JUDGE,

SITTING WITHOUT A JURY, ACCORDING TO APPLICABLE COURT RULES

AND PROCEDURES, AND NOT AS A CLASS ACTION LAWSUIT.

15. INDEMNIFICATION. Except to the extent that JPay is otherwise liable under this

Agreement or by law, you agree to indemnify and hold JPay, its shareholders,

subsidiaries, affiliates, directors, officers, employees, agents, representatives,

suppliers, service providers, and subcontractors harmless from any and all losses,

liabilities, claims, demands, judgments and expenses, including but not limited to

reasonable attorney's fees, arising out of or in any way connected with your use of or

the performance of the JPay Service.

16. DISCLAIMER OF WARRANTIES AND LIMITATION OF LIABILITY. THE JPAY

SERVICE IS PROVIDED BY JPAY INC. ON AN "AS IS" AND "AS

AVAILABLE" BASIS. JPAY MAKES NO REPRESENTATIONS OR

WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE

OPERATION OF THE JPAY SERVICE OR THE INFORMATION, CONTENT,

MATERIALS, PRODUCTS OR SERVICES INCLUDED ON THIS SITE. YOU

EXPRESSLY AGREE THAT YOUR USE OF THE JPAY SERVICE IS AT

YOUR SOLE RISK AND THAT YOU ARE SOLELY RESPONSIBLE FOR THE

ACCURACY OF THE PERSONAL AND PAYMENT INFORMATION THAT

YOU PROVIDE.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, JPAY

DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT

NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND

FITNESS FOR A PARTICULAR PURPOSE. JPAY DOES NOT WARRANT

THAT THIS SITE, ITS SERVICES OR EMAIL SENT FROM JPAY ARE FREE

OF VIRUSES OR OTHER HARMFUL COMPONENTS. JPAY (AS WELL AS

ITS OFFICERS, DIRECTORS, EMPLOYEES, AFFILIATES AND

STOCKHOLDERS) WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY

KIND ARISING FROM THE USE OF THIS SITE, ANY CREDIT CARD

COMPANY'S NONAUTHORIZATION OF A USER'S BANK CARD

PAYMENT, ANY GOVERNMENT ENTITY'S NONACCEPTANCE OF A

PAYMENT FROM A USER USING THE JPAY SERVICE, FOR

DISRUPTIONS IN THE JPAY SERVICE, OR FOR ERROR, DELAY OR MIS

DELIVERY OF A PAYMENT, REGARDLESS OF THE CAUSE, INCLUDING

(WITHOUT LIMITATION) DIRECT, INDIRECT, INCIDENTAL, PUNITIVE AND

CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED

WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN

DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE

ABOVE DISCLAIMERS, EXCLUSIONS OR LIMITATIONS MAY NOT APPLY

TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

JPay.com

Home

About

Inmate Search

Prison Search

Contact Us

Help

Inmate Services

Money Transfer

Email & VideoGram

JPay Player

Video Visitation

Legal Agreements | Consumer Protection | Privacy Policy

Parole & Probation

Restitution

Supervisions Fees

Court Fees

SelfReport Fees

Release Cards

Social

blog.jpay.com

forum.jpay.com

Facebook

Twitter

A Securus Technologies Company

Are You a Corrections Agency?

© 20022016 JPay Inc. All Rights Reserved

Attachment 3

Terms of use

Effective Date: March 30, 2015

TouchPay Holdings, LLC d/b/a GTL Financial Services, a wholly-owned subsidiary of Global Tel*Link Corporation, is

the owner and operator of the website located at the url www.connectnetwork.com (the “Site”). These Terms of Use

apply when you access, visit or use the Site or use any of the products or services that Global Tel*Link Corporation

(“GTL”), or one of its affiliates (individually “Affiliate” and collectively “Affiliates”) provide, including My Phone Account,

Offender Trust Fund, Send An Email and Offender Phone Account (the Site and these products and services will be

referred to in these Terms of Use as the “Service”). For purposes of these Terms of Use, “Company”, “we”, “us”, or

“our”, means GTL, and any Affiliate where the Affiliate or its products or services are implicated.

Notice Regarding Dispute Resolution: These Terms of Use contain provisions that govern how claims you

and we may have against each other are resolved (see Section R below), including an agreement and

obligation to arbitrate disputes, which will, subject to limited exceptions, require you to submit claims you

have against us to binding arbitration, unless you opt-out in accordance with Section R(4). Unless you optout of arbitration: (1) you will only be permitted to pursue claims against us on an individual basis, not as

part of any class or representative action or proceeding and (2) you will only be permitted to seek relief

(including monetary, injunctive, and declaratory relief) on an individual basis.

A. Acceptance of these Terms of Use by Users of the Site. By using the Service, or clicking the “accept” button

when you register to use the Service through the Site or when you are otherwise prompted to do so, you agree to be

bound by the terms of these Terms of Use.

B. Acceptance of these Terms of Use by Other Users of the Service. If you create an account to use the Service

other than through the Site, and if you do not agree with or consent to the terms of these Terms of Use, you will have

thirty (30) days from the date you create the account with us to cancel the account. If you decide that you want to

cancel the account within this thirty (30) day period, please contact our Customer Service team using the information

supplied through the “Contact Us” link on the Site. If you cancel the account we will provide you with a refund of any

fees you have paid and not used in connection with the Service.

C. Eligibility. The Service is intended for individuals who are at least eighteen (18) years old. If you are not at least

eighteen (18) years old, please do not access, visit or use the Service.

D. Your Privacy Rights. In connection with your use of the Service, please review the Your Privacy Rights statement

(“Privacy Statement”) in order to understand how we use information we collect from you when you access, visit or

use the Service. The Privacy Statement is part of and is governed by these Terms of Use and by accepting the

Terms of Use, you agree to be bound by the terms of the Privacy Statement, and agree that we may use information

collected from you in accordance with the Privacy Statement.

E. Registration. As a condition of using certain features of the Service, you may be required to register through the

Site and select a password and user I.D. You may not: (1) select or use as a user I.D. a name of another person with

the intent to impersonate that person; (2) use as a user I.D. a name subject to any rights of a person other than you

without appropriate authorization; or (3) use as a user I.D. a name that is otherwise offensive, vulgar or obscene. We

reserve the right to refuse registration of, or to cancel a user I.D., in our sole discretion. You shall be responsible for

maintaining the confidentiality of your user I.D. and password.

F. Prohibited Activities. You may not access or use the Service for any purpose other than the purpose for which

we make it available to you. We may prohibit certain activities in connection with the Service in our discretion. These

prohibited activities include, without limitation, the following:

1.

Criminal or tortious activity, including child pornography, fraud, trafficking in obscene material, drug dealing,

gambling, harassment, stalking, spamming, copyright infringement, patent infringement, or theft of trade

secrets.

2. Advertising to, or solicitation of, any user to buy or sell any products or services.

3. Transmitting chain letters or junk email to other users.

4. Using any information obtained from the Service in order to contact, advertise to, solicit or sell any products

or services to any user without their prior explicit consent.

5. Engaging in any automated use of the Service, such as using scripts to send comments or messages.

6. Interfering with, disrupting or creating an undue burden on the Service or the networks or services

connected to the Service.

7. Attempting to impersonate another user or person.

8. Using the user I.D. or account of another user.

9. Using any information obtained from the Service in order to harass, abuse or harm another person.

10. Accepting payment of anything of value from a third person in exchange for your performance of any

commercial activity on or through the Service on behalf of that person.

11. Using the Service in a manner inconsistent with any and all applicable laws and regulations.

G. Management of the Service. You acknowledge that we reserve the right, but have no obligation, to (1) take

appropriate legal action against anyone who, in our sole determination, violates these Terms of Use, including,

without limitation, reporting you to law enforcement authorities, (2) in our sole discretion and without limitation, refuse,

restrict access to or availability of, or disable all or a portion of the Service, and (3) otherwise manage the Service in a

manner designed to protect the rights and property of the Company and users of the Service and to facilitate the

proper functioning of the Service.

H. Monitoring of Calls Made and Video Visits Made and Email Sent through the Service. You acknowledge and

agree that we may, and the correctional facility where an offender is incarcerated may, monitor or record calls and

video visits as well as obtain the location of your phone when you use the Service, and read emails sent using the

Service, in accordance with the policies in place at the correctional facility where an offender is incarcerated. By

accepting these Terms of Use you authorize us, and the applicable correctional facility, to monitor and record calls

and video visits you make through the Service and to read emails you send through the Service in accordance with

the policies in place at the applicable correctional facility.

I. Use of the Service. The Service and its contents and the trademarks, service marks and logos contained on the

Service, are the intellectual property of the Company or its licensors and constitute copyrights and other intellectual

property rights of the Company or its licensors under U.S. and foreign laws and international conventions. The

Service and its contents are provided for your informational, personal, non-commercial use only and may not be

used, copied, reproduced, distributed, transmitted, broadcast, displayed, sold, licensed, or otherwise exploited for any

other purpose whatsoever without the express written consent of the Company. You agree not to engage in the use,

copying or distribution of the Service or of any of its contents for any commercial purpose. You agree not to

circumvent, disable or otherwise interfere with security related features of the Service. We may, but are not obligated

to, periodically provide updates to the Service to resolve bugs or add features and functionality. You do not acquire

any ownership rights to the Service or to any contents contained on the Service. All rights not expressly granted in

these Terms of Use are reserved by the Company. You are solely responsible for your interactions with other users of

the Service.

J. Termination of Your Use of the Service. We may suspend or terminate your use of the Service if you violate

these Terms of Use or in our discretion. We may also impose limits on or restrict your access to parts or all of the

Service without notice or liability.

K. Charges for the Service. Fees will apply to your use of certain features of the Service, including any calls

that are made through the Service. The fees and charges may vary based on, among other things, the correctional

facility where an offender is incarcerated. We reserve the right to change the fees charged periodically, in our

discretion.

L. Submissions. If you submit opinions, suggestions, feedback, images, documents, and/or proposals to us through

the Service, or through any other communication with us, you acknowledge and agree that: (1) the submissions you

provide will not contain confidential or proprietary information; (2) we are not under any obligation of confidentiality,

express or implied, with respect to the submissions you provide; (3) we shall be entitled to use or disclose (or choose

not to use or disclose) the submissions you provide for any purpose, in any way, in any media worldwide; (4) the

submissions you provide will automatically become the property of the Company without any obligation of the

Company to you; and (5) you are not entitled to any compensation or reimbursement of any kind from the Company

in connection with your submissions under any circumstances.

M. Links to Other Websites. The Service may contain links to third-party websites, resources or data. You

acknowledge and agree that the Company is not responsible or liable for: (1) the availability or accuracy of these

third-party websites, resources or data; or (2) the content, products, or services on or available from these websites,

resources or data. You also acknowledge that you are solely responsible for, and assume all risk arising from, the

use of any these websites, resources and data. Links to third party websites on the Service are not intended as

endorsements or referrals by the Company of any products, services or information contained on the applicable

websites. These Terms of Use do not apply to third party websites, including the content of and your activity on those

websites. You should review third-party websites’ terms of service, privacy policies and all other website documents,

and inform yourself of the regulations, policies and practices of third-party websites.

N. Disclaimer of Warranties. THE INFORMATION CONTAINED IN AND PROVIDED THROUGH THE SERVICE,

INCLUDING TEXT, GRAPHICS, LINKS, OR OTHER ITEMS, IS PROVIDED "AS IS". NEITHER THE COMPANY

NOR ITS SUPPLIERS WARRANT THE ACCURACY, ADEQUACY, COMPLETENESS OR TIMELINESS OF THE

INFORMATION, MATERIALS, PRODUCTS, AND SERVICES ACCESSED ON OR THROUGH THE SERVICE AND

THE COMPANY EXPRESSLY DISCLAIMS LIABILITY FOR ERRORS OR OMISSIONS IN THE INFORMATION OR

MATERIALS ACCESSED ON OR THROUGH THE SERVICE. NO WARRANTY OF ANY KIND, WHETHER IMPLIED

OR EXPRESSED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF NON-INFRINGEMENT, TITLE,

MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, AND FREEDOM FROM COMPUTER VIRUS, IS

GIVEN IN CONJUNCTION WITH ANY INFORMATION, MATERIALS, OR SERVICES PROVIDED THROUGH THE

SERVICE.

O. Limitation of Liability. IN NO EVENT SHALL THE COMPANY OR ITS THIRD PARTY SUPPLIERS BE LIABLE

FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING, WITHOUT LIMITATION, DIRECT OR INDIRECT,

PUNITIVE, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR OTHER DAMAGES, LOSSES OR EXPENSES,

INCLUDING ANY LOST PROFITS, LOST DATA, OR LOST SAVINGS, WHETHER BASED ON BREACH OF

CONTRACT, BREACH OF WARRANTY, TORT OR ANY OTHER LEGAL THEORY, ARISING OUT OF OR IN ANY

WAY CONNECTED WITH THE USE OF THE SERVICE OR RELIANCE ON OR USE OR INABILITY TO USE THE

INFORMATION, MATERIALS OR SERVICES PROVIDED THROUGH THE SERVICE, OR IN CONNECTION WITH

ANY FAILURE OF PERFORMANCE, ERROR, OMISSION, INTERRUPTION, DEFECT, DELAY IN OPERATION OR

TRANSMISSION, COMPUTER VIRUS OR LINE OR SYSTEM FAILURE, EVEN IF THE COMPANY OR ITS THIRD

PARTY SUPPLIERS ARE ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.

P. Unauthorized Transactions. In the event that you use a credit card to pay for any products or services offered

through the Site, you are representing to the Company that you are authorized to use that credit card.

Q. Indemnification. You agree to defend, indemnify and hold the Company harmless from and against any and all

claims, damages, and costs including attorneys’ fees, arising from or related to your use of the Service.

R. Dispute Resolution.

1.

Arbitration. The parties shall use their best efforts to settle any dispute, claim, question, or disagreement

directly through consultation and good faith negotiations which shall be a precondition to either party

initiating a lawsuit or arbitration. All claims arising out of or relating to these Terms of Use (including its

formation, performance and breach) and the Service shall be finally settled by binding arbitration, excluding

any rules or procedures governing or permitting class actions. The arbitrator, and not any federal, state or

local court or agency, shall have exclusive authority to resolve all disputes arising out of or relating to the

interpretation, applicability, enforceability or formation of these Terms of Use, including, but not limited to

any claim that all or any part of these Terms of Use is void or voidable. The arbitrator shall be empowered to

grant whatever relief would be available in a court under law or in equity. The arbitrator’s award shall be

binding on the parties and may be entered as a judgment in any court of competent jurisdiction. To the

extent the filing fee for the arbitration exceeds the cost of filing a lawsuit, we will pay the additional cost. The

interpretation and enforcement of these Terms of Use shall be subject to the Federal Arbitration Act.

The parties understand that, absent this mandatory provision, they would have the right to sue in

court and have a jury trial. They further understand that, in some instances, the costs of arbitration

could exceed the costs of litigation and the right to discovery may be more limited in arbitration than

in court.

2.

Class Action Waiver.The parties further agree that any arbitration shall be conducted in their individual

capacities only and not as a class action or other representative action, and the parties expressly waive their

right to file a class action or seek relief on a class basis. If any court or arbitrator determines that the class

action waiver set forth in this paragraph is void or unenforceable for any reason or that an arbitration can

proceed on a class basis, then the arbitration provision set forth above shall be deemed null and void in its

entirety and the parties shall be deemed to have not agreed to arbitrate disputes.

3.

Exception - Litigation of Small Claims Court ClaimsNotwithstanding the parties’ decision to resolve all

disputes through arbitration, either party may also seek relief in a small claims court for disputes or claims

within the scope of that court’s jurisdiction.

4.

Thirty Day Right to Opt Out. You have the right to opt-out and not be bound by the arbitration and class

action waiver provisions set forth this Section by sending written notice of your decision to opt-out to the

following address: c/o Global Tel*Link Corporation, 12021 Sunset Hills Road, Reston, Virginia 20190, Attn:

Arbitration Opt-Out. The notice must be sent within thirty (30) days of the date you have agreed to Terms of

Use; otherwise you shall be bound to arbitrate disputes in accordance with the terms set forth above. If you

elect to opt-out of these arbitration provisions, we also will not be bound by them. In addition, if you elect to

opt-out of these arbitration provisions, we may terminate your use of the Service. If we terminate your use of

the Service, we will provide you with a refund of any fees you have paid and have not been used in

connection with the Service.

S. Amendments. These Terms of Use may be amended by the Company from time to time. We will post any

material changes to these Terms of Use on the Site with a notice advising of changes. You may cancel your account

within thirty (30) days following the date the amended Terms of Use are posted by contacting us using the contact

information in Section Z below. If you choose to cancel your account within this thirty (30) day period, you will not be

bound by the terms of the revised Terms of Use but will remain bound by terms of these Terms of Use, and, we will

provide you with a refund of any fees that you have paid and that have not been used in connection with the Service.

T. No Oral Modifications. Employees of the Company are not authorized to modify these Terms of Use, either

verbally or in writing. If any employee of the Company offers to modify these Terms of Use, he or she is not acting as

an agent for the Company or speaking on our behalf. You may not rely, and should not act in reliance on, any

statement or communication from an employee of the Company or anyone else purporting to act on our behalf.

U. No Third Party Beneficiaries. These Terms of Use are between you and the Company. There are no third party

beneficiaries.

V. Independent Contractors. No agency, partnership, joint venture, or employment is created as a result of these

Terms of Use and you do not have any authority of any kind to bind the Company in any respect whatsoever. W.

Non-Waiver. The failure of either party to exercise in any respect any right provided for herein shall not be deemed a

waiver of any further rights hereunder.

X. Force Majeure. The Company shall not be liable for any failure to perform its obligations hereunder where the

failure results from any cause beyond the Company’s reasonable control, including, without limitation, any

mechanical, electronic or communications failure or degradation.

Y. Severability. If any provision of these Terms of Use is found to be unenforceable or invalid (other than the class

action waiver in Section R), that provision shall be limited or eliminated to the minimum extent necessary so that

these Terms of Use shall otherwise remain in full force and effect and enforceable.

Z. Contact Us. f you have any questions about these Terms of Use, you may contact us by email at

termsofuse@gtl.net or by postal mail at c/o Global Tel*Link Corporation, 12021 Sunset Hills Road, Suite 100, Reston,

Virginia 20190, Attn: Legal Department. If you have any questions regarding the Service or your account, or if you

would like to cancel your account, please contact our Customer Service team using the information supplied through

the “Contact Us” link on the Site.

Assignment.These Terms of Use are not assignable, transferable or sublicensable by you except with our prior

written consent. We may transfer, assign or delegate these Terms of Use and our related rights and obligations

without obtaining your consent.

CLOSE

•

•

•

•

•

About ConnectNetwork

Consumer Disclosures

Terms of Use

Privacy Policy

© Deposits to an inmate's trust account, as well as probation, community corrections, and background check

payments are provided by TouchPay Holdings, LLC d/b/a GTL Financial Services, which is also the owner and

manager of this website. TouchPay Holdings, LLC d/b/a GTL Financial Services is wholly owned by GTL

Corporation. All transactions conducted at ConnectNetwork.com to make prepaid collect deposits, PIN debit

deposits and Debit Link deposits are provided by GTL Enhanced Services LLC, which i