93-Year-Old Woman Owed $2,300 in Tax Debt so Government Sold Her $40,000 Home and Kept all Proceeds

by Ashleigh N. Dye

Geraldine Tyler, 93, of Minneapolis owed the government nearly $15,000 in tax debt, so the government sold her home for $40,000 and kept the proceeds. Tyler left her condominium in 2010 after gun violence in her neighborhood and dangerous situations left her feeling unsafe. She was unable to afford the cost of her new apartment and the property tax on the home she left behind. As a result, she accumulated $2,300 in debt. After five years, that debt ballooned to $15,000, as the government charged her interest, penalties, and fines. When she was unable to pay the growing amount, the government seized her property and sold it for $40,000 — keeping all of the money, even though she owed only $15,000.

Tyler appealed the issue in federal court, but the U.S. Court of Appeals for the Eighth Circuit in Tyler v. Hennepin Cty., 26 F.4th 789 (8th Cir. 2022), ruled that this is legal.

“Tyler does not argue that the county lacked lawful authority to foreclose on her condominium to satisfy her delinquent tax debt,” the Court wrote. “Rather, Tyler argues that the county’s retention of the surplus equity ... is an unconstitutional taking.” The Court ruled against her and further asserted that Tyler has no rights to the proceeds of the sale.

“It’s pretty shocking,” Christina Martin, Tyler’s attorney said. “This is very bad for property rights.”

While this situation may seem to be an anomaly, about a dozen states have foreclosure systems that allow the government to keep the profits from seizures and sales. Many times, this results in the former homeowners becoming homeless over a tax bill.

A case in Washington D.C. involved a 76-year-old man who was removed from and lost his home due to a $134 tax debt. Coleman ex rel Bunn v. District of Columbia, 70 F. Supp. 3d 58 (D.D.C. 2014), His property was valued at $197,000. The man, who suffered from dementia, then spent months living on his porch thinking he had locked himself out. “I see this all the time. Most people don’t know, they don’t understand what’s going on.” Martin says.

Tyler is nearing her 100th birthday and is worried she may not see the resolution of her case. “She said to me, ‘How much longer is this going to take? I haven’t got forever.’” Martin said.

Tyler’s situation resembles civil forfeiture, a process that enables the government to seize all types of assets from someone who is merely suspected of committing a crime. The government can take anything: cash, vehicles, life savings, property. A criminal conviction is not a requirement for such seizures — even an arrest is not required. As Tyler’s case proves, one does not even have to be suspected of a crime, just merely unable to pay off a debt.

“It ought to worry people, because if they can do this to your house, what stops them from doing this to your mutual funds, your bank account, your car. You name it.” Tyler’s attorney, Martin observed.

Source: reason.com

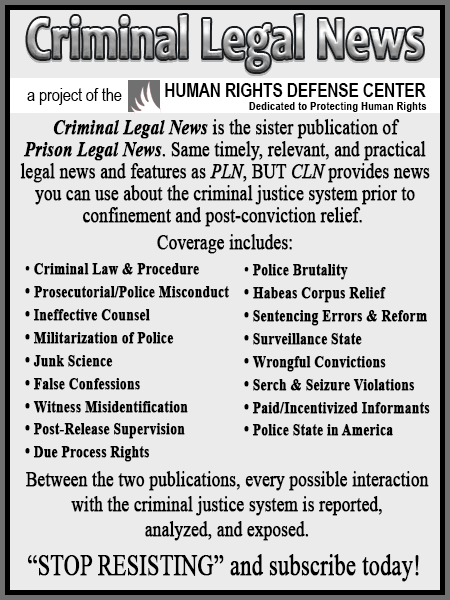

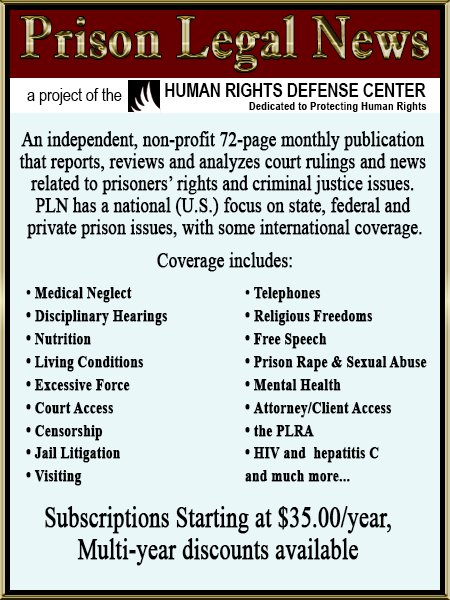

As a digital subscriber to Criminal Legal News, you can access full text and downloads for this and other premium content.

Already a subscriber? Login